Tomorrow, at 13:30 GMT, the anticipated US NFP will be released and the word on the street is that we might see some disappointing numbers. Regardless if the “street” is right or wrong, there is no doubt that these are interesting levels and with a continuous decline driving the pair down, betting on the pair’s temporary rebound is not a far-fetched assumption.

An attractive way to leverage this unique opportunity with a limited loss and no fear of being stopped out of your position, is buying options. In this case, two out-of-money Calls (OTM options are options that their strike is further away from the spot). This position will begin profiting if the pair’s closer to the money strike is reached and will increase its profit once the strike of the other option is reached and exceeded. The leverage for this position is 1:240 with the total amount being 200K (each option is on the amount of 100K) and your premium at open is $835.

The idea behind this position is that if we encounter a rebound from these levels due to weaker than expected NFP data combined with these already extreme levels, the move up can be dramatic.

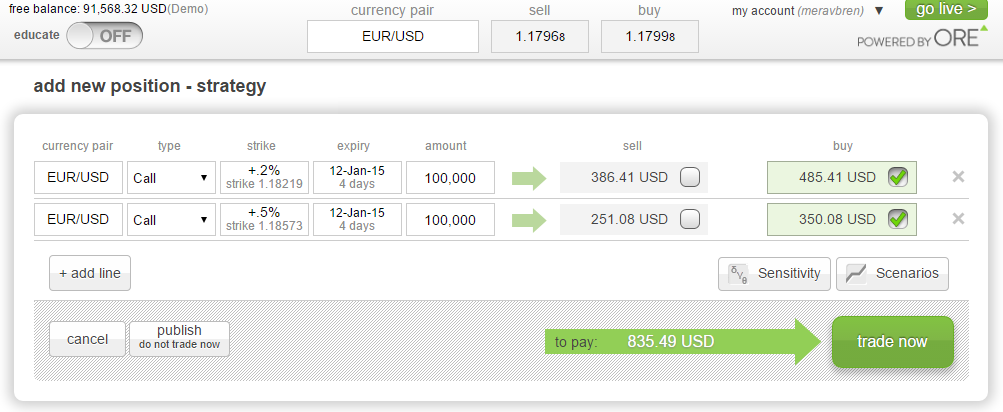

Below you can find a position involving the two OTM Calls. One with strike 1.18219 and the other 1.18573. The strikes, number of Calls and amount on which each Call is on can be adjusted according to the amount of risk you wish to take.

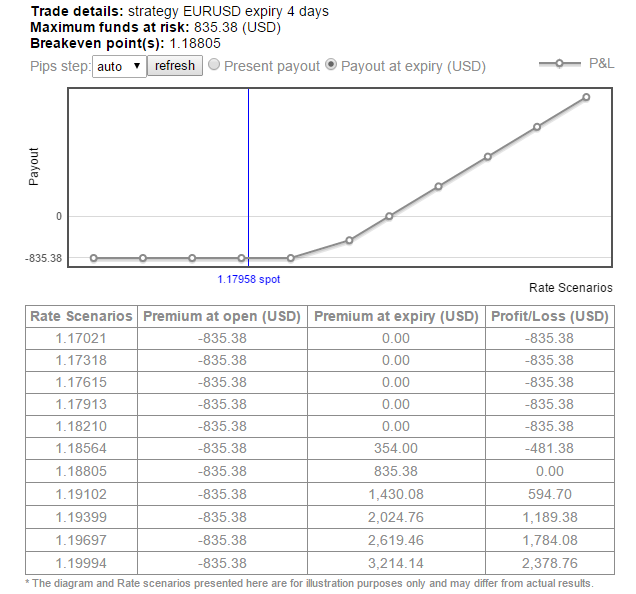

In the graph and table below you can find the different rate scenarios at expiry. Your maximum funds at risk equals $835. Your breakeven level equals 1.18805 and notice how your profit increases by 70% with every 29pips step.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.