Cable has had a lackluster series of trading sessions over the past several days printing negative closes on 5 successive trading sessions. Price reached a most recent high last Tuesday at 1.47691 on the back of receding fears of a Brexit success at the referendum on June 23rd.

However, that sentiment did not last very long, along with weak economic data released Wednesday last. GDP growth for the first quarter of 2016 was released at 0.4%, a substantial decline from the previous number at 0.6%. It would seem that the uncertainty being created by a vote on Britain’s future within the EU is creating a subdued business environment. Many corporations will be adopting a wait and see approach, until after the referendum.

Although it is not completely clear as to whether a Brexit would or wouldn’t be beneficial to the economy, financial markets do not like uncertainty, which means that in the meantime Sterling denominated assets are likely to see in an increase in volatility.

The Bank of England Governor Mark Carney, has tried to remain unbiased in his comments, but even he has remarked that the financial markets would take a hit in the case of a Leave victory. He has also mentioned that economic data will not be seen under the same light from here until the referendum as they may not correctly reflect the true state of the economy once it is out of the way.

On Thursday, at 11:00 GMT there will be a scheduled Bank of England meeting and a decision will be taken on interest rates. The consensus is for the board to vote to hold interest rates steady. It will be interesting to see if there are any board members that, despite Governor Carney’s comments, vote for an interest rate cut.

The Governor had recently mentioned that continued weak economic data may bring cause for a change in monetary policy, and a cut in interest rates. On Wednesday, there will also be data releases for UK Industrial and Manufacturing Production at 08:30 GMT.

If you think that volatility will increase over the next week then you maybuy a straddle strategy, which consists of simultaneously buying a Call and a Put option with the same strike, expiry and amount.

