EUR/GBP

The dollar traded mixed against its G10 counterparts during the European morning Friday, in the absence of any major market moving events. It was higher against AUD and NZD, in that order, while it was lower vs SEK, NOK, EUR and CHF. The greenback was virtually unchanged against CAD, JPY and GBP.

EUR traded somewhat higher after a moderate improvement in the final service-sector PMIs for June from France and Italy, despite the decline in the German figure. Eurozone's final service-sector PMI confirmed the preliminary reading, while retail sales for May beat expectations and decelerated less than expected. Nevertheless, with the US markets closed today and all attention shifted onto the outcome of the Greek referendum on Sunday, there is unlikely to be fresh positioning and the markets could remain muted. The restrained mood of investors is also reflected in the equity markets, with DAX trading a touch lower from Thursday.

The British pound gained a bit after the country's service-sector PMI increased more than expected in June. Investors overlooked the disappointing manufacturing PMI figure released on Wednesday, as the service sector PMI corroborated the positive construction PMI and eased concerns over the rebound in Q2 growth. Even though GBP jumped on the news, the uncertainty over the Greek crisis and the thin market kept the pound from strengthening further.

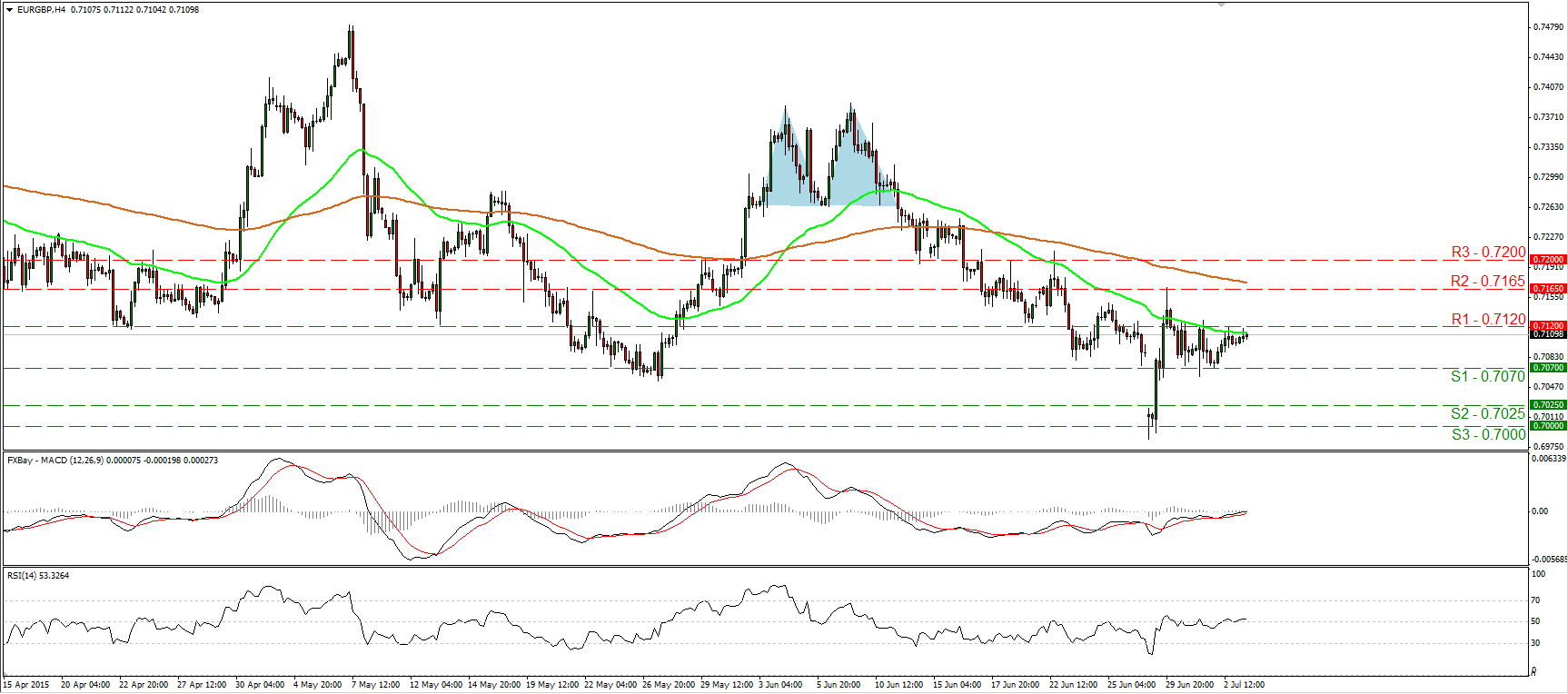

EUR/GBP traded in a consolidative manner during the European morning Friday, staying fractionally below the resistance barrier of 0.7120 (R1). I believe that a clear move above that obstacle is likely to encourage buyers to pull the trigger for the next resistance territory of 0.7165 (R2). Our short-term momentum studies lie near their equilibrium lines, confirming the recent sideways action, but they also stand in their bullish territories. This increases somewhat the likelihood that the forthcoming wave could be positive. The RSI stands fractionally above its 50 line, while the MACD has just poked its nose above its zero line. Our daily momentum studies give evidence that EUR/GBP could trade a bit higher as well. The 14-day RSI, although below its 50 line, has turned up, while the daily MACD shows signs of bottoming and could move above its trigger line soon. On the daily chart, the pair has been trading in a non-trending mode since mid-March. Therefore, I would consider the overall outlook to be neutral. I would like to see a clear close below the psychological figure of 0.7000 (S3) before I assume the continuation of the prevailing long-term downtrend.

Support: 0.7070 (S1), 0.7025 (S2), 0.7000 (S3)

Resistance: 0.7120 (R1), 0.7165 (R2), 0.7200 (R3)

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.