Market Commentary

European equity indexes and US equity index futures are trad-ing with gains so far today, despite weaker Q2 GDP prints for the Eurozone and Germany. Sentiment continues to predomi-nate as the driving force behind the recent extension higher.

German GDP contracted by 0.2% Q/Q in Q2 vs. an expansion of 0.7% in Q1. EU GDP was flat Q/Q in Q2 vs. prev. 0.2% in Q1.

Political commentary continues with regard to Ukraine and Russia, with Putin’s recent comments highlighting that he will “do utmost to stop bloodshed in Ukraine”. While these com-ments are not backed by anything material, markets seem to be content with taking these comments in in the context of a path to resolution.

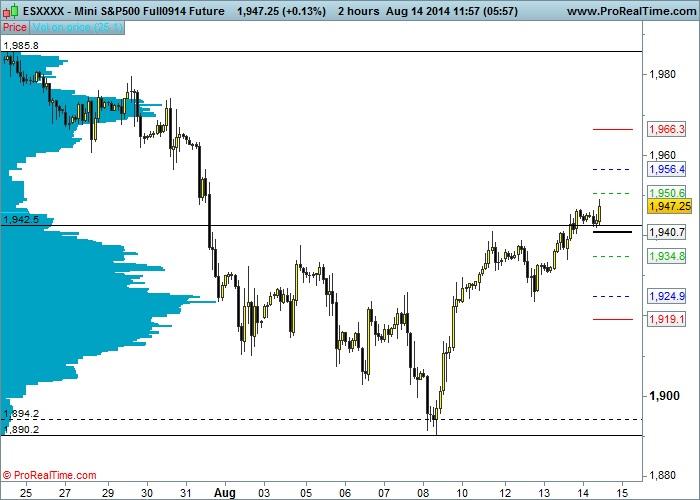

Intraday Strategy: E-mini S&P

E-mini S&P broke above the 18th July low (1942.50) yesterday and closed above the level. US equity index futures and EU equity in-dexes are positive on the day so far despite the earlier releases of weaker German and EU GDP figures for Q2.

Our strategy for the day ahead entails buying into a pullback to the pivot, targeting R1 and R2.

Intraday Strategy: DAX

The Dax seems to have discounted weaker German Q2 GDP.

Our strategy for the day ahead entails buying into stabilization fol-lowing a pullback to the pivot.

Intraday Strategy: EUR/USD

The EUR/USD has been oscillating between last week\’s low and the 1.34 handle so far throughout this week, with limited directional-ity, despite a couple of strong spikes to the upside (primarily as a function of USD weakness).

For today’s session we prefer to buy into signs of stabilization at yesterday’s low, targeting the pivot and the 1.34 handle/R1.

Technical Analysis: Nasdaq and DJIA

Nasdaq and DJIA futures are breaking to new highs of the day ahead of the open.

Technical Analysis: Bund and US 10-year T-note Futures

German 10-year yield is below 1% this morning. September Bund futures testing the 150.00 handle. US 10-year treasury futures are moving higher on correlation.

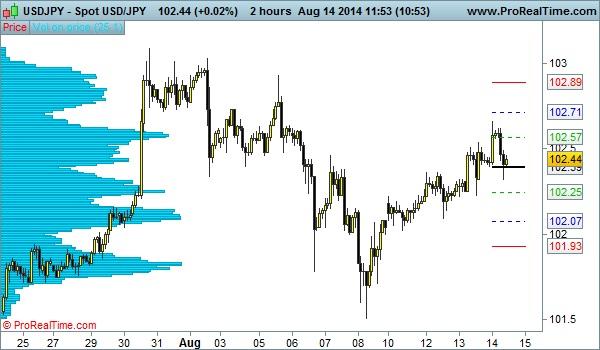

Technical Analysis: GBP/USD and USD/JPY

Aggressive sterling weakness is abating today, allowing GBP/USD to stabilize just below the 1.67 handle.

City Trading & Investment Ltd are an incorporated entity registered in England & Wales. Company registration number is 08677745. Registered address: 37th Floor, One Canada Square, Canary Wharf, London, E14 5AB. Trading futures contracts on margin carries a high level of risk and may not be suitable for all investors. This excessive leverage can work against you at a significant capital cost. Before deciding to trade futures products you should carefully consider your investment objectives, level of experience and risk appetite. It is possible that you may lose some or all of your initial capital/investment and, there-fore, you should not invest money or financial assets that you cannot afford to lose. You should be aware of all of the risks associated with futures trading and trading financial instruments in general. You should seek advice from an independent financial advisor.

Any opinions, news, research, analyses, prices or other information contained in these reports is provided as general market commentary and is for educational purposes only. The content does not constitute investment advice in any shape or form. City Trading & Investment will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The content of this report do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments. Furthermore, the content of this report does not constitute advice or a recommendation with respect to such securities or other financial instruments or investments.

The content on this report is subject to change at any time without notice, and is provided for the sole purpose of assisting the educational appetite of traders. City Trading & Investment has taken reasonable measures to ensure the accuracy of the information within this report; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content of the report or from your inability to access the report, or for any delay in or failure of the transmission or the receipt of this report. Furthermore, no part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of City Trading & Investment Ltd.

This report is not intended for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation. None of the services or investments referred to in this report are available to persons residing in any country where the provision of such services or investments would be contrary to local law or regulation. It is the responsibility of the readers of this report to ascertain the terms of and comply with any local law or regulation to which they are subject.

Investment asset valuations and pricing can go up and down. Investment price fluctuations can be violent and can result in the loss of some or all of your initial investment/capital. The financial assets referred to in this research and the potential income or losses from them may also fluctuate violently as described. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Certain transactions, including those involving futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.