Prices witnessed a sharp recovery after setting a new multi-year bottom on Jan 20. The recovery triggered a speculation that a bottom is in place and a major corrective rally is in the making. However, here we are again with prices sliding fast.

One of the major reasons for a sharp recovery in last two weeks was the talk of a joint production cut. Russia, Iraq and Iran took turns to say they are ready for a joint effort – OPEC and non-OEPC production cut. However, it is easier said than done and markets seem to have realized this again. Even the OPEC delegates and Saudi officials said they are not in talks with non-OPEC producers.

Still, the speculation refuses to die completely. Every now and then there is a talk of a joint production cut or even an individual effort – Saud production cut. Here is why, the speculation refuses to die and pops its head every now and then –

- Supply-Demand mismatch: Crude oil supply in the market has reached 96.9 million barrels per day during the past three months. On the other demand is well short of the supply. As per the International Energy Agency forecasts, demand stands at only 94.7 million barrels per day. This means an excess supply of 2.2 million barrels per day.

- Oil fell to $25/barrel and the market is still suffering from 2 million b/d of oversupply.

- Economic woes – As per OPEC figures, oil exports by member countries in 2015 fell to $964.6 billion dollars, $135.4 billion lower than 2014. This is a challenging scenario for OPEC members whose economies are deeply dependent on their oil income,

- Saudi under pressure – The OPEC’s strongest member Saudi is under pressure. If reports are to be believed, the Kingdom can sustain the ongoing price war for couple of years more, given its 660 billion forex reserves, however, budget deficits are on the rise and there is growing speculation that it may have to end its currency peg.

- Iran plans to boost its exports to 2.3 million barrels per day in the next fiscal. The country suffered from sanctions since 2012 and is in no mood to accept production cuts. This also means the gap between supply and demand would rise even further.

- Neither it is possible to bring OPEC and non-OPEC producers on a common terms.

What happened in last supply driven oil bust?

- Demand was muted for several years, in part because of conservation measures embraced by the US after the Arab oil embargo in the 1970s.

- Oil output outside OPEC grew rapidly. Production in the North Sea surged. Output in China, Oman and Mexico increased, while US also started producing more oil.

- In response, Saudi announced a production cut in order to support prices. The US EIA report shows Kingdom’s output fell from 10 million barrels a day in the early years of the decade to 2.3 million in August 1985.

- However, the move hurt Saudi as it started losing oil market share and thus it started pumping oil again in November 1985. This resulted in a more severe oil price drop –from over $30 a barrel in November 1985 to nearly $10 by July 1986.

- Prices spiked in 1990 after Iraq invaded Kuwait.

- It will lose its market share and may have to face more economic problems than it is facing now

- Iran and other weaker nations would exploit the opportunity by pumping more oil

At the most, a technical correction could be seen, but by large prices may establish a $20-25 range above multi-year lows. Overall, we are unlikely to see oil move back above $50 anytime soon as –

- Oversupply will persist

- Low possibility of production cut

- Demand to stay weak until China has rebalanced itself successfully from an export driven to consumption driven economy. (Aggregate demand deficiency likely to stay intact until China rebalancing is successful).

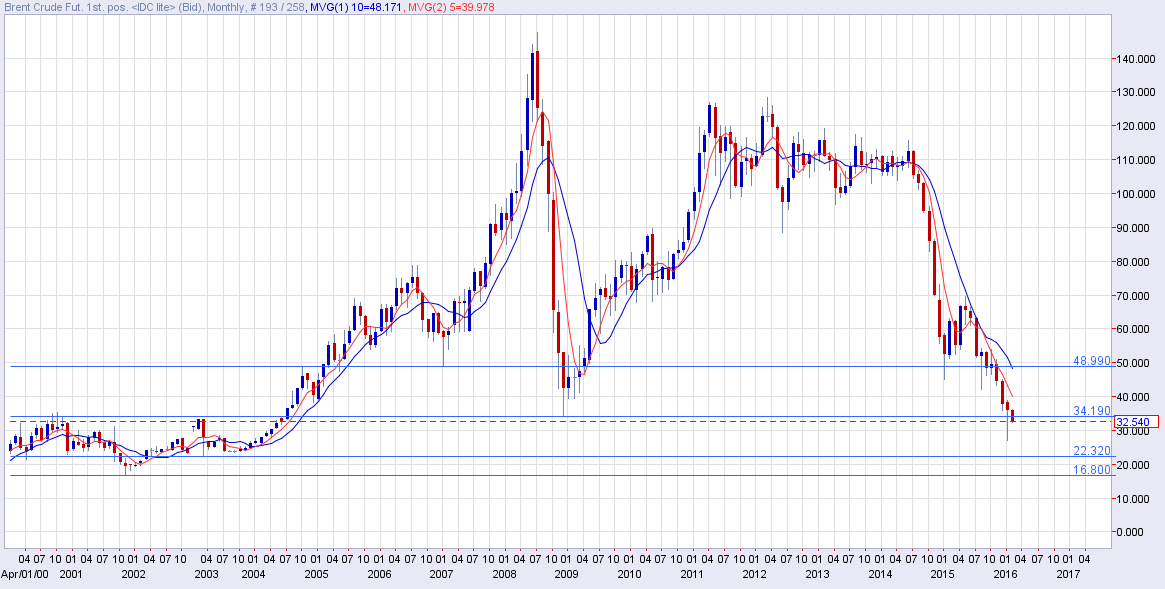

Brent oil monthly chart

- Prices are back below Dec 2008 low of $34.19

- Next major support levels are - $27.08 (latest cyclical low), $22.32 (Mar 2003 low), $16.80 (Nov 2001 low).

- Major resistance levels are - $39.32 (Feb 2009 low), $42.19 (Aug 2015 low), $46.24 (Sep 2015 low), $45.16 (Jan 2015 low), $48.99 (Jan 2007 low).

- A major technical correction could run out of steam at a major hurdle at $48.99 (Jan 2007 low), following which prices may remain range bound largely.

- Global slowdown, excess can very well result in a drop to $16.80 levels this year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.