With new levels in the FX market, it seems that there are many new opportunities out there. But, with exciting opportunities comes risk, risk that we might not be able to weather through if such unexpected occurrences will repeat.

This is something every FX trader might be thinking, and who can blame them, last week’s surprise was brutal and deadly for some but, if you were an options trader holding long option positions, this is where you would shine.

Going long through buying options gives the trader opportunities where the upside is unlimited and the downside limited. If last week you were long through buying Call options in any of the pairs that crashed, your losses amounted to the premium paid for those options and not a dollar more.

If you want to jump back into the game but don’t want the risk on your head and your bank account, look into going long or short in the underlying market (e.g. spot market) though purchasing Calls and Puts, respectively. Furthermore, there are opportunities to explore in buying Puts and Calls across different pairs at the same time.

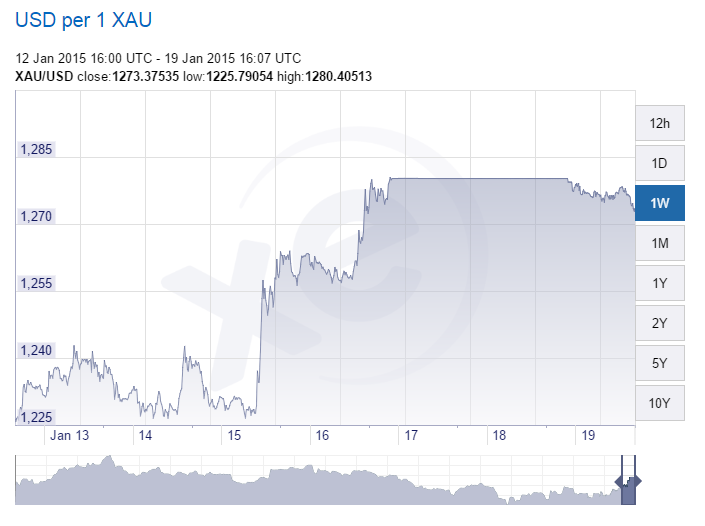

Gold (XAUUSD) has been used as a safe haven after the currency war on Thursday and the pair extended its gains from $1227 to $1275 (see chart below). If EURCHF continues to fall we may see gold rise further. On the other hand, if EURCHF recovers then gold may come off its highs. In any case we don't expect these pairs to move in the same direction.

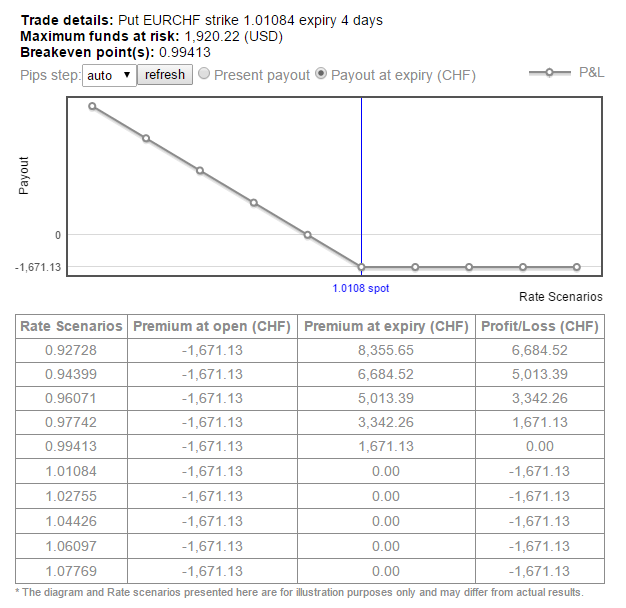

An interesting position to trade this outlook is the purchase of a Put on the EURCHF and a Put on XAUUSD. As long as these pairs are moving enough*, and moving in opposite directions, you will profit. If the pairs do not move your loss is limited to the sum premium paid for the options.