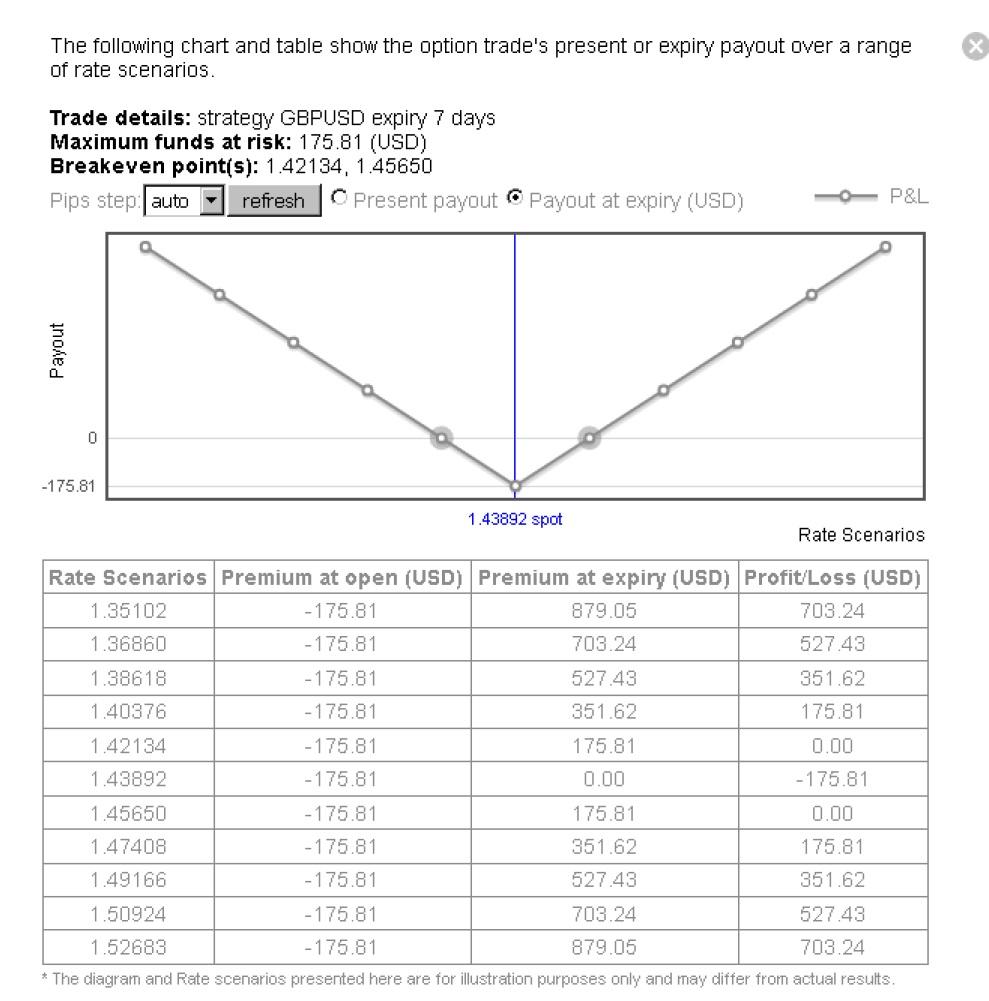

The screenshot below shows a GBPUSD Buy Straddle with a 1.43904 strike, 7 day expiry and for £10,000 would cost $175.85, which would also be the maximum risk.

This screenshots shows the profit and loss profile of the above Buy Straddle, just click the Scenarios button.

On the other hand, if you feel volatility will remain flat or decline over the next week, then you may sell a Straddle strategy, which consists of simultaneously selling a Call and a Put option with the same strike, expiry and amount.

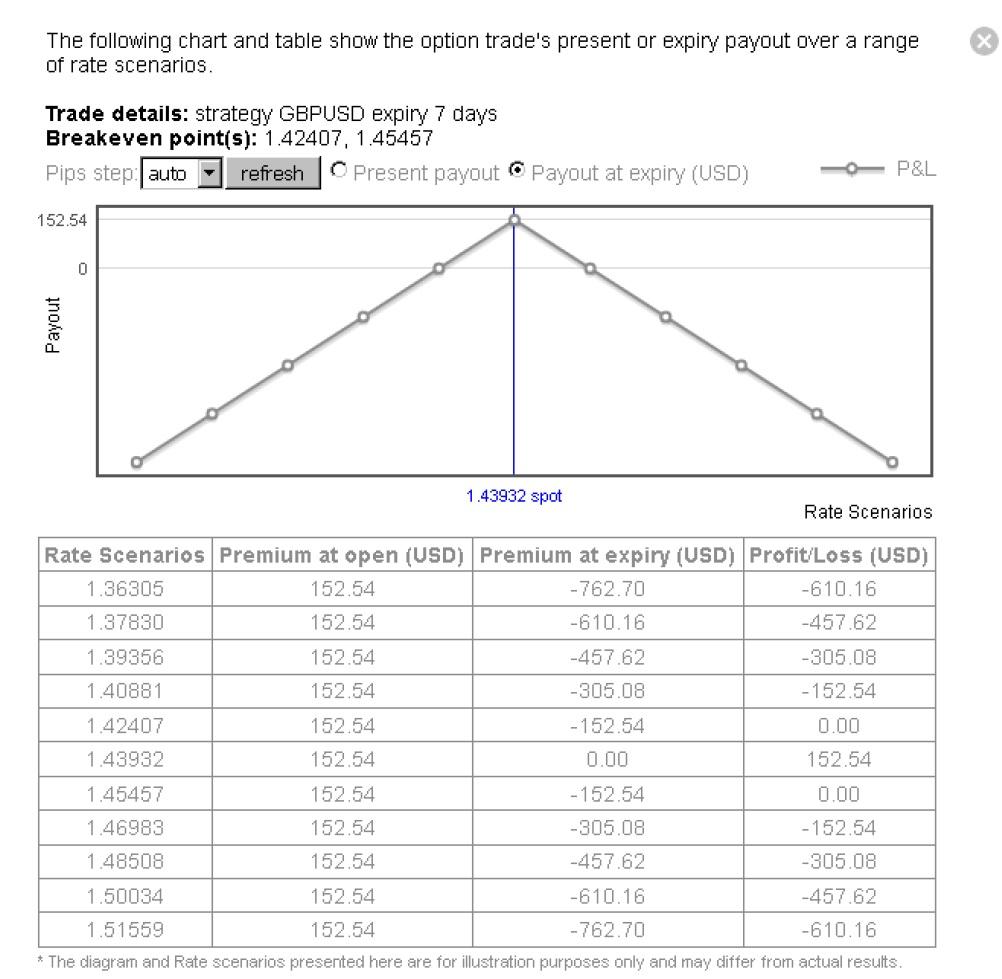

The screenshot below shows a Sell Straddle strategy with a 1.43884 strike, 7 day expiry and for £10,000 would generate $152.50 of revenue, with a total risk of $440.26.

This screenshot shows the profit and loss profile of the above Sell Straddle strategy.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.