USD/CAD

The dollar traded unchanged or lower against almost all of its G10 counterparts during the European morning Wednesday. It was lower vs CHF, EUR and NOK, in that order, while it was unchanged against SEK, NZD, CAD, GBP and JPY. The greenback was slightly higher only against AUD.

Later in the day, the Bank of Canada meets to decide on its key policy rate. We don’t expect much new information at today’s meeting and the market consensus is for the Bank to remain on hold. Therefore, the impact on CAD will depend on the tone of the statement accompanying the decision where BoC Governor Poloz could reiterate his bullish view on the economy’s prospects. Such an event along with improved activity data could support CAD, at least temporarily.

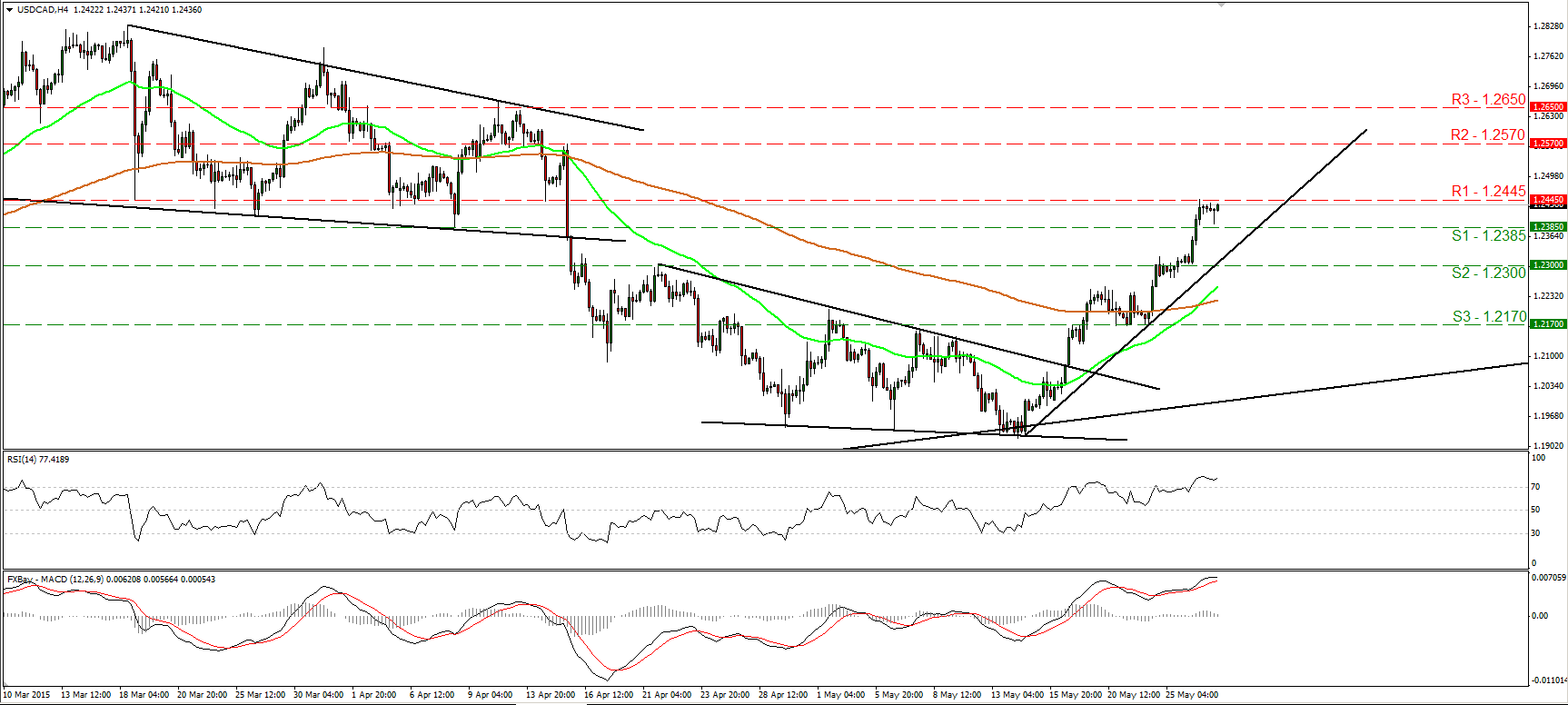

USD/CAD started trading higher after exiting a falling wedge formation on the 18th of May. Since then, the pair has been printing higher peaks and higher troughs, and as a result I would consider the short-term picture to be positive. During the European morning Wednesday, the pair is struggling below the resistance barrier of 1.2445 (R1), where an upside break could set the stage for extensions towards our next resistance at 1.2570 (R2), defined by the peak of the 15th of April. Nevertheless, bearing in mind that the BoC is likely to come out with an optimistic statement later in the day, and taking into account that our short-term oscillators provide weakness evidence, I would be mindful that a pullback could be looming before buyers take in charge again. The RSI topped within its overbought territory, while the MACD has also topped and could fall below its trigger line soon. A break below 1.2385 (S1) could confirm the pullback case and perhaps extent the correction towards 1.2300 (S2). As for the broader trend, on the 14th of May, the rate rebounded from the longer-term uptrend line taken from the low of the 11th of July. This keeps the overall picture of USD/CAD to the upside as well.

Support: 1.2385 (S1), 1.2300 (S2), 1.2170 (S3).

Resistance: 1.2445 (R1) 1.2570 (R2), 1.2650 (R3).

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.