Surprisingly the Reserve Bank of Australia (RBA) left interest rates unchanged at 2.25%. The market priced in a 0.25% cut and, before the announcement, AUD/USD traded low as $0.7751. Following the RBA's no-change, the pair rallied over 1% to $0.7841.

Tomorrow, the Australian GDP will be released at 00:30 GMT and is expected to be 2.6% versus previous months 2.7%. Later this week we have the release of the employment situation in the US which leaves the US Dollar under pressure.

Currently AUD/USD is trading at 0.7820 and the 1 day ATM (at-the-money) AUD/USD option volatility is around 13.3%. This is relatively very high; the equivalent EUR/USD volatility is around 10.55%.

A positive GDP figure plus the growing pressure on US Dollar towards Friday’s employment data may cause AUD/USD to rise. If you expect Australia’s GDP to be in line with expectations or better, an interesting position to take is the Bull spread.

A Bull spread is used to profit from an increase in market rate with limited risk and no stop-out. To set-up this strategy, you buy an OTM (out-of-the-money) Put option and, at the same time, sell an ATM (at-the-money) or ITM (in-the-money) Put. As the market rises towards the sell Put's strike rate the positions payout rises.

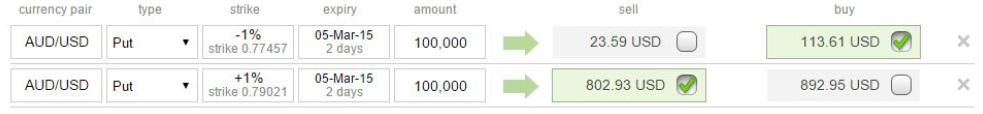

The below is an example of a Bull spread strategy:

In the top line, we buy a Put option with strike 1% below market (out-the-money) at 0.7745. In the second line, we sell a Put 1% above market (in-the-money) at 0.7902. Both options have amount 100,000 and expire in 2 days. Note that expiry is after tomorrow’s Australian GDP and before Friday’s Non-Farm Payrolls. By selling the more expensive, in-the-money option, we receive money when placing the position.

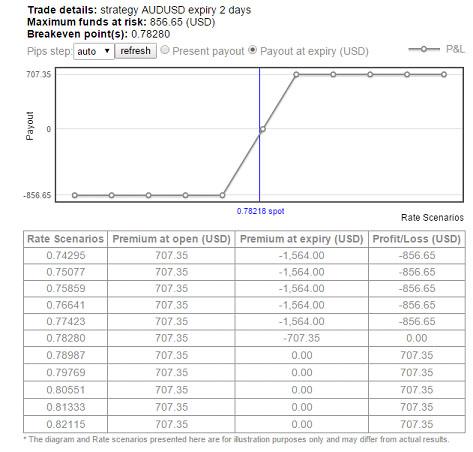

The payout scenario at expiry is shown in the chart and table below. If the AUD/USD is trading above 0.7828 there is profit which reaches its maximum return of $707 above 0.7898. If the pair trades below 0.7828 there is a loss and a maximum loss of $856 is reached below 0.7742.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.