USD/SEK

The dollar traded mixed against its G10 peers during the European morning Thursday. It was higher against CHF and CAD, in that order, while it was lower against SEK, NOK and GBP. The greenback was virtually unchanged vs AUD, JPY, EUR and NZD.

In Germany, the regional CPIs generally accelerated on a monthly basis but decelerated on an annual basis in July. These figures indicate that the national inflation rate, due out later this afternoon, is likely to be lower on a yoy basis as well. This also increases the likelihood that Friday's Eurozone CPI rate is likely to decline. Such disappointing data could add to expectations that the ECB will have to keep QE in place for longer and put EUR under selling pressure.

The Swedish krona gained after the country's preliminary GDP improved in Q2 from Q1 and expanded at a faster pace than expected. Coming after the dip of the CPI back to deflation, the strong data could take off some pressure from the Riksbank to take further action. Nevertheless, given that the data are only preliminary and the possibility for revision is high, I would like to see a rise in the CPI rate to trust the recovery. Therefore, I prefer to maintain my USD/SEK long-term bullish view and see the current setback as providing renewed USD buying opportunities.

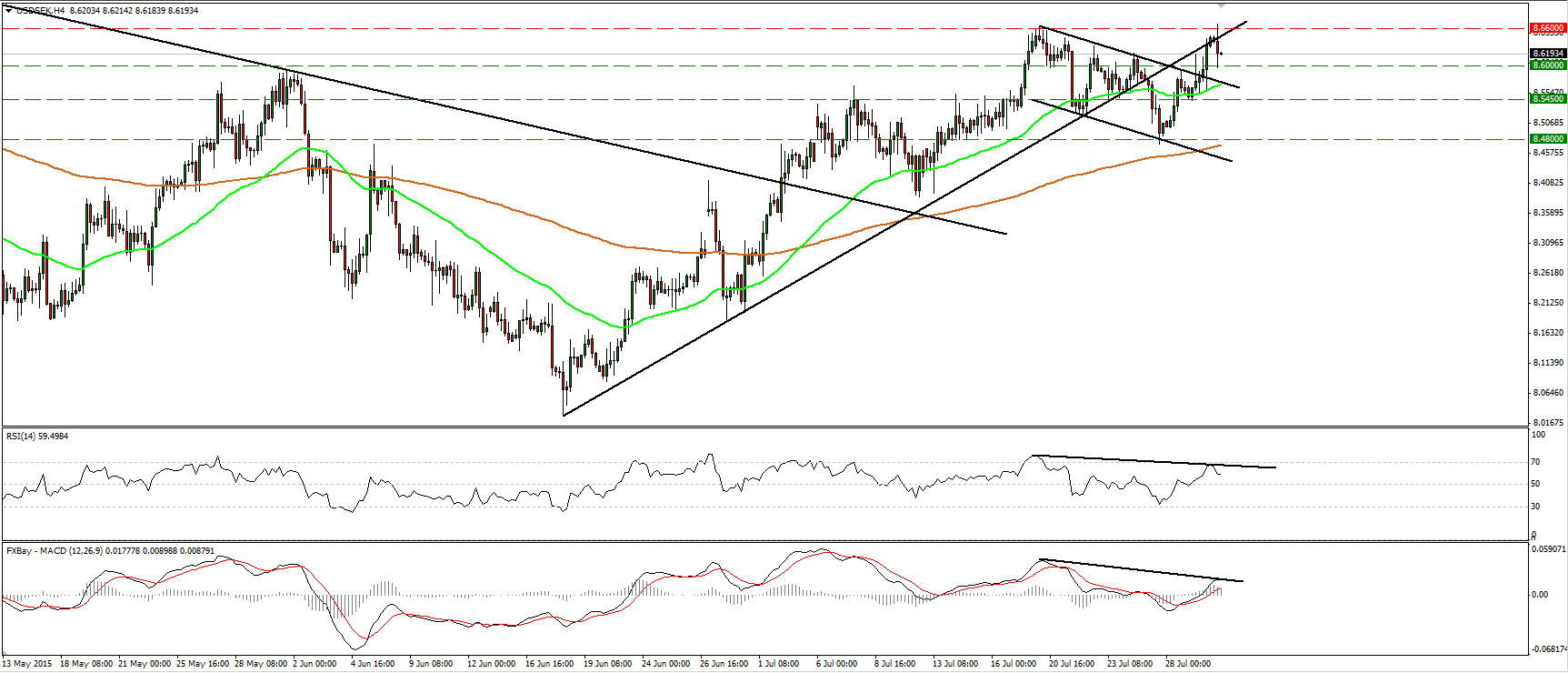

USD/SEK traded lower during the European morning Thursday, after it hit resistance at the 8.6600 (R1) resistance barrier. Although the rate lies above the upper bound of a short-term downside channel that had been containing the price action from the 20th of July until yesterday, it is still trading below the uptrend line taken from back at the low of the 18th of June. Having that in mind and that there is negative divergence between both our short-term oscillators and the price action, I see the likelihood for the pair to continue trading lower. A break below 8.6000 (S1) however is needed to confirm the case. Such a break is likely to extend the negative wave perhaps towards the 8.5450 (S2) zone. Our daily momentum studies support my view as well. The14-day RSI edged down after hitting resistance at its 70 line, while the daily MACD has topped and fallen below its trigger line. As for the broader trend, I still see a major uptrend. As a result, I would treat any further extensions of today's decline as a pullback before buyers take in charge again.

Support: 8.6000 (S1), 8.5450 (S2), 8.4800 (S3)

Resistance: 8.6600 (R1), 8.7000 (R2), 8.7500 (R3)

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.