EUR/GBP

The dollar traded mixed against the other G10 currencies during the European morning Wednesday. It was higher against NZD, AUD, CHF, GBP and CAD, while it traded lower versus NOK, JPY and SEK. The greenback traded virtually unchanged against EUR.

The only worth-mentioning release we had today was the UK construction PMI for August. The index rose compared to the previous month, but missed estimates of a larger increase. The impact on the pound was minimal at the release, but the currency continued its decline thereafter. Tomorrow, we get the service-sector PMI for the month, which is also expected to have risen. Given though that the construction index today missed estimates and that the manufacturing one unexpectedly declined on Tuesday, another miss in the service-sector PMI looks possible. At midday, GBP/USD is trading below the 1.5290 line, and I would expect it to continue lower and challenge the 1.5250 hurdle any time soon. The bears could get a first opportunity later today when the US ADP employment report is coming out. Expectations are for a strong report, which could add fuel to USD long positions.

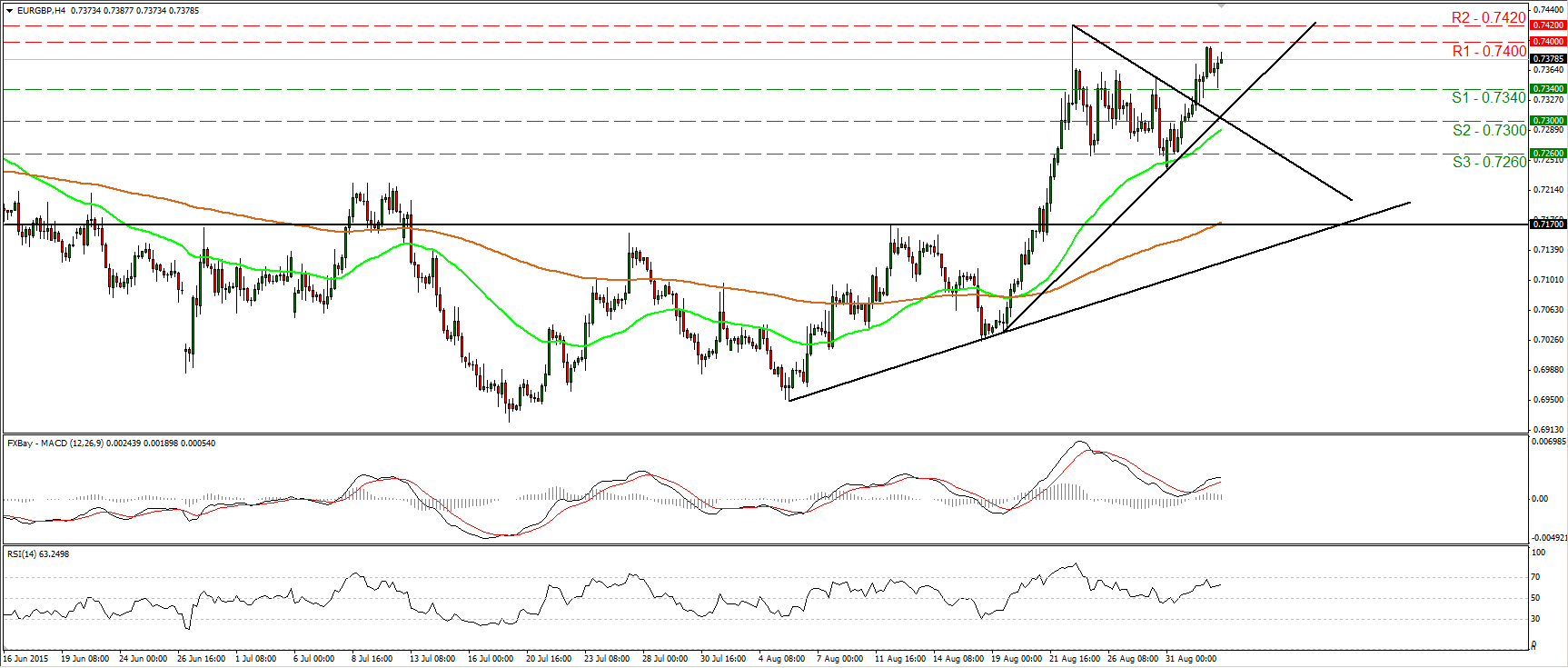

EUR/GBP traded higher during the European morning Wednesday, after it hit support fractionally above the 0.7340 (S1) line. Yesterday, the rate broke above a short-term downtrend line taken from the peak of the 24th of August, and this shifted the short-term bias back to the upside, in my view. A break above the 0.7400 (R1) resistance is likely to bring into the game the peak of the 24th of August at 0.7420 (R2). I believe that a clear move above the latter barrier is needed for a strong bullish leg, perhaps towards the psychological zone of 0.7500 (R3). The RSI has turned up again and looks to be headed towards its 70 line, while the MACD stands above both its zero and signal lines, but points east. These indicators detect upside momentum, but the fact that the MACD is pointing sideways corroborates my view to wait for a break above 0.7420 (R2) before getting more confident on the upside. As for the broader trend, the move above 0.7170 signaled a forthcoming higher high on the daily chart and turned the medium-term outlook positive as well. Therefore, I would treat the 24th-31st of August decline as a corrective phase and I would expect a close above 0.7420 (R2) to confirm a forthcoming higher high and the resumption of the aforementioned upside path.

Support: 0.7340 (S1), 0.7300 (S2), 0.7260 (S3)

Resistance: 0.7400 (R1), 0.7420 (R2), 0.7500 (R3)

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.