The yellow metal has extended its losses this morning, now trading at $1179. The Gold Volatility Index is at 16.88 which is a relatively low level for the year, see graph below.

There are some major data releases and other global news on the front line this week; the Greece situation continues, Iranian nuclear program, EU Consumer Price Index (CPI), US Non-Farm Payroll (NFP) and more.

Gold Volatility Index Chart:

To trade an expected increase in volatility you may buy options because an option's value increases as volatility rises. But also note that Gold is trading at a 10 day low (see chart below). If you expect Gold price to rise and/or volatility to increase then buying a Call option is a suitable trade because a Call option's value increase as market price and/or volatility rises.

The position:

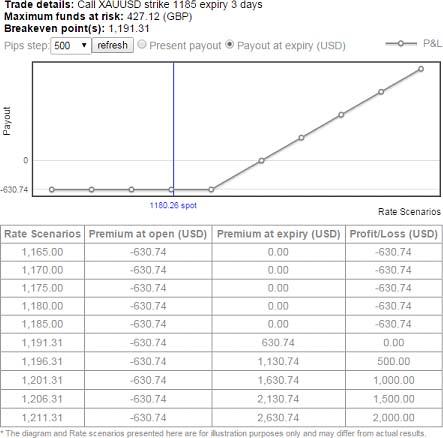

Buy a short-term, XAU/USD Call to expire this Friday at 14:00 GMT, with strike equal to $1185 (out-of-the-money). The option can be traded on MT4 using symbol C#XAUUSDw-2 or on ORE's web platform. The cost of this option on a 100 units (1 lot on MT4) is approximately $600 and this is your maximum risk for the position. Your upside is unlimited.

Web-platform Symbol:

MT4 Symbol:

The below chart and table shows the option trades payout at expiry over a range of market rates:

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.