Two important data figures will be released at 12:30 GMT; Canadian employment data, which is expected to drop 5,000 in jobs and the unemployment rate to rise from 6.6% to 6.7% and, the U.S. Producer Price Index (PPI) YoY is expected to be unchanged at 0%.

Currently, this week USD/CAD traded at a high of 1.2788, now at 1.27387. As shown in the chart below, these are the highest levels since 2008.

There is a rise in USD/CAD volatility mainly due to aggressive U.S. Dollar strength and also due to these new highs and we expect volatility to continue.

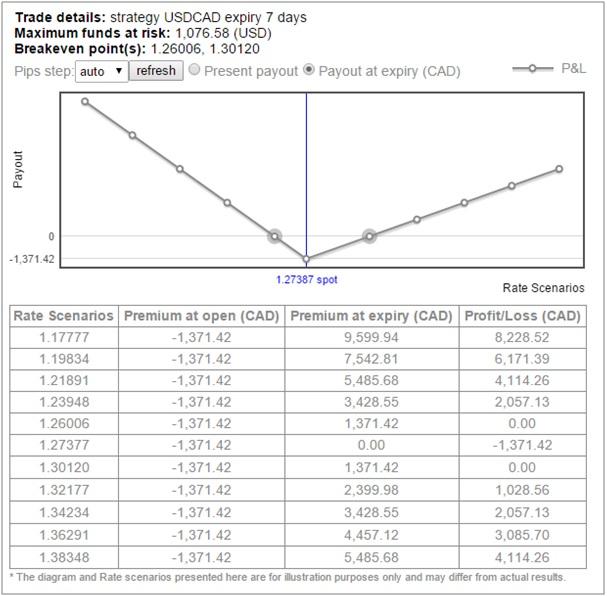

To trade the volatility and take into consideration the price is at a 6 year high, you could place a long straddle position with a downside bias.

A long straddle involves buying both a Put and a Call ATM (at-the-money). To place a bias on the downside you will buy a Call and Put with a 1:2 ratio. This means you will profit if the market trades in either direction but you profit more if it trades down.

Below is a scenario graph and table presenting your payout at expiry over a range of market rates. The Call option is of amount $50,000 and the Put is $100,000, both have strike rate = 1.27387.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure above 0.6400

AUD/USD managed to regain some composure and rebounded markedly from Tuesday’s YTD lows in the sub-0.6400 region ahead of the release of the Australian labour market report on Thursday.

EUR/USD holds above 1.0650 amid renewed selling pressure in US Dollar

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar and a risk-friendly environment.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin price is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

Australia unemployment rate expected to rise back to 3.9% in March as February boost fades

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February.