USD/NOK

The dollar traded higher against almost all of its G10 counterparts during the European morning Thursday. It was lower only vs NZD, while it remained stable against AUD and JPY.

In Germany, industrial output accelerated in February, confirming that yesterday’s fall in the same month’s factory orders was just an anomaly in the positive data coming out from the nation. At the same time, the country’s exports for February beat expectations. The recent positive economic releases from Germany suggest that the Eurozone’s growth engine is gathering steam again, which is also reflected in much of the data coming out from the Eurozone as a whole. Nevertheless, the strong data was not enough to support EUR/USD and the common currency fell further to trade a few pips above our 1.0710 support line. A break of that line is likely to push the rate even lower, perhaps towards 1.0650. The euro’s weakness is quite noticeable; it was the weakest of all the G10 currencies yesterday for no apparent reason. Even today, the fact that Greece successfully made its promised payment to the IMF could have given the euro some support, but apparently didn’t.

In the UK, the trade deficit widened sharply to GBP 2.8bn in February, from an upwardly revised GBP 1.5bn previously, exceeding by far market expectations. The widening was mainly due to a fall in exports of goods to non-EU countries, particularly to the US – disappointing as the dollar strengthens. The weak figure along with a strong dollar in general pushed GBP/USD below 1.4800. Nevertheless, I would wait for a clear break below 1.4740 to get more confident for further declines.

The Norwegian krone was the second major loser among the major currencies despite the small rise in oil prices during the morning. On Friday, the country’s CPI for March is forecast to have accelerated, probably due to the fact that the effect of lower oil prices is gradually fading. This could prove NOK-supportive, at least temporarily. The low oil prices however are expected to keep NOK under selling pressure despite the overall strong fundamentals.

