EUR/GBP

The dollar is trading higher against almost all of its G10 peers during the European morning Tuesday, ranging from +0.14% vs GBP to +0.85% vs NOK. It was slightly lower only against JPY.

The euro traded lower even after Eurozone’s preliminary estimate of CPI came in at -0.1% yoy in March vs -0.3% yoy in February, in line with expectations. The bloc’s unemployment rate declined to 11.3% in February from an upwardly revised 11.4% in January. Even the fall in the German unemployment rate to a record low was not enough to reverse the negative sentiment towards EUR. EUR/USD fell below the 1.0800 level and is currently heading to test our next support at 1.0700. A break of that level could see scope for another leg down, perhaps towards 1.0610.

The final estimate of UK GDP for Q4 showed a rise of +0.6% qoq and +3.0% yoy, above expectations of an unchanged reading from the 2nd estimate (+0.5% qoq). GBP/USD jumped on the news but gave back all the gains immediately as the bears found a renewed GBP shorting opportunity. Despite the strong figures, the building uncertainty ahead of the UK general election in May is likely to weigh on the sterling and push GBP/USD even lower. However, the better fundamentals may keep GBP supported against EUR.

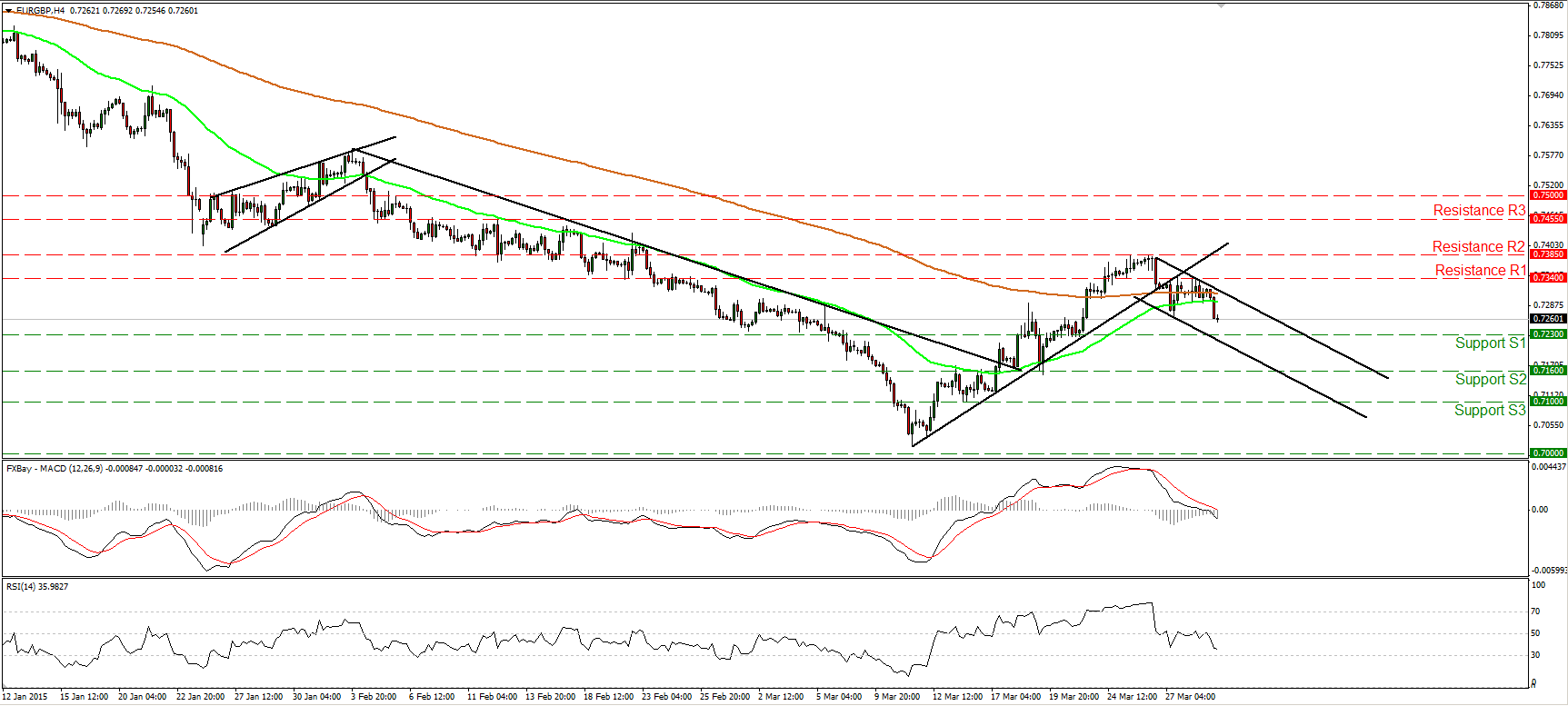

EUR/GBP traded lower during the European morning Tuesday, after finding resistance at 0.7340 (R1). After the break below the short-term uptrend line taken from the low of the 11th of March, the rate started trading within a possible downside channel. For that reason, I would consider the short-term bias to have switched to negative. A clear move below the support line of 0.7230 (S1) is likely to set the stage for more bearish extensions and could target the next support at 0.7160 (S2). Our short-term oscillators reveal negative momentum and support the continuation of the new-born short-term downtrend. The RSI slid after hitting resistance near its 50 line and is now headed towards its 30 line, while the MACD, already below its trigger, dipped into its negative territory. On the daily chart, the broader trend is negative as well. After the downside exit of the triangle pattern on the 18th of December, the price structure has been lower peaks and lower troughs below both the 50- and the 200-day moving averages. The recent decline came after EUR/GBP hit resistance at the 50-day moving average and supports my stance to treat the recovery started on the 11th of March as a corrective move of the larger negative path.

Support: 0.7230 (S1), 0.7160 (S2), 0.7100 (S3).

Resistance: 0.7340 (R1), 0.7385 (R2), 0.7455 (R3).

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.