EURUSD

Unofficial news on the ECB QE of 50Billion Euro a month were reported yesterday and are in line with expectations but other than the QE size, conditions of the QE are no less important.

If the QE figure will differ to the upside from current expectations and yesterday’s rumors, volatility will spike and the currency is most likely to trade down towards the 1.1500 mark. If the QE is in line with expectations or is lower, the currency is most likely to remain within current range but the pair’s volatility will be left to QE conditions. We don’t expect to see an out of range strengthening for the EUR since we also have the Greece elections coming up on Sunday, leaving all EUR related trades under pressure.

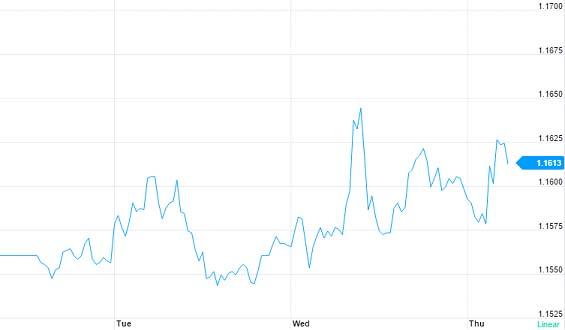

Below you can view this week’s movement chart of the currency now trading at 1.1613.

EURUSD support levels are seen at 1.1425-1.1440 and resistance levels are 1.1665-1.1680.

It feels like there’s more weakening room for the EUR vs USD but also much of the news to be released might already be priced in the market, making a strangle strategy more attractive than a simple Put option on the EURUSD.

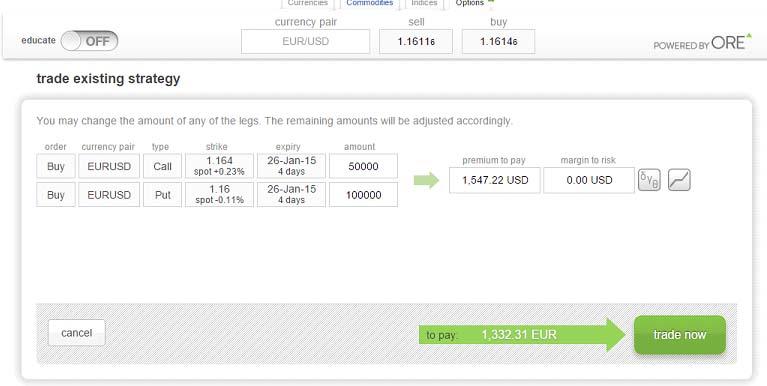

I have created a strangle position that is stronger to the downside, meaning it will profit more if the currency pair trades down. The strategy consists of both a Call and a Put but in this case the amount of the put is twice the amount of the Call, 100K vs 50K. The strategy is to expire on Monday, post the Greece elections taking place on Sunday. If today’s events effect the pair strongly and you encounter immediate profit, consider closing the position prior to expiry.

Below you can view the build of both legs of the strategy:

You can also view and trade this strategy in the ORE Marketplace under the name “ECB strangle”.

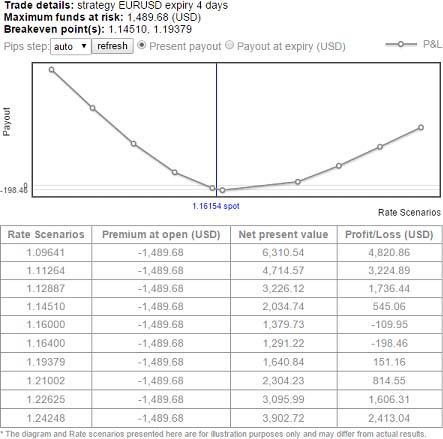

For better understanding of the rate scenarios, view graph below. The payout described is the present payout. You may view the payout on expiry in the marketplace. Notice that if the pair trades to its near support level of 1.145 today, you will profit 30% of your $1547 premium paid.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.