*The move needs to exceed your breakeven point after which you will see profit. In the example below you will find that your breakeven point on the EURCHF is 0.99413

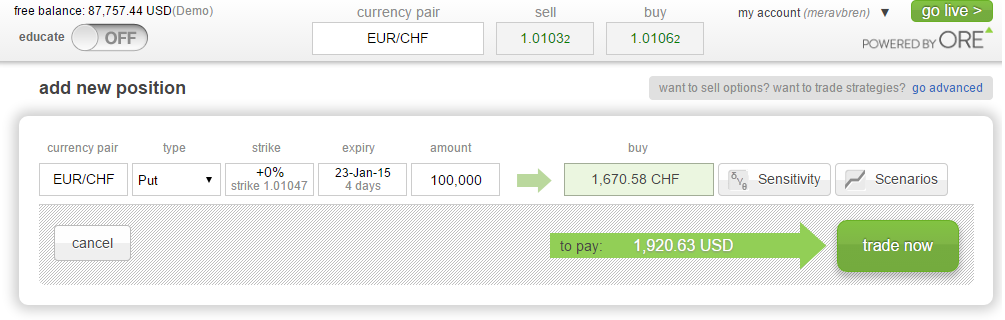

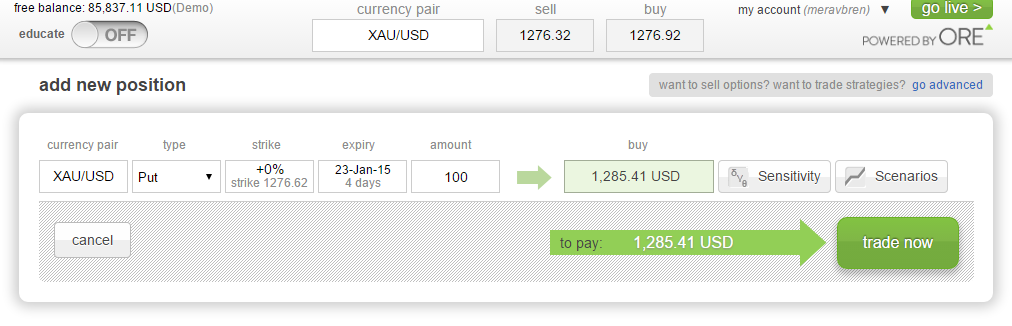

The position:

Long Put on EURCHF for 4 days (to expire Friday before the weekend) on 100,000 = 1,670CHF

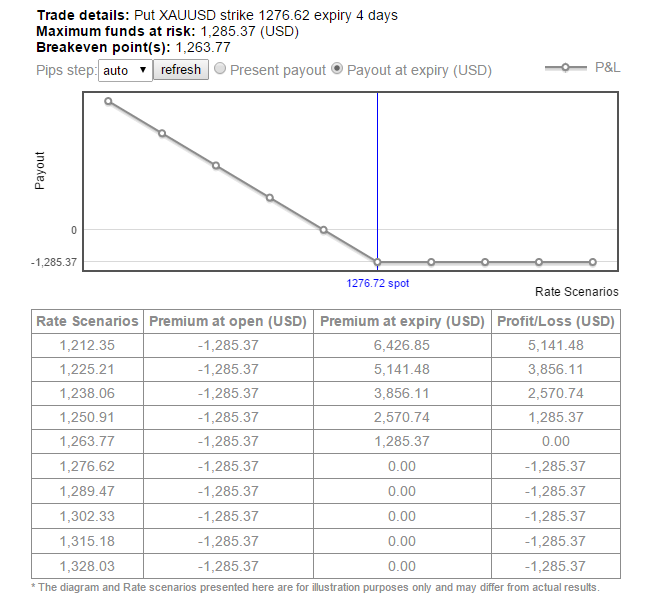

Long Put on XAUUSD for 4 days on 100 units = 1,285USD

The rate scenarios per each position separately shown below:

Notice that you’ll be up 100% in the EURCHF on expiry if the currency declines by 3.3% and in the XAUUSD you’ll profit 100% if the commodity declines by only 1.9%.

Your loss in case of the options expiring out of the money equals the sum of both premiums paid at open: 1920+1285 = 3,205USD (rate used for USDCHF=0.87).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.