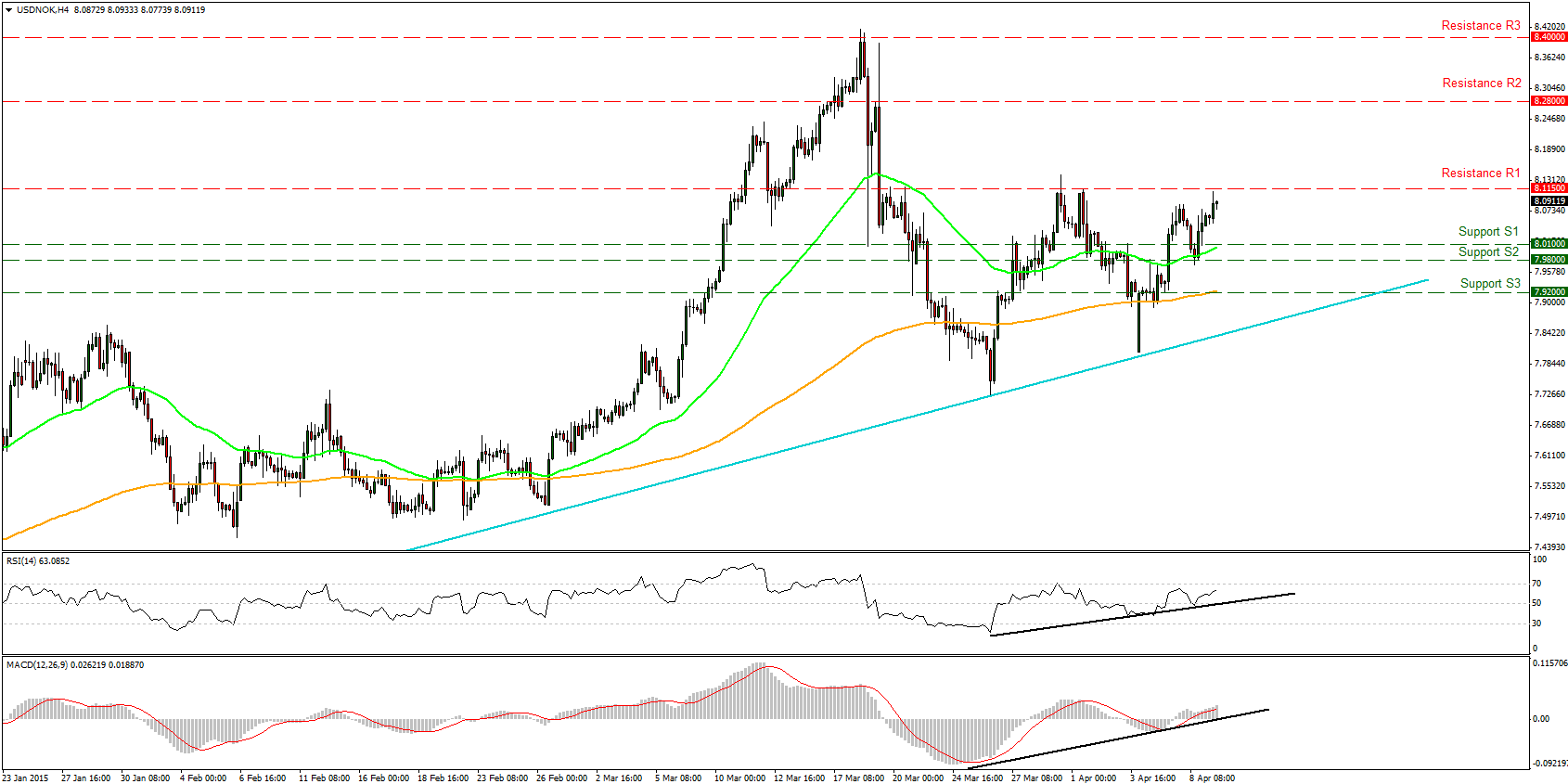

USD/NOK raced higher during the European morning Thursday after hitting support near the 8.0100 (S1) line, but the advance was halted slightly below our resistance line of 8.1150 (R1). A clear and decisive break above the well tested 8.1150 (R1) area is necessary to pave the way for our next resistance at 8.2800 (R2). Our daily momentum studies support this notion. The 14-day RSI rebounded from slightly below its 50 line and is pointing up again, while the MACD, already positive, shows signs of bottoming and could emerge above its trigger line in the near future. As far as the overall trend, it remains positive. USD/NOK has been printing higher peaks and higher troughs above both the 50- and the 200-day moving averages since the beginnings of September. It is worth mentioning that the 50-day moving average acts as a curving trend line, supporting that long-term upside path.

Support: 8.0100 (S1), 7.9800 (S2), 7.9200 (S3).

Resistance: 8.1150 (R1), 8.2800 (R2), 8.4000 (R3).

Recommended Content

Editors’ Picks

AUD/USD defends 0.6400 after Chinese data dump

AUD/USD has found fresh buyers near 0.6400, hanging near YTD lows after strong China's Q1 GDP data. However, the further upside appears elusive amid weak Chinese activity data and sustained US Dollar demand. Focus shifts to US data, Fedspeak.

USD/JPY stands tall near multi-decade high near 154.50

USD/JPY keeps its range near multi-decade highs of 154.45 in the Asian session on Tuesday. The hawkish Fed expectations overshadow the BoJ's uncertain rate outlook and underpin the US Dollar at the Japanese Yen's expense. The pair stands resilient to the Japanese verbal intervention.

Gold: Buyers take a breather below $2,400 amid easing geopolitical tensions

Gold price is catching a breath below $2,400 in Asian trading on Tuesday, having risen over 1% in the US last session even on a solid US Retail Sales report, which powered the US Dollar through the roof. Easing Middle East geopolitical tensions and strong Chinese data could cap Gold's upside.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Israel-Iran military conflict views and takeaways

Iran's retaliatory strike on Israel is an escalation of Middle East tensions, but not necessarily a pre-cursor to broader regional conflict. Events over the past few weeks in the Middle East, more specifically this past weekend, reinforce that the global geopolitical landscape remains tense.