USD/CAD

The dollar traded lower against most of its G10 peers during the European morning Friday ahead of the US employment report for August. It was higher only against SEK and CHF, while it traded virtually unchanged versus GBP. The greenback depreciated against JPY, AUD, NZD, NOK and EUR, in that order.

With no material releases until now, investors’ eyes are on the US employment report due out later today. This could be the most important employment report of the year, in our view, since it’s the last one ahead of the September FOMC policy meeting and may determine whether they raise rates at that meeting. The report is expected to show a 217k increase in nonfarm payrolls, slightly above the 215k print in July. Another reading above 200k would suggest that the US labor market is still gathering momentum despite the recent turmoil in China and the collapse in equity markets worldwide. A strong employment report, coming after the upward revision to the Q2 GDP figure, could bring forward expectations of a September hike, something that could boost the greenback across the board.

At the same time, Canada’s unemployment rate for the same month is coming out. The unemployment rate is forecast to have remained unchanged, but the net change in employment is expected to show a decline. Following the recent plunge in oil prices and the reluctance of investors to push CAD higher after the better-than-expected GDP data on Tuesday, I would expect the currency to come under additional selling pressure at the release.

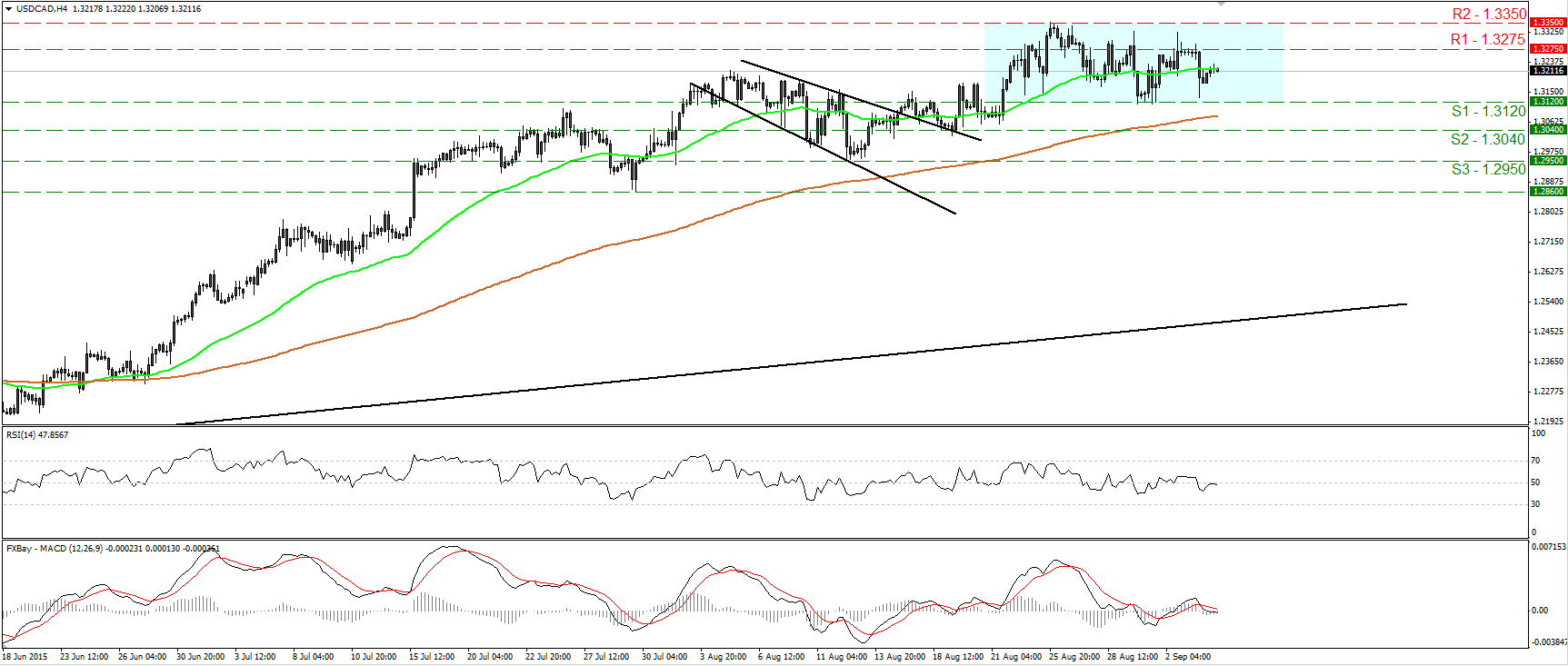

USD/CAD has been trading in a sideways range between 1.3120 (S1) and 1.3350 (R2) since the 21st of August. Therefore, I would consider the short-term path to be neutral for now. However, the compensation of the aforementioned releases could be the trigger for a strong bullish leg. A clear break above the 1.3275 (R1) barrier could open the way for another test at 1.3350 (R2), the upper bound of the aforementioned range. Another break above the latter obstacle would confirm a forthcoming higher high on the daily chart, and perhaps set the stage for extensions towards the psychological territory of 1.3500 (R3). As for the broader trend, the pair is still trading well above the long-term uptrend line drawn from back the low of the 11th of July 2014. Therefore, I would consider the major path of USD/CAD to be to the upside. Nevertheless, I see negative divergence between both the daily oscillators and the price action. This is another reason I believe that a break above 1.3350 (R2) is needed to reinforce that long-term uptrend.

Support: 1.3120 (S1), 1.3040 (S2), 1.2950 (S3)

Resistance: 1.3275 (R1), 1.3350 (R2), 1.3500 (R3)

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.