This has brought about some major action in the EUR/USD pair opening up the opportunity to place a one-day option trade.

Below is a chart showing the huge decline in EUR/USD over the last two days.

With this strong decline, buying a 1 day ATM (at-the-money) Call option, to trade a rebound, is now very cheap; the quick decline in EUR/USD has caused the price of Call options to drop sharply.

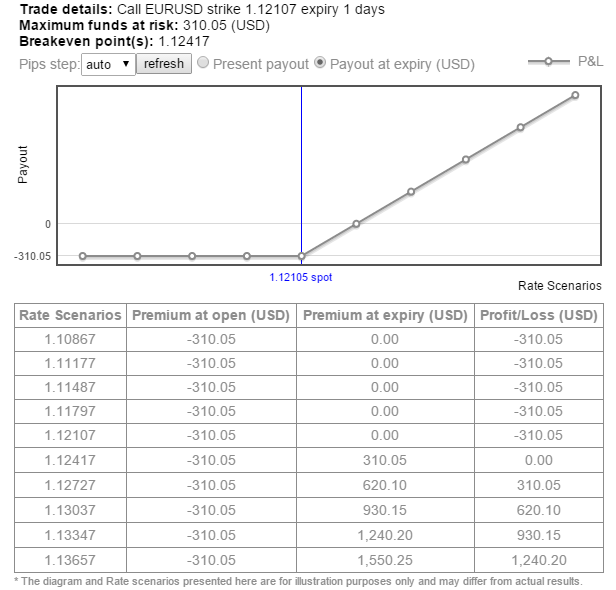

The below chart and table shows the profit or loss, at expiry, of an ATM EUR/USD call option over a range of market rates. The deal size of the option is 100,000 and the strike at time of trade placement equals the spot rate at 1.1210. This trade will expire tomorrow at 15:00 GMT after U.S. GDP and Personal Consumption data. If EUR/USD, at expiry, is trading 60pips above its current level you will profit 100%. Note that, today the pair declined around 150 pips in a few hours alone!

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.