USD/NOK

The dollar is trading higher against all of its major counterparts during the European morning Wednesday, ranging from +0.30% vs CHF to +1.1% vs NZD. It seems that the greenback regained its glamour this week and the correction against its G10 peers over the past few days has come to a halt. Ahead of the ADP report released later in the day, the market is betting on a strong figure that may keep alive the scenario for a rate hike as early as June.

The euro traded lower even after Eurozone’s manufacturing PMI for March was revised higher. The German final manufacturing PMI increased a touch, adding to the recent encouraging data coming from the country. France’s final manufacturing PMI on the other hand, despite being revised up marginally, marked the 11th successive month in contraction. EUR/USD traded fractionally above our support of 1.0700. A dip below that level could trigger further declines, perhaps towards 1.0610.

The British pound declined sharply despite the rise in the country’s manufacturing PMI to 54.4 in March from 54.0 previously. This was because at the same time, the Office of National Statistics released its productivity report for Q4 in which it showed that labor productivity fell by 0.2% qoq in Q4. In 2014 as a whole, labor productivity was little changed from 2013 and slightly lower than in 2007, prior to the economic downturn. Added to that, the unit labor costs (ULC) have increased only modestly, by less than 1% per year on average over the last five years, reflecting low growth in labor costs per hour worked. Little pressure on ULC means little risk of cost/pull inflation and could therefore push further back expectations for a rate hike by the Bank of England. This is likely to keep GBP/USD under increased selling pressure, especially ahead of the election, and push the rate below 1.4700 in the near future.

The Norwegian krone weakened after the country’s manufacturing PMI fell into contractionary territory in March at 48.8. The weak PMI along with the low oil prices are expected to keep NOK under selling pressure despite the overall strong fundamentals.

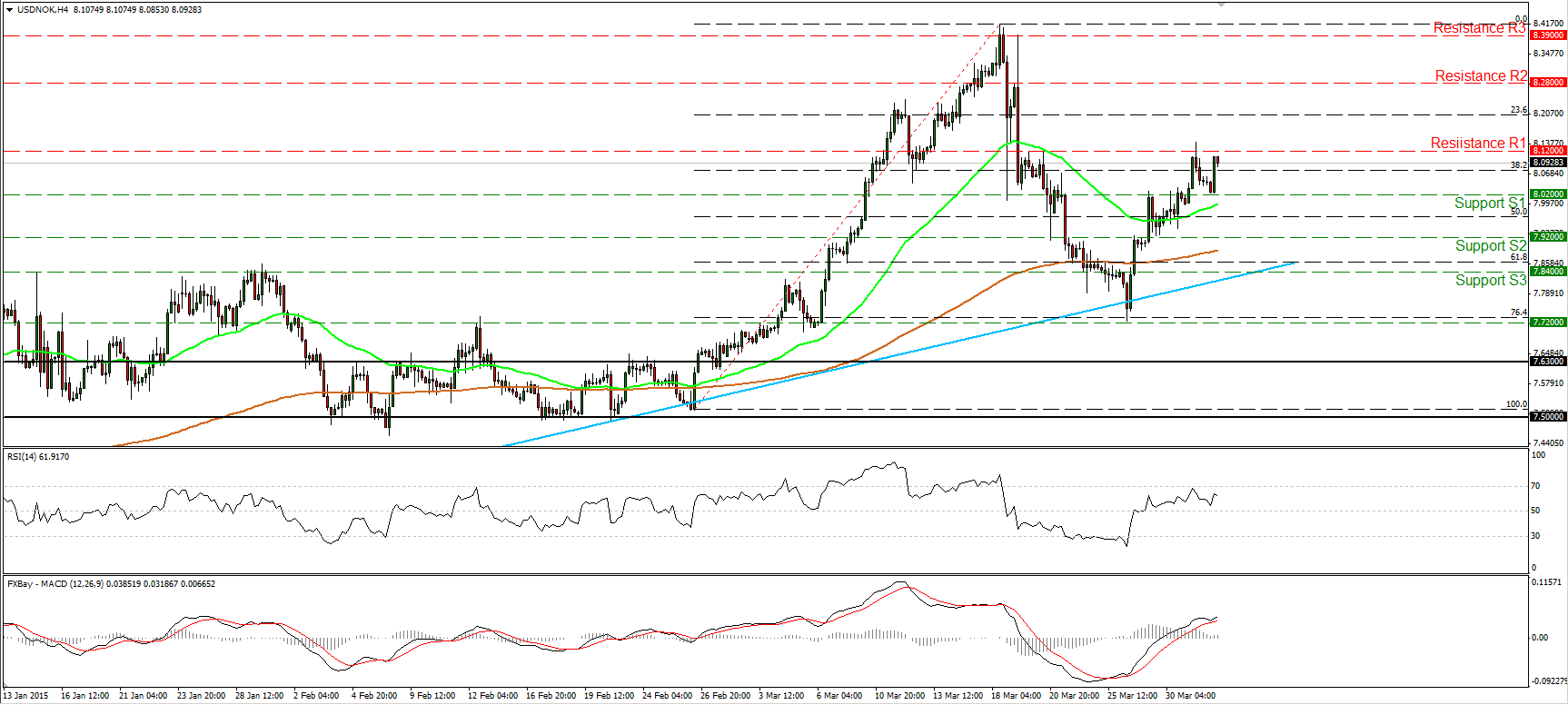

USD/NOK raced higher during the European morning Wednesday after hitting support near the 8.0200 (S1) line, but the advance was halted slightly below our resistance line of 8.1200 (R1). The rebound from 7.7200, which happens to be the 76.4% retracement level of the 26th of February -18th of March up wave, turned the short-term picture positive in my view, hence further bullish extensions could be looming. A clear and decisive break above 8.1200 (R1) would confirm a forthcoming higher high on the 4-hour chart and perhaps pave the way for our next resistance at 8.2800 (R2). Our daily momentum studies detect upside momentum and corroborate my stance. The 14-day RSI rebounded from slightly below its 50 line and is pointing up again, while the MACD, already positive, shows signs of bottoming and could emerge above its trigger line in the near future. As far as the overall trend is concerned, I see a positive picture here as well. USD/NOK has been printing higher peaks and higher troughs above both the 50- and the 200-day moving averages since the beginnings of September. It is worth mentioning that the 50-day moving average acts as a curving trend line, supporting that long-term upside path.

Support: 8.0200 (S1), 7.9200 (S2), 7.8400 (S3).

Resistance: 8.1200 (R1), 8.2800 (R2), 8.3900 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.