The EURUSD saw an increase in volatility yesterday when it dropped 118 pips, or 1.03%, to go from its high yesterday at 1.13906 to close at 1.12723. As mentioned previously we had been expecting volatility to pick up again as the market for this pair had been trading in a fairly tight range over several trading sessions.

Yesterday also saw the release of Retail Sales data for the US and although it was lower than expected at 0.2%, the Euro saw no relief and price continued to fall 30 minutes after the number. There are renewed fears of how fast the Federal Reserve may hike interest rates, and any signs of higher inflation in the US can only weigh on the likeliness of hikes happening at a faster rate.

Today we saw Consumer Price Index (CPI) released for the Euro area which was 0.0%, last month’s number was at minus 0.1%.CPI is a metric for gauging inflation and both policy makers and traders watch this number closely. The markets don’t seem to have given this small increase in CPI any weight as EURUSD price continues to trade relatively flat to pre-data release.

And later on today at 1:30pm we have CPI data for the US, the previous month’s number was 1.0% and the forecast for today’s number is for an increase to 1.2%. As CPI is a gauge for inflation the markets will be watching this number closely, in the case of a substantial deviation from the forecast we can expect an increase in volatility.

Friday at 2:15pm will see the release of Capacity Utilization and Industrial Production, these numbers are not considered as having an immediate impact on market volatility, but they are indicators of economic activity, and the higher the numbers the more likely it is to create bullish sentiment for the US dollar.

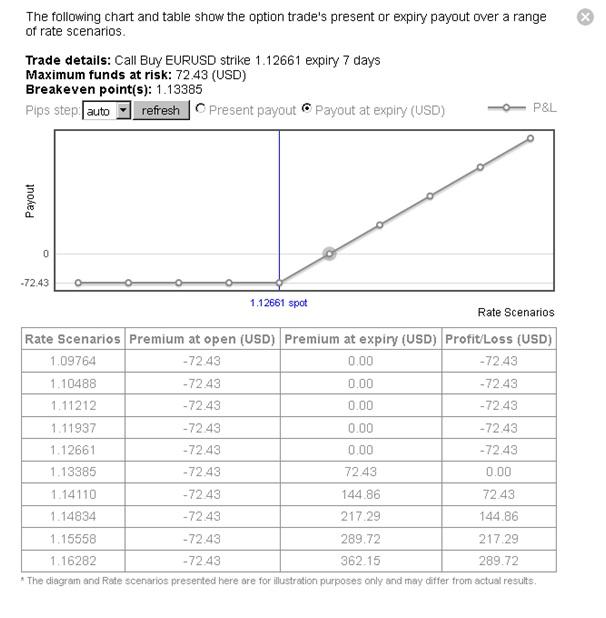

If you think the EURUSD will revert its downward trend and increase in price over the next week, then you may buy a Call option, which gives you the right to buy EURUSD at a pre-determined price (strike) on a specific date (expiry) and for an amount of your choice.

The screenshot below shows a EURUSD Call option with a 1.12653 strike, 7 day expiry and for €10,000 would cost $72.43, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above Call option, just press the Scenarios button.

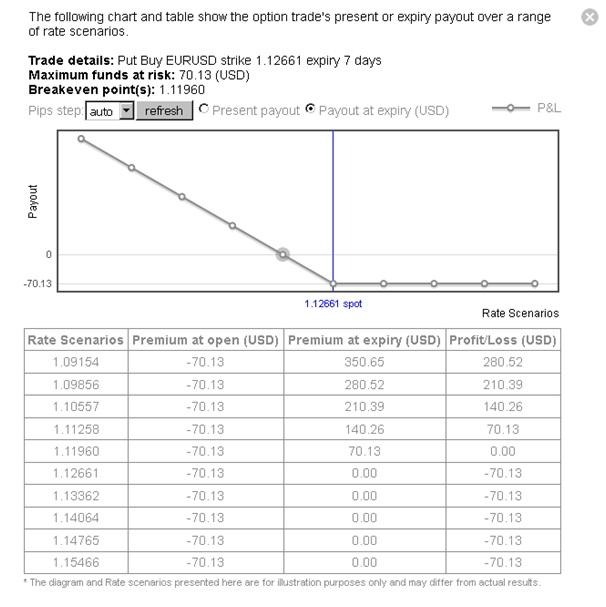

On the other hand, if you think the price of EURUSD will continue to fall over the next week,then you may buy a Put option which gives you the right to sell the pair at a specific strike and expiry and for an amount of your choice.

The screenshot below shows a EURUSD Put option with a 1.1265 strike, 7 day expiry and for €10,000 would cost $70.13, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.