GBP/CAD

The dollar traded higher or unchanged against all but one of its major peers during the European morning Tuesday. It was lower only against JPY. The greenback outperformed AUD, NZD, NOK, CAD and GBP, in that order, while it traded virtually unchanged versus EUR and SEK.

The pound suffered today after the UK manufacturing PMI for August unexpectedly declined to 51.5 from 51.9 in July, missing estimates of a modest rise to 52.0. This could increase speculation that tomorrow’s construction PMI is going to miss estimates as well and weigh on expectations of solid growth in Q3. GBP/USD was declining ahead of the release and at the event, it accelerated lower to trade temporarily below the support zone of 1.5330, marked by the low of the 8th of July. A disappointing construction PMI tomorrow could pull the trigger for another attempt below that support zone, something that could pave the way for the 1.5250 area defined by the low of the 9th of June.

Later in the day, the focus will be on Canada’s GDP data. The loonie was the main winner yesterday among the G10s following the surge in oil prices, but today it surrendered to its stronger US counterpart. The market expects the monthly GDP for June to have improved, but the Q2 GDP as a whole is forecast to have fallen further. This could put further pressure on the BoC to act soon and could push CAD even lower. USD/CAD rebounded from 1.3120 today, and a disappointment in Canada’s GDP data could push it higher, for another test at 1.3325, yesterday’s high.

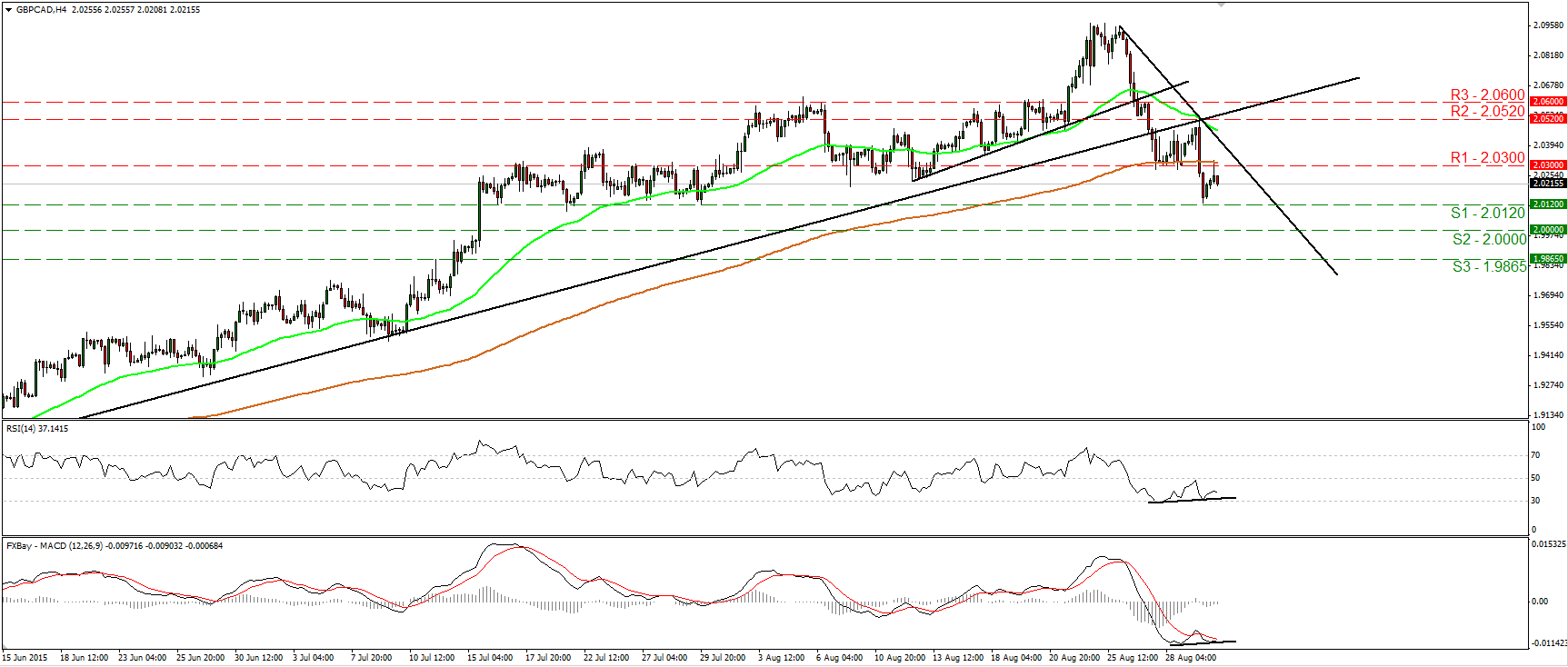

GBP/CAD traded higher during the European morning Tuesday, after it hit the key support zone of 2.0120 (S1). Although Canada’s GDP data could push the pair a bit higher, the short-term trend on the 4-hour chart still looks negative. However, given that there is positive divergence between our short-term oscillators and the price action, I prefer to wait for a break below 2.0120 (S1) before getting more confident on the downside. Such a break is likely to open the way for the psychological zone of 2.0000 (S2). As for the broader trend, on the 27th of August, GBP/CAD fell below a medium uptrend line taken from the low of the 5th of May. What is more, there is negative divergence between both our daily oscillators and the price action. The technical signs derived from the daily chart amplify the case that any near-term bounces are likely to remain limited and that the aforementioned short-term downtrend is likely to continue for a while.

Support: 2.0120 (S1), 2.0000 (S2), 1.9865 (S3)

Resistance: 2.0300 (R1), 2.0520 (R2), 2.0600 (R3)

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.