DAX futures

The dollar traded lower against most of its G10 peers during the European morning Friday, ranging from -0.15% vs AUD to -0.80% vs EUR. It was stable only against NZD and JPY.

The German Ifo Business climate index rose for the sixth consecutive month in April, driven most likely by the low energy prices, the lower exchange rate and the ECB stimulus introduced in January. The current assessment index rose as well, in line with the strong ZEW survey released earlier this week. On the other hand, the expectations index declined a bit in line with the decline seen in the ZEW expectation index on Tuesday, possibly reflecting concerns over Greece. Besides that, if the current situation is so improved, there is less reason to expect further progress in the next months. Overall, the strong data suggested that the gradual improvement in German business confidence continues. It also suggests that business investment in Eurozone’s largest economy picked up in Q1 and fuels optimism about an economic recovery. The positive developments from low oil prices and a weaker euro will slowly feed through the real economy going forward and will provide further support to domestic sentiment.

The Nasdaq Composite index closed yesterday at an all-time high of 5056. The index overcame its 15-year-old record close yesterday, which occurred in March 2000, after the dotcom boom. Higher oil prices boosted energy stocks, while solid tech earning reports contributed to the surge. Nasdaq futures continued to rally during European morning Friday, which could hint further rally in the index.

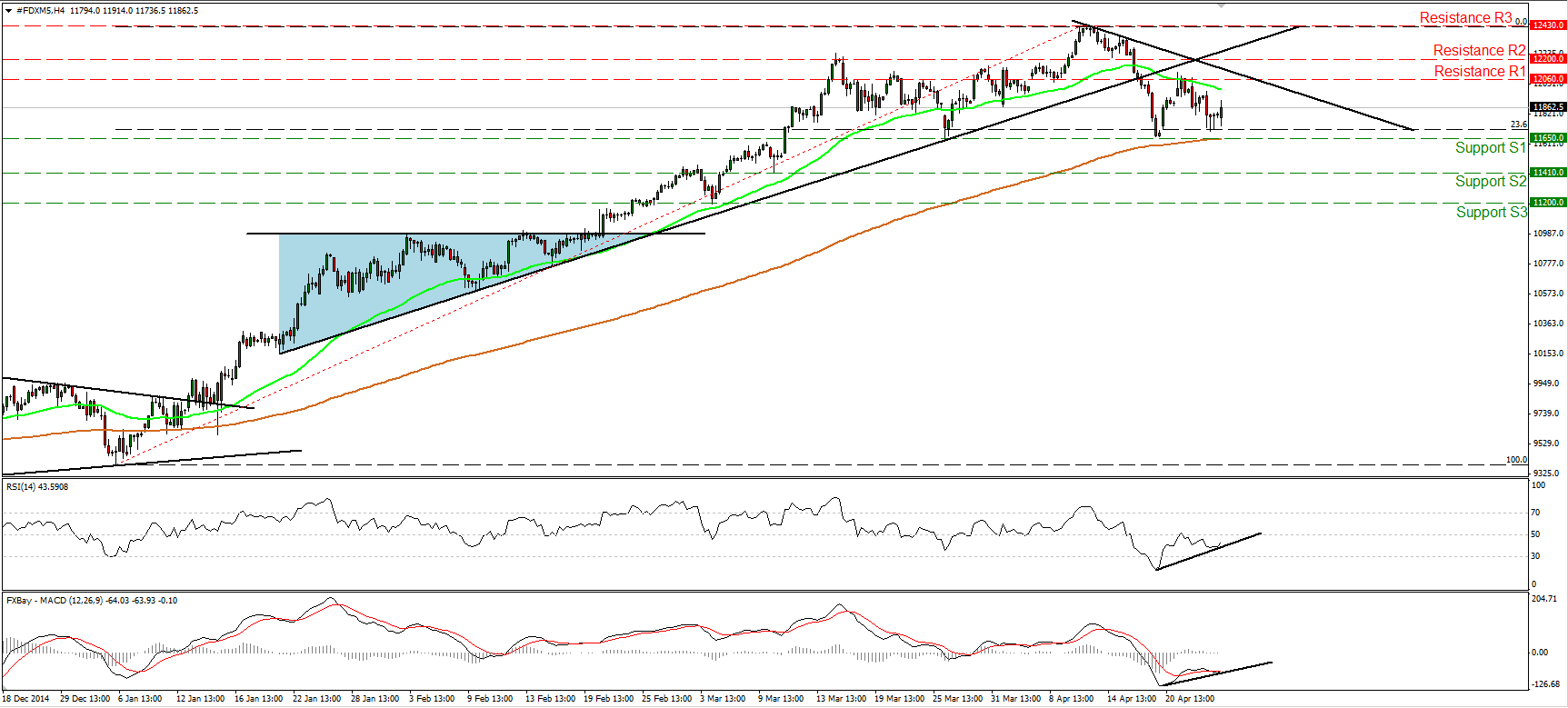

DAX futures traded higher during the European morning Friday, after hitting support slightly above the key support line of 11650 (S1), at the 23.6% retracement level of the 6th of January – 10th of April advance. Although the index is still trading below the uptrend line taken from 21st of January, I believe that the picture is not negative yet. A clear close below 11650 (S1) would be necessary to turn the picture negative. Something like that could pave the way for our next support at 11410 (S2), defined by the low of the 10th of March. Our momentum studies are both rising above their respective upside support lines. What is more, the RSI is pointing up and could be headed towards its 50 line, while the MACD is now ready to cross again above its signal line. These momentum signals give me a reason to take a neutral stance and to wait for a move below the 11650 (S1) hurdle to get confident on the downside. On the other hand, a move above 12200 (R2) would probably signal that the fall from the 10th of April was just a 23.6% correction and could target again the highs of 12430 (R3).

Support: 11650 (S1), 11410 (S2), 11200 (S3).

Resistance: 12060 (R1), 12200 (R2), 12430 (R3).

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.