The British pound has been quite stable versus the Dollar in the past month with a range not greater than 1%.

There is important data to be released tomorrow in the UK. The morning will start with the bank stress results at 7GMT, governor Carney speech will take place at 9GMT and CPI data will be released at 9:30GMT. Will we see some action or rather continue to experience low volatility?

Currently, ATM GPBUSD options have a relatively low volatility. The options are priced with 8% versus EURUSD with 10.4% and other pairs such as USDJPY, USDCHF and even USDCAD that indicate much higher volatility, around 11%.

Low volatility can be a good opportunity to buy the options of the pair prior to the data tomorrow since it effects the cost of those options. High volatility translates to a higher option price and vice versa.

Considering the upward trend against the dollar and the dollar index continuing to weaken, there is an interesting, semi strangle position you can consider. Buying a CALL with strike equaling the R1, 1.5745 and a PUT with strike OTM at S2, 1.5654 on half the amount. In this example, the CALL is on the amount of a 1 lot and the put on the amount of 0.5 lot expiring on Thursday.

On the ORE platform in the Marketplace, you may view and trade this strategy under the name “Semi strangle”. The strategy will appear as such and the amounts are adjustable.

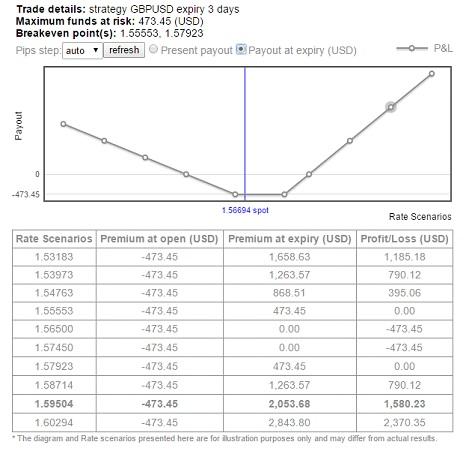

In the graph below you can view the scenarios of the trade idea on expiry.

Your premium at open equals $473 for the strategy. You begin to profit if/when the spot trades beyond either strike. If the pair sees no volatility and does not trade beyond wither point, you will lose 100% of the premium paid.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD stand firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

USD/JPY climbs relentlessly ahead of BoJ meeting

The USD/JPY extends its uptrend despite verbal intervention from the Minister of Finance. The wide differential between US and Japanese interest rates is seen as a major factor contributing to the rise. The idea that a lot is already priced into the US Dollar could limit USD/JPY upside.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.