Tomorrow there is the release of the U.S. GDP, expected at 1.0% and the interest rate decision, expected to be unchanged at 0-0.25%. Thursday there is the release of the Euro zone Consumer Price Index (CPI) expected at 0.0%.

EUR/USD has seen some swings this month, ranging between its highs on April 6 at 1.1028 and lows on April 13 at 1.0527 as seen in the graph below.

If you believe these next few days will continue to be volatile, a popular voatility strategy is a long strangle. The strangle is very similar to the straddle with one difference, the strikes of the options. In a straddle, you purchase both a Call and a Put with the same strike and in a strangle, similarily you purchase a Call and a Put bu t they have different strikes andthe strikes are OTM (out-of-the-money. This means the Call will have a strake that is higher than the spot market and the Put will have a strike that is lower. This results in lower cost to buy the stratgy compared with a straddle.

You can trade this position on MT4 using ORE option symbols or on the ORE web solution, OPTIONSREASY.

The position with the MT4 symbols:

BUY symbol C#EURUSDw+2, with strike = 1.0915

BUY symbol P#EURUSDw+0, with strike = 1.0815

By purchasing both these options, you are creating a strangle that will expire Friday, May 1st.

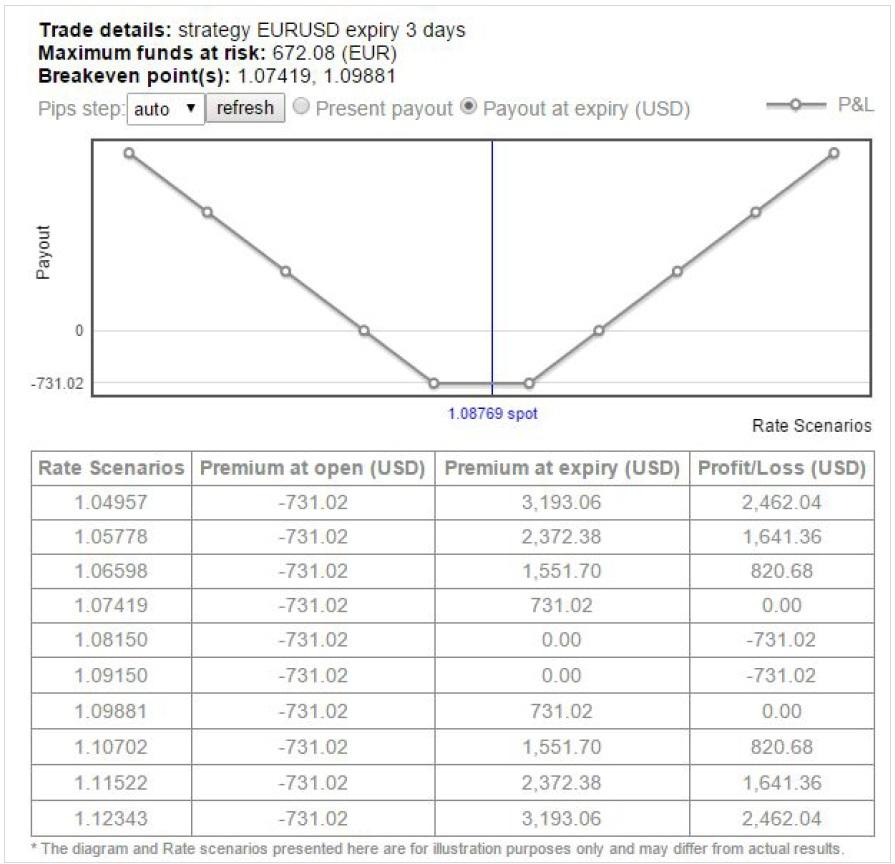

The graph below shows the strategies profit or loss at expiry over a range of EUR/USD rates. The total cost of this position of an amount of 1 lot (100,000 EUR), at the time of writing = $731.

If the market trades back to its month highs, the position will profit $400, more than 50% of its value at open. You will also receive a profit if the market trades down below 1.0741. If the market does not move out of the range 1.0741 - 1.0988, you will make a loss with maximum risk $731.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.