EUR/GBP

The dollar traded higher against most of its G10 peers during the European morning Monday, ranging from +0.20% against AUD to +1.10% vs NOK. The greenback was virtually unchanged against JPY and NZD.

In Germany, all the regional CPIs rates rose on a monthly and annual basis in May. These figures indicate that the national inflation rate, due out later this afternoon, is likely to rise as well. This also increases the likelihood that Tuesday's Eurozone CPI is likely to rise for the first time this year. Nevertheless, with the ECB's QE already in place, neither the German CPI nor the Eurozone's CPI are as market-affecting as before. In the meantime, Eurozone's final manufacturing PMI ticked down to 52.2 in May from the preliminary reading of 52.3, but was still a touch higher than 52.0 in April. The modest gain reflects a strong recovery from the peripheral economies of Italy and Spain, in contrast to the decline in Germany and the stagnation in France. EUR/USD declined at these releases and at the time of writing trades few pips above our 1.0865 support line. A break of that level could push the rate lower towards our next support of 1.0820.

The British pound weakened after the country's manufacturing PMI missed expectations and rose only to 52.0 in May vs the forecast of 52.5. Even though it was a moderate improvement from April's 51.8, expectations of a broad rebound in UK economic growth in Q2 are called into question by two successive low readings. GBP/USD fell to test the 1.5215 support zone. A break of that level could signal further declines, perhaps towards our 1.5165 support line.

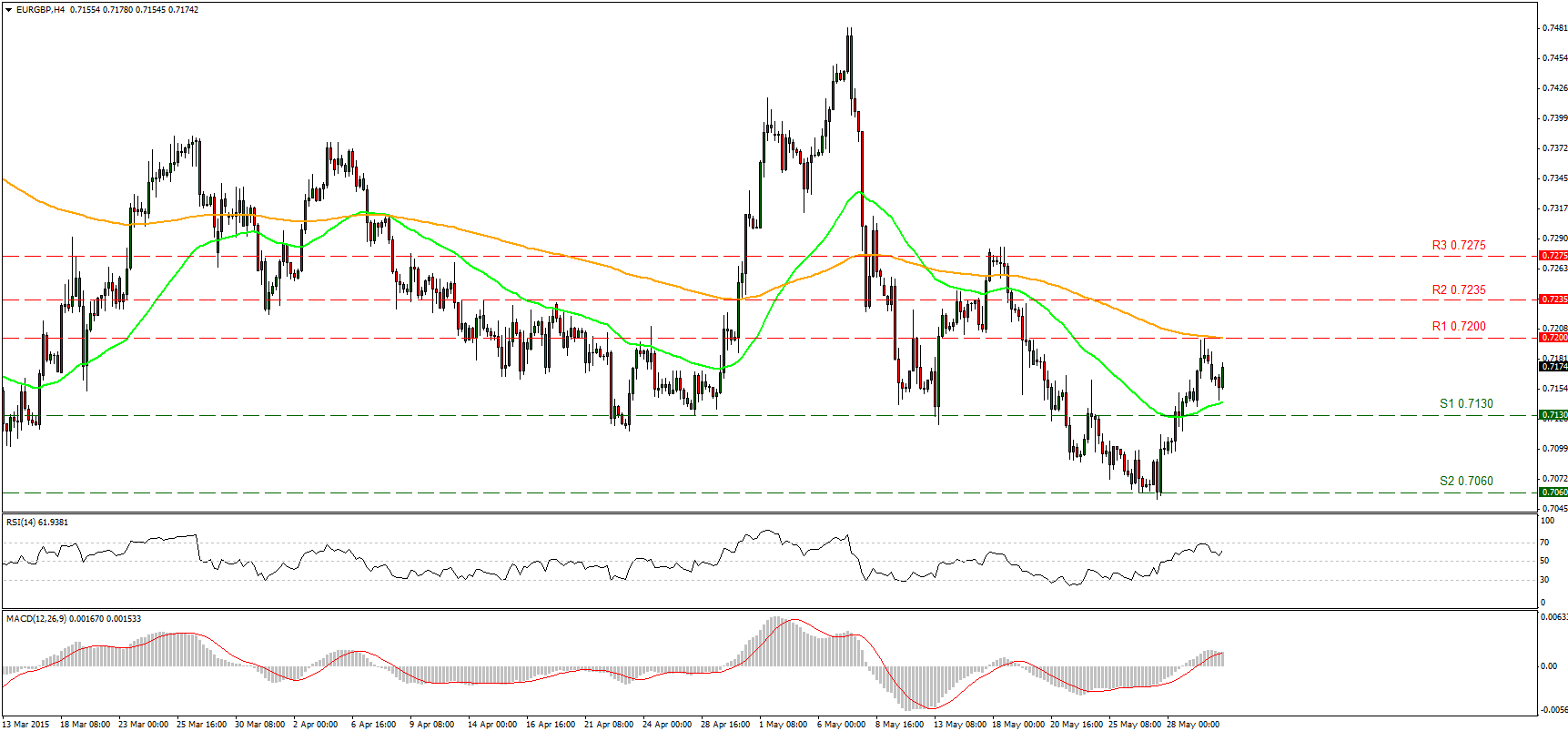

EUR/GBP traded somewhat higher during the European morning Monday, after finding support few pips above our 0.7130 (S1) support line and the 50-period moving average. However, I would need the rate to break above the 200-period moving average and then the 0.7200 (R1) resistance hurdle to trust further advances. Our short-term momentum indicators support the notion that the advance may have come to an end. The RSI found resistance at the 70 line and turned down, while the MACD crossed below its trigger line and points south. As for the broader trend, on the daily chart, the rate is trading below both the 50- and 200-day moving averages, but a clear close below the psychological figure of 0.7000 (S3) is needed to signal the resumption of the prevailing longer-term downtrend.

Support: 0.7130 (S1), 0.7060 (S2), 0.7000 (S3).

Resistance: 0.7200 (R1) 0.7235 (R2), 0.7275 (R3).

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.