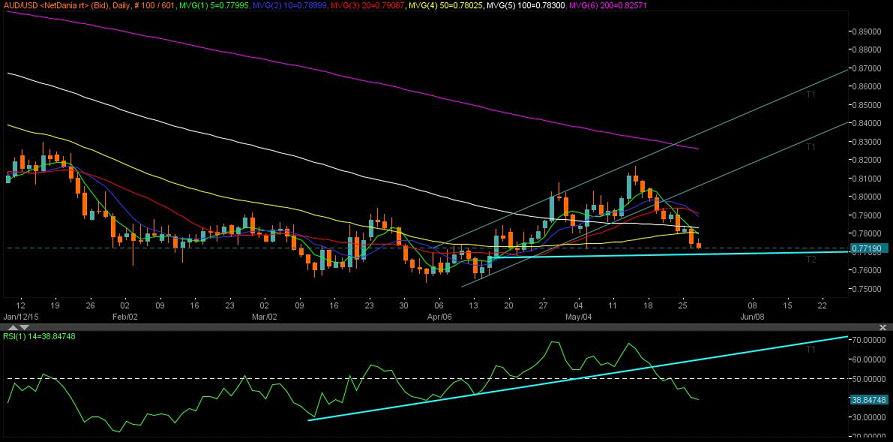

The AUD/USD pair faced rejection at 0.82 barrier and ever since has maintained an offered tone for most of the last 10 trading sessions or so. The pair dropped from fresh four month highs and displayed a bearish channel break out, breaching the big 0.80 figure to the downside. A fresh sell-off was triggered below the last pushing the pair to just ahead of 0.77 barrier, where it currently stands.

Moreover, losses accelerated below a break of 100-DMA placed around 0.78 handle mainly after the recent US CPI print surprise markets on the upside, boosting USD bulls and eventually weighing on AUD/USD. The Aussie extends its decline in today’s trade in running and is poised to test 0.77 handle as the US reversed its corrective slide following stronger than expected new home sales, durable goods orders and consumer confidence which bolstered the upmoves in the greenback.

Poor Australian Private Capex figures to aggravate the downslide

Against the back drop of persistent USD strength amid signs of US economy gaining steam, we expect AUD/USD to drop 0.7680 lows on the release of poor Australian private capital expenditure q/q scheduled for release on Thursday. A break below 0.7680 major support, selling pressure is expected to intensify dragging the pair lower to 0.7600-0.7580 levels in the week ahead.

Thursday’s Aus Capex data is the key indicator of the week. It is released each quarter, magnifying the impact of each release. The indicator slipped badly in Q4, coming in at -2.2%. This was worse than the forecast of -1.7%. Again a -2.3% drop is expected in private capex figures which is due to be report at 00.30GMT. Markets generally pay close attention to this data as this print is closely watched by the Reserve Bank of Australia (RBA).

Meanwhile, today’s Australian construction data release showed a declines for the sixth straight period last quarter in Australia, led by declines in engineering activity. The total value of completed construction activity fell 2.4% q/q in Q1 2015, the Australian Bureau of Statistics (ABS) reported.

USD dollar strength to persist

The US dollar is expected to extend its upward trajectory in the later part of this week as the key focus now remains Friday’s second estimate of first quarter GDP release from the US. Markets are expecting the Q1 print will be revised down to show a 0.9% contraction rather than the meagre 0.2% increase. However, in my opinion this data may do little to dent the ongoing strength in the US dollar.

Also, the final reading on the University of Michigan's consumer confidence for May is expected to reverse part of the massive plunge suggested by the preliminary data. The data is expected to have risen to 90.0 against the previous reading of 88.6.

Falling Iron-prices to drag prices further in red

As reported by Reuters, Iron ore futures in China slipped today following a rally that lifted them to a two-week high as Citigroup cut its long-term price forecast by a third in anticipation of slowing Chinese demand.

Citigroup slashed its long-term forecast to $55 a tonne from $81, predicting global demand will shrink from 2018 to 2025 as Chinese steel consumption slows while low-cost supply will continue rising. The bank kept its 2016-2018 price estimate at $40 a tonne.

While iron ore has recovered from a decade-low of $46.70 reached in April, it was still down more than 50 percent from last year's peak. Moreover, markets view this recent rally as short-lived and expect the ferrous metal to resume its long-term downtrend. Iron-ore is Australia’s top export product.

Technically, AUD/USD has broken below the short-term upside channel last week and remains pressured on broad USD strength ahead of the crucial Australian private capital expenditure data. The pair is likely to test the key support of 0.7680 (April 20 Low) following dismal capex figures, below which a fresh sell-off could trigger pushing the Aussie to 0.7600-0.7580 levels. In case the data beats expectations or comes in line with forecasts, we could see a correction to the upside back near 0.7800-0.7840 levels. Overall, the pair remains exposed to downside risks although may reverse from 0.7580 levels as the pair remains in an extremely oversold region with the daily RSI standing around 38.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.