The financial markets are relatively calm on Monday even though the Greeks rejected the creditor’s offer in the referendum conducted on Sunday, bringing the world one step closer to the new government in Greece or Grexit.

Except the sharp drop in the Treasury yields, all other traditional safe haven assets are more or less calm. The risk aversion in the major equity markets across the globe has not had any major impact on the FX markets. The EUR/USD pair gapped lower in the Asian morning to hit a low below 1.10 levels, before recovering to a high of 1.0983 after Greece’s finance minister Varoufakis resigned. The pair now trades around 1.1010-1.1020 as we head into the US session.

Apart from the Greek issue, the developments in China are worth taking a note of. China announced a slew of measures over the weekend in an effort to stabilize the rout in the equities, which risks turning into a full blown crash.

The next 24 hours are important as three events shall set the tone for the common currency, commodities and commodity currencies and the Chinese Yuan. The first event is the ECB’s decision regarding the extension of the emergency liquidity assistance (ELA) for Greek banks, followed by the Reserve Bank of Australia decision tomorrow and the sentiment in the Chinese equity markets.

The ECB is reportedly scheduled to decide on the ELA for Greek banks later today. So far, the markets have been relatively calm even though we have moved closer to the possibility of Grexit. The markets may have stayed calm since there is also a possibility of a new government in Greece, followed by new negotiations. However, the risk aversion may catch fire if the ECB rejects liquidity support to the Greek banks. The ECB has made it clear earlier that it does not intend to support banks unconditionally. In order to avail the support, the banks need to remain solvent. Without the ECB funding, the Greek banks are likely to go bust midweek. Consequently, if the ECB rejects ELA funding for Greek banks later today, the EUR/USD pair could come under fresh selling pressure. In this case, the US services PMI is likely to get overshadowed.

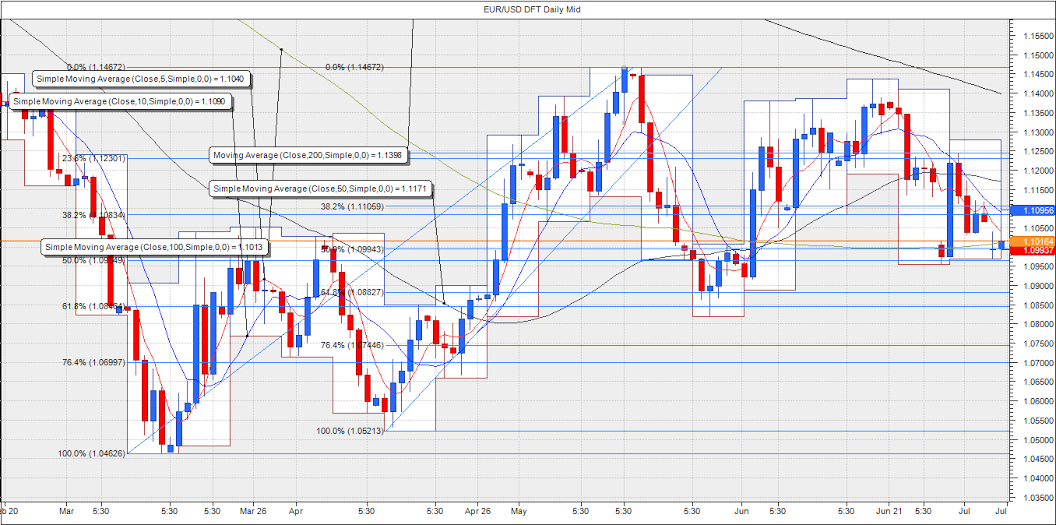

EUR/USD daily chart

The EUR/USD pair was rejected at 1.1083 (38.2% Fib R of Mar to May rally), followed by a sell-off to the current rate of 1.1010-1.1020. Greek banks failing to get ELA from the ECB would push the pair below 1.0964 (50% Fib R of Mar to May rally) and open doors for a sell-off 1.0882 (61.8% Fib R of Apr low to May high). A failure to sustain above the 100-DMA at 1.1013 would add to the bearishness.

