Japan’s unemployment rate and Consumer Price Index (CPI) are due to be released at 23:30 GMT with expectations at 3.5% and 2.2% respectively.

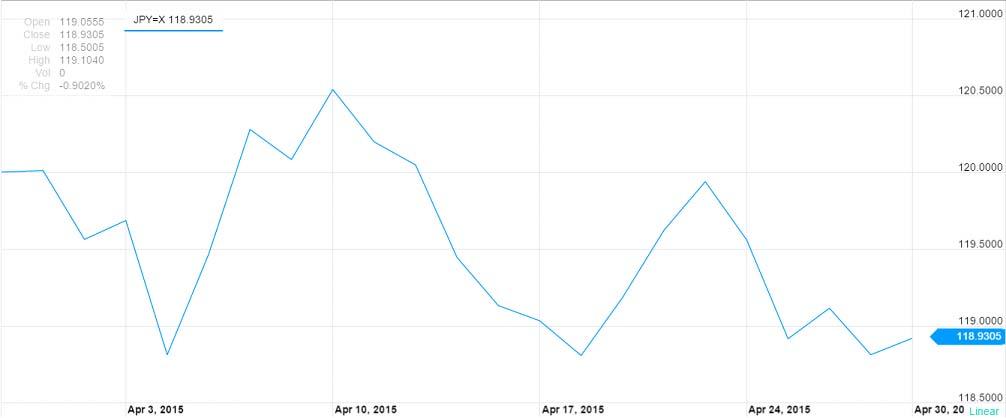

In the past month we have seen USD/JPY stuck in a range between 118.7 and 120.5. Currently it is trading on the lower end of this range at 118.85 as observed in the chart below.

The Bank of Japan (BOJ) has lowered its CPI and GDP forecasts but maintained that its 2015 policy is steady.

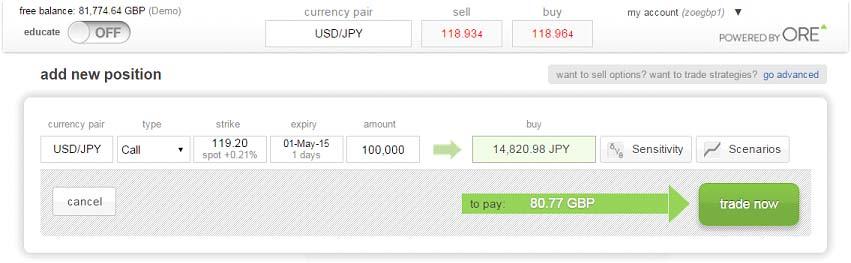

If you think the pair will rebound from its lows on account of poor data from Japan or the strengthening of the Dollar, you can purchase a Call option that is out-of-the-money (OTM), which is cheaper than an at-the-money option (ATM).

The position:

Buy a Call with strike rate 119.20 that expires tomorrow (01-May-15) for amount 100,000 USD (1 lot).

Web-platform position:

MT4-platform symbol:

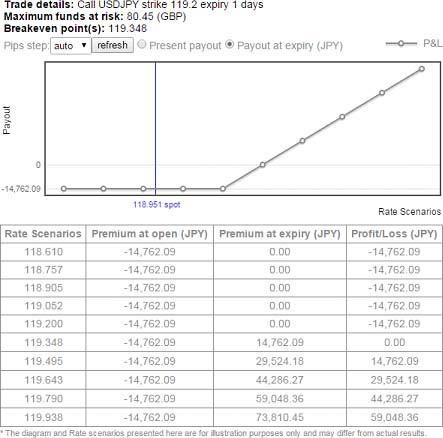

The chart below shows the profit or loss of the trade over a range of USDJPY rates at expiry If USDJPY moves to 119.495, you will be in 100% profit. If the pair trades lower, you cannot lose more than the premium of this option which is 80.77 GBP (124 USD).

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.