EUR/GBP

The dollar was higher against almost all of its G10 peers during the European morning Monday, ranging from +0.15% against SEK, to +0.30% vs NOK. The greenback was virtually unchanged against AUD and GBP, in that order, while it was slightly lower vs NZD.

The British pound strengthened initially after the country's manufacturing PMI beat expectations and rose to 51.9 in July from 51.4 previously vs the forecast of a rise to 51.5. In the following minutes however, the currency gave back all the gains and fell back to trade unchanged against the USD. Investors seem to be cautiously positioning themselves ahead of the action-packed day this Thursday, when the BoE will release its rate decision, the minutes of that meeting showing members votes, and the quarterly Inflation Report, all at the same time. With several members adopting a more hawkish stance recently, we will be watching if this will be reflected in the rate votes. In such case, this will most likely be GBP bullish, which we prefer to express against the commodity currencies AUD, NZD and CAD.

EUR continued its choppy price action after the French, German and Eurozone's final manufacturing PMIs for July came in line or slightly above the initial estimate. EUR/USD found support at our 1.0960 support line and bounced a bit higher, while the move was limited way below the psychological round figure of 1.1000. Given the current neutral picture, I would prefer to wait for the US personal income and personal spending released later in the day to determine the short-term direction of the pair.

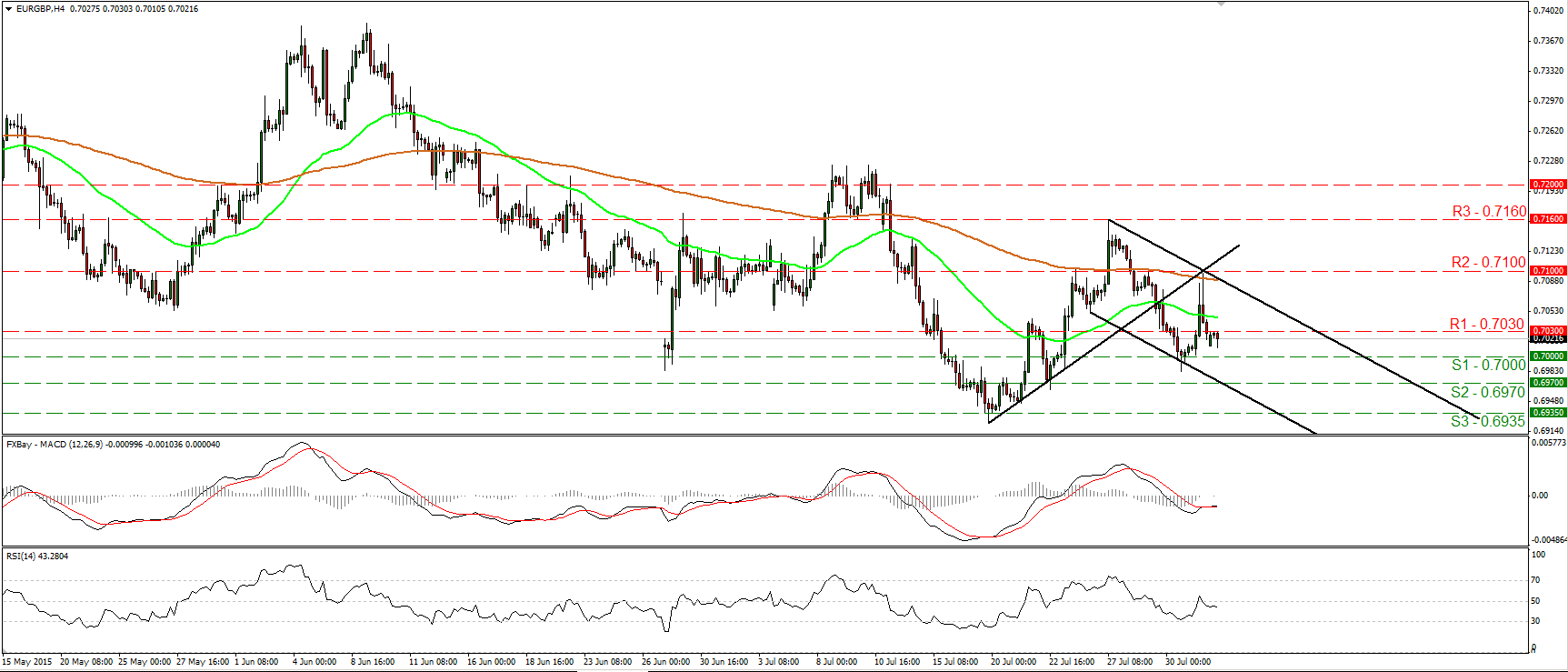

EUR/GBP traded somewhat lower during the European morning Monday, after it hit resistance at the 0.7030 (R1) barrier. The rate is trading below the prior uptrend line taken from the low of the 17th of July and within the downside channel that has been containing the price action since the 24th of July. As a result, I would consider the short-term outlook to remain negative. I would expect a break below the psychological round figure of 0.7000 (S1) to open the way for the next support at 0.6970 (S2). The RSI fell below its 50 line and points somewhat down. The MACD also detects negative momentum, but stands above its trigger line and points sideways. This makes me believe that it is better to wait for a clear move below 0.7000 (S1) before trusting the down road again. On the daily chart, the price structure remains lower peaks and lower troughs. Therefore, I believe that the overall picture is negative as well.

Support: 0.7000 (S1), 0.6970 (S2), 0.6935 (S3)

Resistance: 0.7030 (R1), 0.7100 (R2), 0.7160 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.