RBA comments could set the tone for the commodity currencies. The commodities have taken a beating today on the results of Greek referendum. Crude oil prices tanked more than 2%. Iron ore prices are falling as well along with other base metals. We have commodities under pressure due to the Greece-led risk aversion, looming uncertainty of Grexit, and concerns in China. Consequently, the RBA is likely to come out extremely dovish and set the tone for the AUD and other commodity currencies. Since the beginning of the current year, an action from the major commodity exporter’s central bank has been followed by its peers. Hence, a dovish RBA is likely to invoke similar comments from other central banks- BOE, RBNZ.

The third important thing to watch out in the next 24 hours is the trend in the Shanghai composite index, which ended with 2% gains, after having begun the day more than 7% higher. The PBOC announced a surprise rate cut in June end, but failed to stem the rout in the equities. In response, China came out with the following measures over the weekend –

China's top brokerages pledged to collectively buy at least 120 billion yuan ($19.3 billion) of shares.

The China Mutual Fund Association, said 25 fund companies also pledged on Saturday to buy shares. Another 69 fund firms said on Sunday they would do the same.

8 companies that had been approved to launch IPOs all announced they had suspended their plans

Hence, the trend in the Shanghai composite tomorrow would set the tone for commodity prices (oil, iron ore) and also influence the commodity currencies - AUD, NZD, CAD. A drop in the Shanghai composite tomorrow would trigger fresh sell-off in the commodities and commodity currencies, in turn triggering more dovish comments from RBA, RBNZ, BOC.

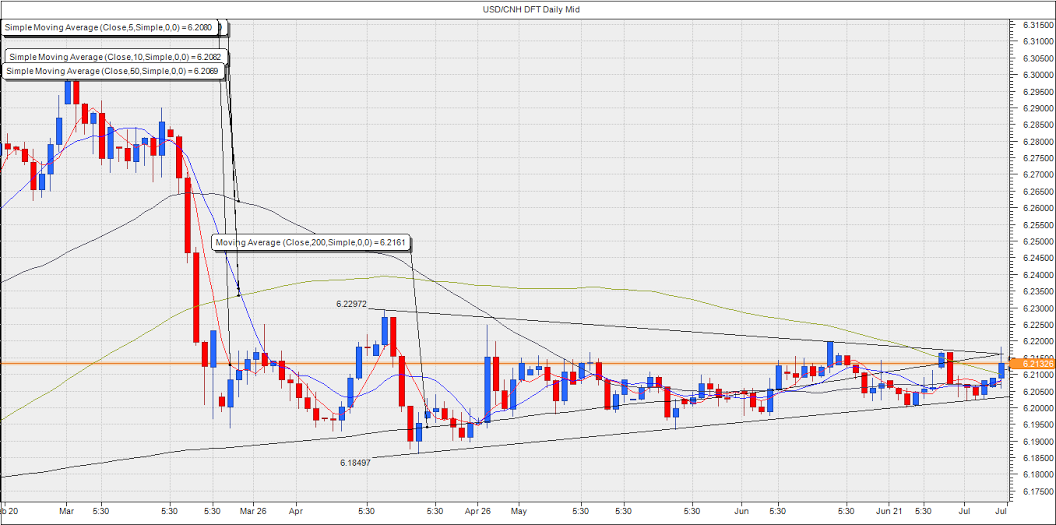

Another point worth noting is the China CPI data due for release due later in the week. With a threat of stock market crash, a weak inflation print later this week could trigger expectations of more aggressive measures in China. This may not support riskier assets across the globe but could lead to a breakout in the USD/CNY pair from the three month long symmetrical triangle on the daily chart.

USD/CNH daily chart

The USD/CNY pair clocked a high of 6.2182, before falling back below the symmetrical triangle resistance and 200-DMA resistance at 6.2161. A break above 6.2161 could open doors for a rise to 6.24.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.