EUR/JPY

The dollar traded mixed against its G10 peers during the European morning Friday, in the absence of any major market-moving events. It was higher against NZD, AUD and CAD, in that order, while it was lower against CHF, NOK and EUR. The greenback was virtually unchanged vs GBP, JPY and SEK.

Eurozone's M3 money supply decelerated unexpectedly in May, while loans to the private sector rose from the previous month. The money supply grew 5.0% yoy in May vs +5.3% yoy previously, missing expectations of 5.4% yoy. Meanwhile, loans to private sector increased 0.2% yoy after a flat reading in April. This adds to the evidence that the ECB's QE and targeted LTRO programs may have started to work.

EUR/USD continued its choppy price action and gyrated around 1.1200 with no clear trending structure. Driven by the uncertainty over the Greek debt crisis, the pair reflects the restrained mood of investors before the "make or break" talks during the weekend.

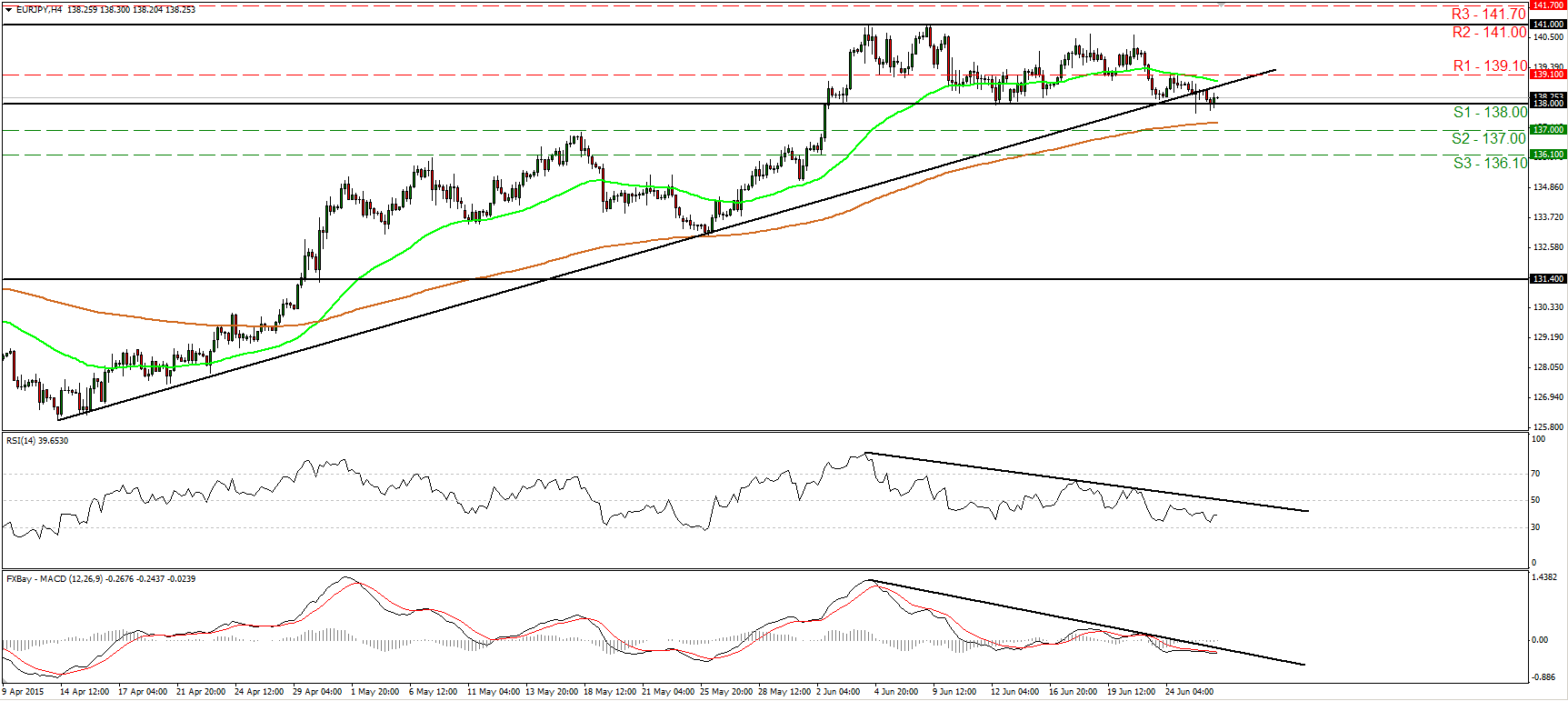

EUR/JPY continued to trade lower during the European morning Friday, and fell below the uptrend line taken from the low of the 14th of April. Now the rate oscillates around the support zone of 138.00 (S1), where a break is likely to open the way for our next support of 137.00 (S2), defined by the inside swing high of the 18th of May. Our short-term oscillators reveal negative momentum and corroborate my view. The RSI, already below its 50 line, shows signs that it could turn down, while the MACD stays below both its zero and signal lines. On the daily chart, the break above 131.40 on the 29th of April signaled a medium-term trend reversal in my view. As a result, I would consider the medium-term trend of EUR/JPY to be positive. I would consider any future near-term declines as a corrective phase of that uptrend.

Support: 138.00 (S1), 137.00 (S2), 136.10 (S3)

Resistance: 139.10 (R1), 141.00 (R2), 141.70 (R3)

Recommended Content

Editors’ Picks

AUD/USD recovers to near 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to near 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.