EUR/GBP

The dollar traded unchanged against almost all of its G10 peers during the European morning Monday, in the absence of any major market moving events due to a public holiday in many countries. The greenback was marginally lower against GBP and NZD.

EUR came under renewed selling pressure after comments by the Greek Interior Minister that Greece could not pay the IMF in June unless it reaches an agreement with its creditors. Greece basically has until the end of May to reach an agreement, otherwise, the country will have to default.

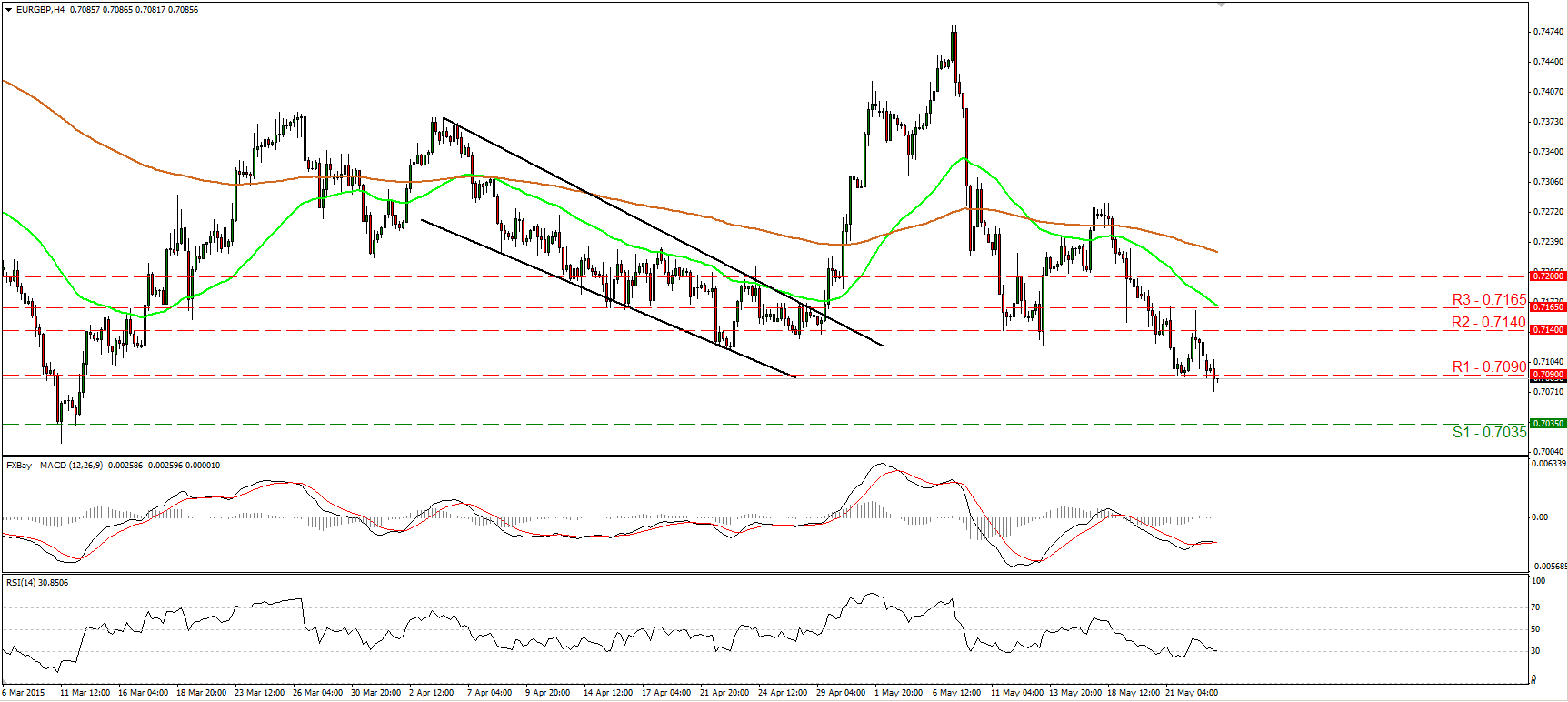

EUR/GBP traded somewhat lower during the European morning Monday, breaking below the support (turned into resistance) barrier of 0.7090 (R1). The move confirms a forthcoming lower low and is possible to trigger extensions towards the support hurdle of 0.7035 (S1). Our short-term oscillators detect negative momentum and support the case for further declines. The RSI slid towards its 30 line and could cross below it soon, while the MACD, already negative, has topped and could now fall below its trigger. On the daily chart, the rate is trading below both the 50- and 200-day moving averages, but a clear close below the psychological figure of 0.7000 (S2) is needed to signal the resumption of the prevailing longer-term downtrend.

Support: 0.7035 (S1), 0.7000 (S2), 0.6900 (S3).

Resistance: 0.7090 (R1) 0.7140 (R2), 0.7165 (R3).

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.