EUR/JPY

The dollar traded higher against almost all of its G10 peers during the European morning Friday. It was higher against NZD, AUD, CAD, JPY, NOK and GBP, in that order, while it was lower vs CHF, SEK and EUR.

Eurozone's preliminary CPI rose 0.2% yoy in July, unchanged in pace from the previous month and in line with market expectations. EUR strengthened however as the core CPI rose 1.0% yoy from +0.8% yoy, above estimates of an unchanged reading. EUR/USD advanced but stayed limited below our 1.0985 resistance level. Given the positive sentiment towards the common currency we could see the rate trading higher in the short run. However, I would prefer to see a clear move above the psychological 1.1000 to trust further advances.

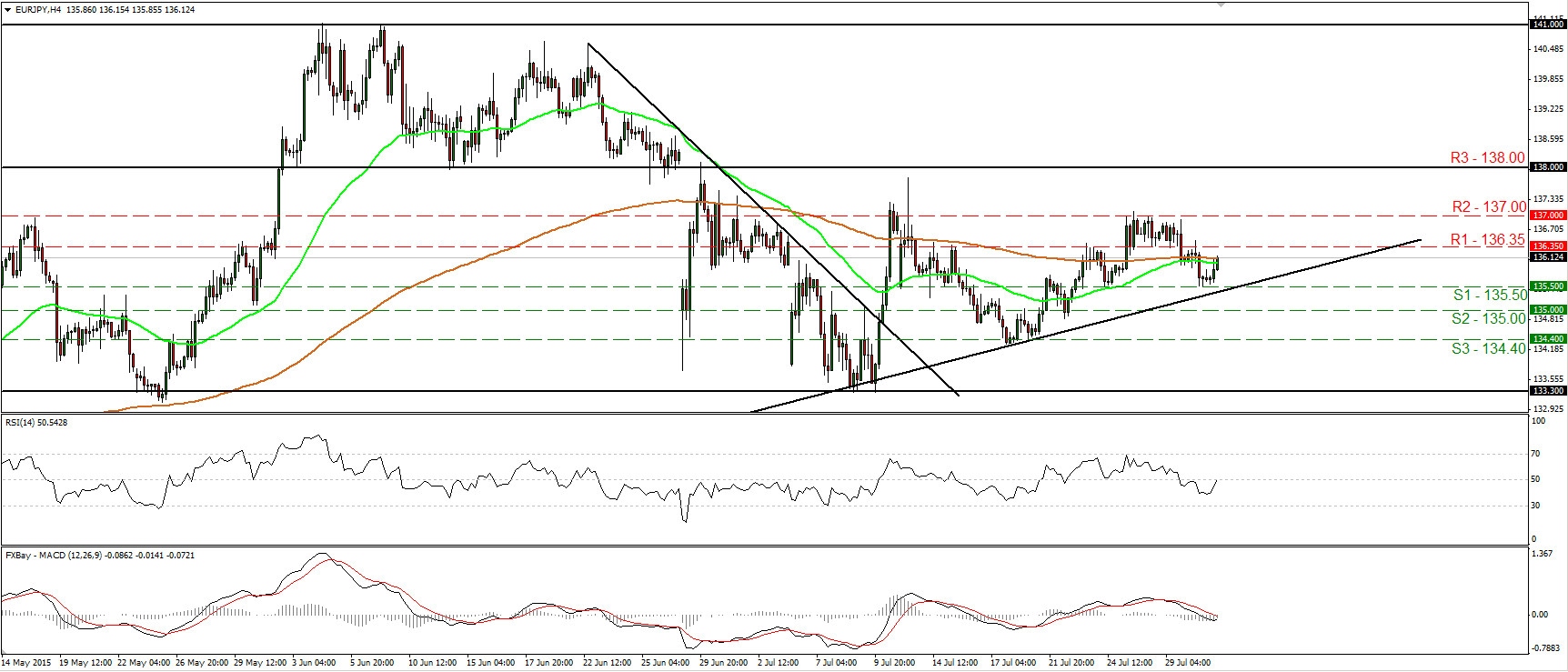

EUR/JPY traded higher during the European morning Friday, after it hit support at the 135.50 (S1) barrier, slightly above the medium-term uptrend line taken from the low of the 14th of April. Taking a look at our short-term momentum indicators, I would expect the positive move to continue. The RSI turned up and just poked its nose above its 50 line, while the MACD, although negative, shows signs of bottoming and that it could turn positive again. A clear move above 136.35 (R1) is likely to confirm the case of further upside and perhaps pave the way for the 137.00 (R2) zone. On the daily chart, the pair is still trading above the aforementioned medium-term uptrend line, and above the 133.30 support area, which stands marginally below the 50% retracement level of the 14th of April – 4th of June advance. As a result, I would see a cautiously positive longer-term picture. I would like to see a daily close below that area before I assume that the medium-term picture has turned negative.

Support: 135.50 (S1), 135.00 (S2), 134.40 (S3)

Resistance: 136.35 (R1), 137.00 (R2), 138.00 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.