EUR/JPY

The dollar traded mixed against the other G10 currencies during the European morning Tuesday. The greenback gained against CHF, AUD and NZD, in that order, while it was lower vs NOK, JPY, CAD and GBP. EUR and SEK were the currencies which had a relatively quiet morning.

The only noteworthy release we had so far was the German Ifo survey for August. All three indices unexpectedly rose from July, confounding expectations of further declines. The expectations index, although it was above the forecast, it declined from the previous month similar to the weak expectations index seen in the ZEW survey. The overall improved Ifo survey helped to recede fears over Germany's recovery path and Eurozone seems to be on track to gather momentum in Q3. At the time of the release, EUR/USD declined a bit, only to find some buy orders slightly above our 1.1500 support level. The rate subsequently jumped towards 1.1550 and maintained its choppy price action established in the Asian trading session. We will need to see the pair breaking either above 1.1625 or below 1.440 for any hope of a nice move into the end of the week.

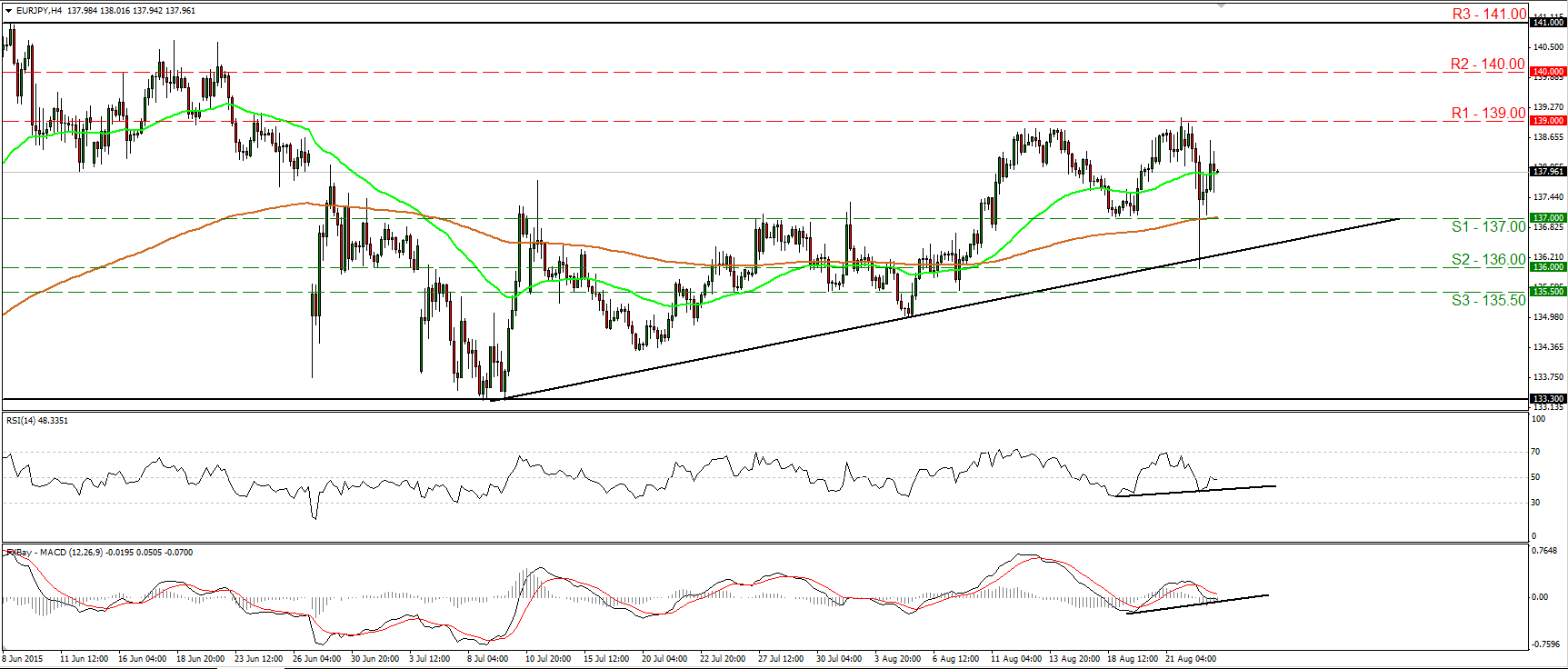

EUR/JPY traded higher during the European morning Tuesday, after it hit support slightly above the 137.00 (S1) hurdle. As long as the rate is trading above the uptrend line taken from the low of the 9th of July, I would consider the outlook to be cautiously positive. However, I would like to see a clear and decisive move above 139.00 (R1) before I get confident on the upside again. Such a move would confirm a forthcoming higher high on the daily chart and perhaps set the stage for extensions towards the psychological round figure of 140.00 (R2). Our short-term oscillators support the somewhat positive picture as well. The RSI edged higher but hit resistance slightly above its 50 line, while the MACD, although slightly below zero, shows signs of bottoming. Furthermore, there is positive divergence between both these indicators and the price action.

Support: 137.00 (S1), 136.00 (S2), 135.50 (S3)

Resistance: 139.00 (R1), 140.00 (R2), 141.00 (R3)

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.