USD/CAD

The dollar traded mixed against its major G10 peers during the European morning Thursday, ahead of the 2nd estimate of the US Q2 GDP. The forecast is for the growth rate to be revised up, to show that the US economy expanded at a faster pace from the already encouraging growth figure seen in the first estimate. This is in line with the Fed's expectations for a stronger growth in Q2, and could support USD. The greenback was higher against EUR, JPY and GBP, in that order, while it was lower vs CAD, NZD, NOK and AUD. It was virtually unchanged against SEK and CHF.

Eurozone's M3 money supply accelerated to 5.3% yoy in July from a revised 4.9% in June, beating expectations of an unchanged reading. More importantly however, was the further increase of the flow of credit to the private sector. The growth rate of loans ticked up to 1.9% yoy in July from 1.7% a month ago, which suggest that the ECB's QE and targeted LTRO programs may have started to work. As a result, spending could pick up and boost prices. Business investment may strengthen as well.

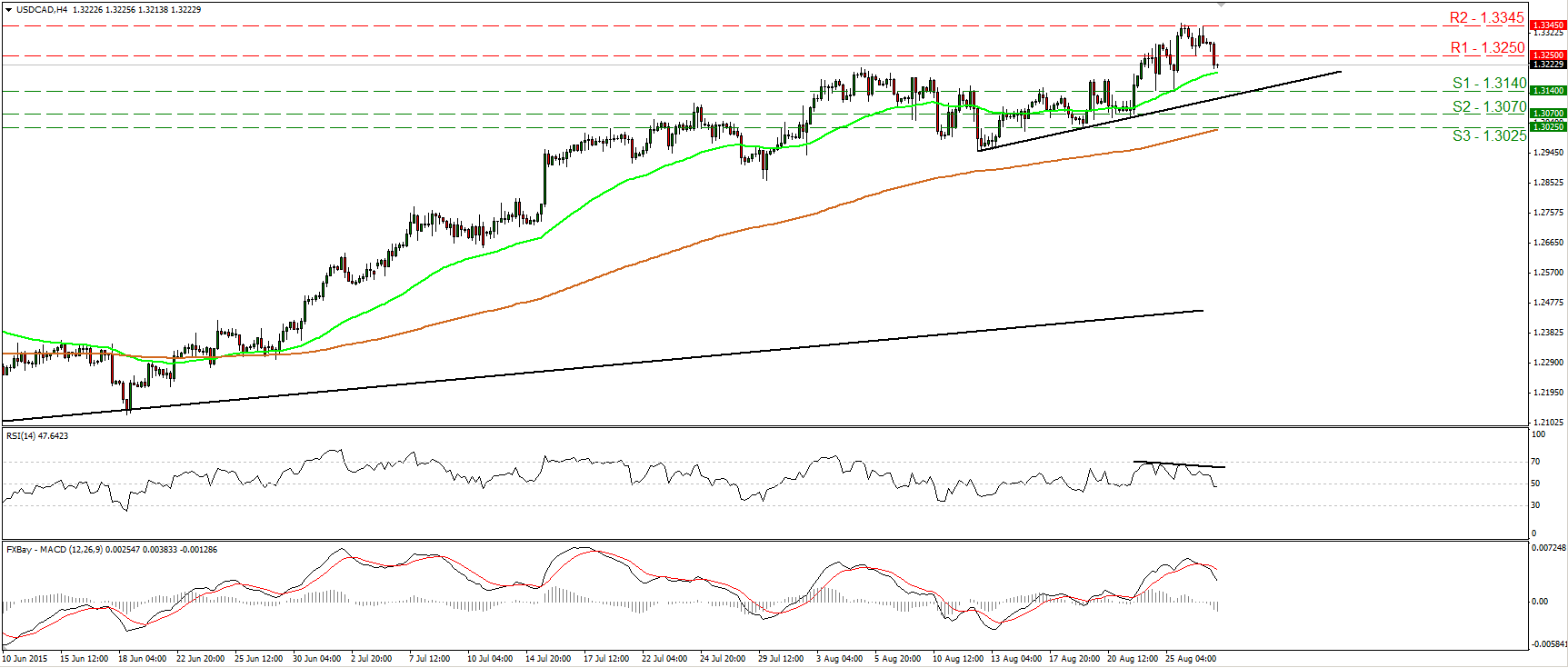

USD/CAD traded lower during the European morning Thursday, breaking below the support (now turned into resistance) barrier of 1.3250 (R1). The short-term trend remains positive in my view, as marked by the uptrend line taken from the low of the 12th of August. However, I see signs that the current pullback may continue for a while, perhaps to challenge once again the 1.3140 (S1) support barrier. The RSI edged lower and fell below its 50 line, while the MACD, although positive, has topped and fallen below its trigger line. Moreover, there is negative divergence between the RSI and the price action. On the daily chart, I still see a major uptrend. The pair is still trading above the uptrend line taken from back the low of the 14th of July 2014. As a result, I would treat any future near-term declines as a corrective move of that long-term upside path.

Support: 1.3140 (S1), 1.3070 (S2), 1.3025 (S3)

Resistance: 1.3250 (R1), 1.3345 (R2), 1.3500 (R3)

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.