EUR/GBP

The dollar traded mixed against its G10 counterparts during the European morning Friday. It was higher against GBP, JPY and NZD, in that order, while it was lower vs SEK, NOK, EUR and CHF. The greenback was unchanged vs AUD and CAD.

The British pound was the main loser after the country’s manufacturing PMI declined to 51.9 in April from 54.0 previously. The market had expected a moderate rise to 54.6. The sharp decline signals a slowdown in growth. Coming after the weaker GDP growth rate for Q1 announced last week, the decline in the manufacturing PMI is another negative sign that the UK economy is losing momentum. With the UK general elections less than a week away and the opinion polls suggesting a tight finish with no clear winner, the 2 week implied volatility spiked above 14, a level last seen before the Scottish referendum in September. The increased uncertainty is likely to put GBP under pressure and the recent appetite for euros could halt the advances in GBP/USD due to stronger EUR/GBP.

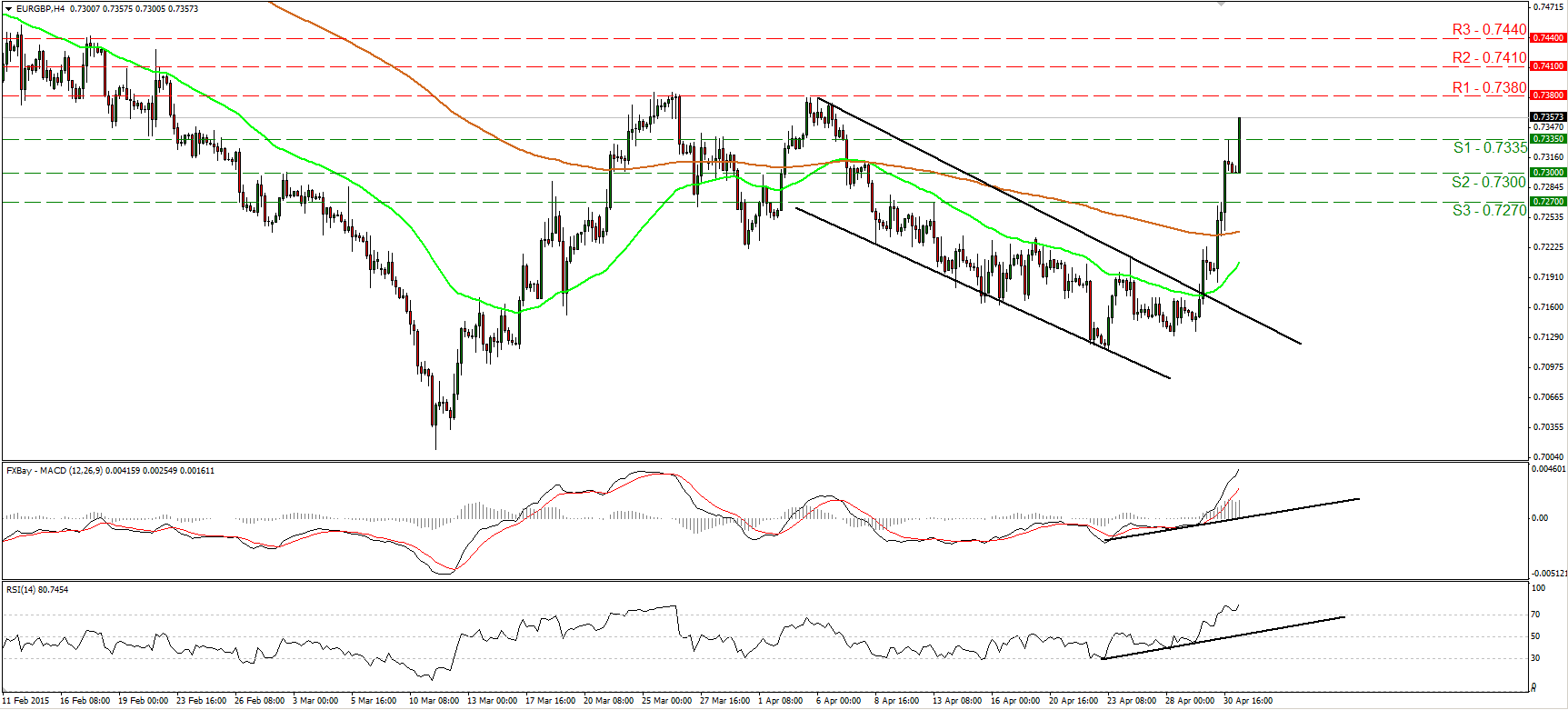

EUR/GBP accelerated higher during the European morning Friday, breaking above the resistance (now turned into support) barrier of 0.7335 (S1). After the break above the downside resistance line on the 29th of April, the price structure has been higher highs and higher lows, and therefore I have switched my short-term view to positive. I believe that we are likely to see the rate challenging the 0.7380 (R1) barrier soon, where a clear upside break could signal extensions towards the next hurdle at 0.7410 (R2). Our short-term oscillators detect strong bullish momentum and amplify the case for the continuation of the positive leg. The RSI already within its overbought zone has turned again up, while the MACD, already above both its zero and signal lines, accelerated higher and keeps pointing north. On the daily chart, the recent rally brings into question the continuation of the larger downtrend. A clear move above the 0.7380 (R1) territory, which stands very close to the 38.2% retracement level of the 16th of December – 11th of March decline, could signal the completion of a possible double bottom formation. That could bring a medium-term trend reversal.

Support: 0.7335 (S1), 0.7300 (S2), 0.7270 (S3).

Resistance: 0.7380 (R1), 0.7410 (R2), 0.7440 (R3).

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'