Gold performance so far in 2016

The yellow metal closed last year at $1061.25 levels, before the uptrend began and the prices rose to a high of $1263.37 this week. This means a 19% gain so far in 2016. The $200 rally is due to –

CNY devaluation (currency debasement effect)

Risk-off in equities (safe haven demand)

Japan’s negative rate surprise (currency debasement + safe haven demand)

The move to negative rates has sparked fears among investors regarding the future course of action if the move to negative rates fails to prop up the economy. So far, the negative rates have not been able to prop up even the markets. Hence, the safe haven demand for the metal is likely to stay intact as investors face a serious question – where are central banks heading?

Dow performance so far in 2016

The Dow Jones Industrial Average (DJIA) finished last year at 17,602 levels, before the downtrend began and prices dropped to a low of 15,503 this week. This means the index is down almost 12%. The drop is being blamed to

Oil price slide

Banking sector concerns (in Europe)

Turmoil in China

Slowdown in US, Fed rate hike and central banker’s moving to uncharted territory (-ve rates)

Though the index is down 12%, it has only retraced 23.6% of the rally from 2009 low.

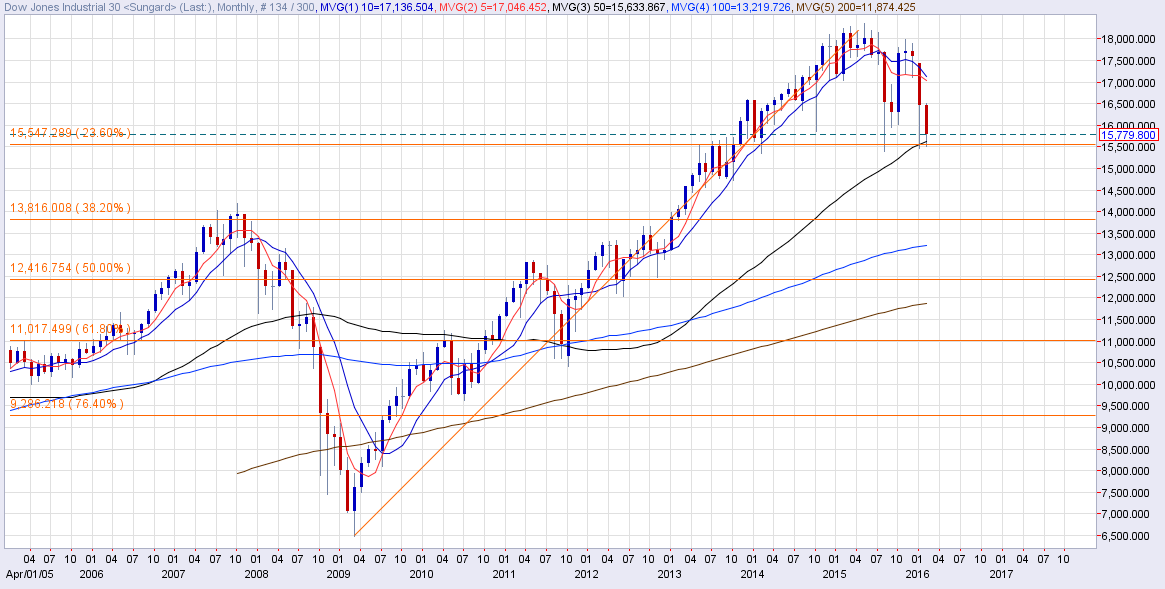

Dow Monthly Chart

Chart clearly shows we are down to 15,547.29 (23.6% of 2009 low – 2015 high).

We have been around this level in August 2015 and Jan 2016. On both the occasions, the index found takers around/below the 23.6% Fibo retracement level.

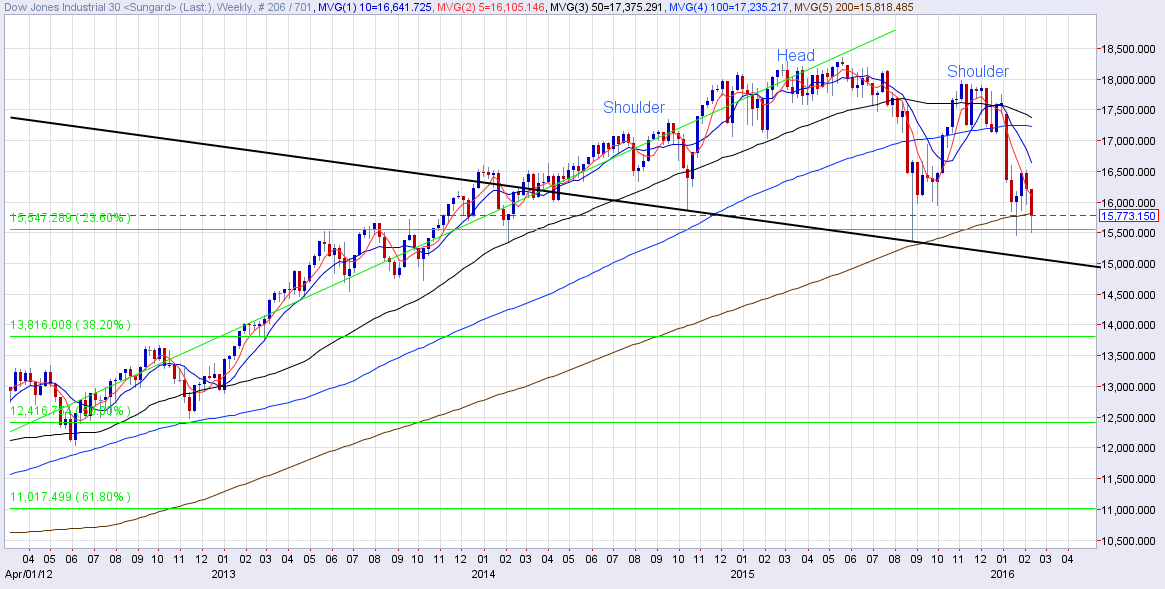

Dow Weekly Chart

Chart shows head and shoulder formation with a neckline support at 15,100-15,000 levels.

A break below the same on weekly charts would mark a major trend reversal.

Watch out for minor rebound

Both charts coupled with oversold conditions on short-duration charts indicate the index could see a rebound in the following weeks from around 15,547.29 (23.6% of 2009 low – 2015 high).

A recovery could see the index re-test 16,500 levels.

However, a serious sell-off could be seen if the price take out head and shoulder neckline 15,100-15,000 levels.

Given the odds of a short-term rebound is high; the traditional overbought safe havens like Gold could witness correction next couple of weeks.

Gold weekly chart

Gold monthly chart

Chart shows a bullish break from the falling channel and weekly 100-MA.

Prices have also taken out falling trend line on the monthly chart for now, but it remains to be seen if we see monthly closing above falling trend line level of $1216.

Moreover, the metal ran into offers at the monthly 100-MA seen at $1258, plus

Metal also looks overbought on short duration charts

Hence, prices may correct to $1200-1190/Oz levels in next two weeks given the possibility of a short-term rebound in Dow index and overbought conditions and exhaustion on part of Gold bulls.

Gold’s February closing above 100-MA at $1258 could be a sign of major trend reversal, as the monthly RSI would confirm a bullish break above 50.00 as well

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.