DAX futures

The dollar traded mixed against its G10 peers during the European morning Tuesday. It was higher against NZD and EUR, in that order, while it was lower against NOK and AUD. The greenback was virtually unchanged against CHF, SEK, GBP, CAD and JPY.

The Eurozone's preliminary CPI rose 0.2% yoy in June, a slowdown from +0.3% yoy previously and in line with expectations. The slowdown in the Eurozone's inflation rate raises concerns over the bloc's recovery path and over the ECB's stimulus programs. In addition to the decline in the headline rate, the core figure also fell to 0.8% yoy from 0.9% yoy. Even though the market reaction was limited on the news due to the Greek crisis, we would sound a note of caution in the medium term as deflation fears may reappear if prices continue to fall. EUR/USD declined a bit in the course of the morning, but remained above the key level of 1.1145, which keeps the outlook neutral for now.

In the UK, the final estimate of the Q1 GDP showed moderately stronger momentum than previously estimated. The final figure showed a +0.4% qoq pace of growth compared to +0.3% in the 2nd estimate, matching market expectations. Further strong UK data could result in rate hike expectations being brought closer, supporting GBP.

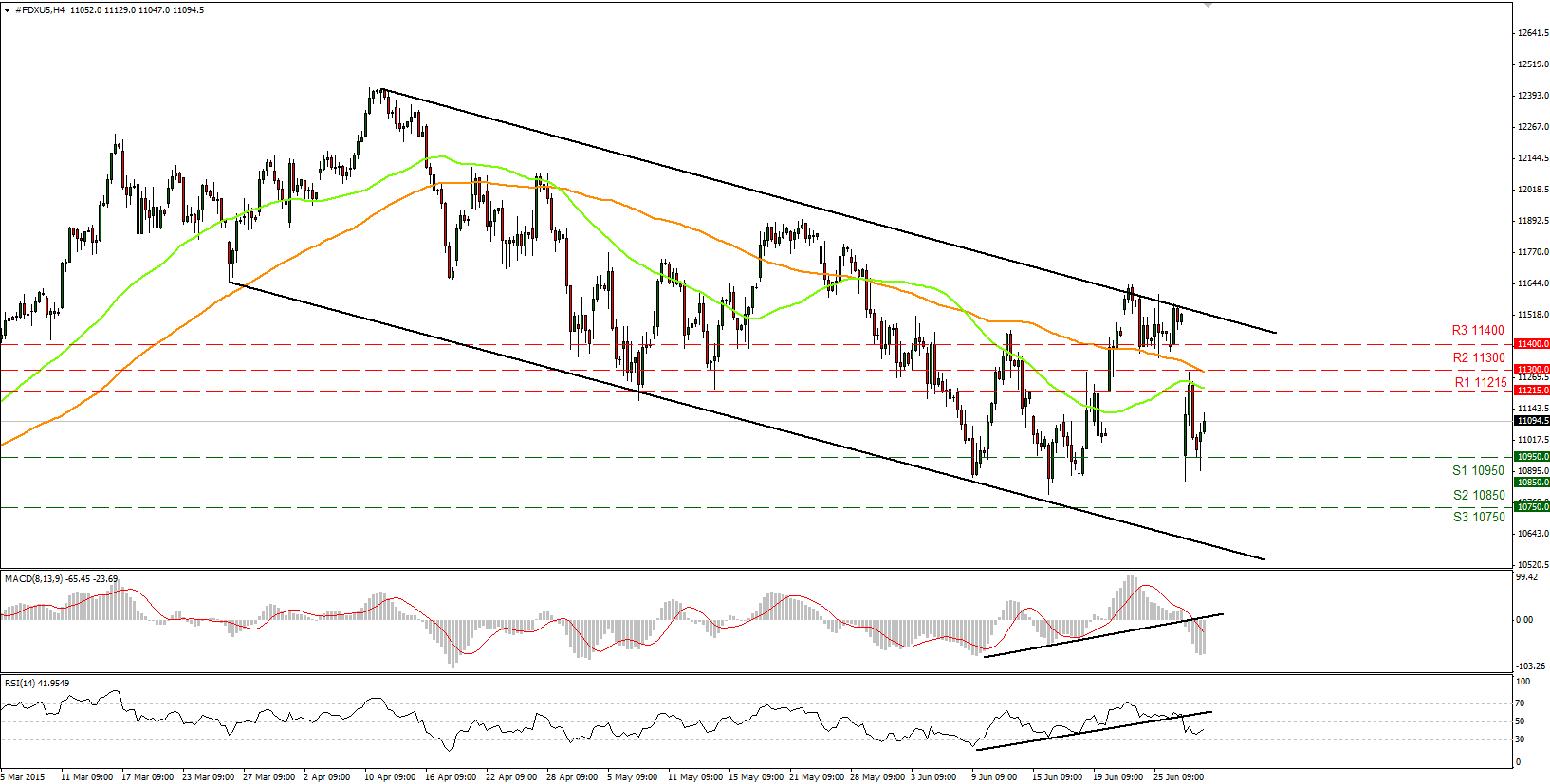

DAX futures opened with a huge gap lower on Monday below the round figure of 11000. Since then it recovered a bit but fell again on Tuesday to find support around 10950 (S1). Given that the index remains within the downside channel that had been containing the price action since the last days of March, the outlook remains negative. I would consider any upside moves as corrections of the medium-term decline. However, I would need to see a decisive break of the 10850 (S2) level to get confident for further declines. Looking at our short-term momentum indicators, they support a halt of the decline. The RSI found support at its 30 line and moved higher, while the MACD, although below its zero and trigger lines, has bottomed and points up. These signs support a minor rebound before the next wave lower. In the bigger picture, although the index remains within the downside channel, a clear close below the 10850 zone is needed to make me trust the medium-term downside path.

Support: 10950 (S1), 10850 (S2), 10750 (S3)

Resistance: 11215 (R1) 11300 (R2), 11400 (R3)

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.