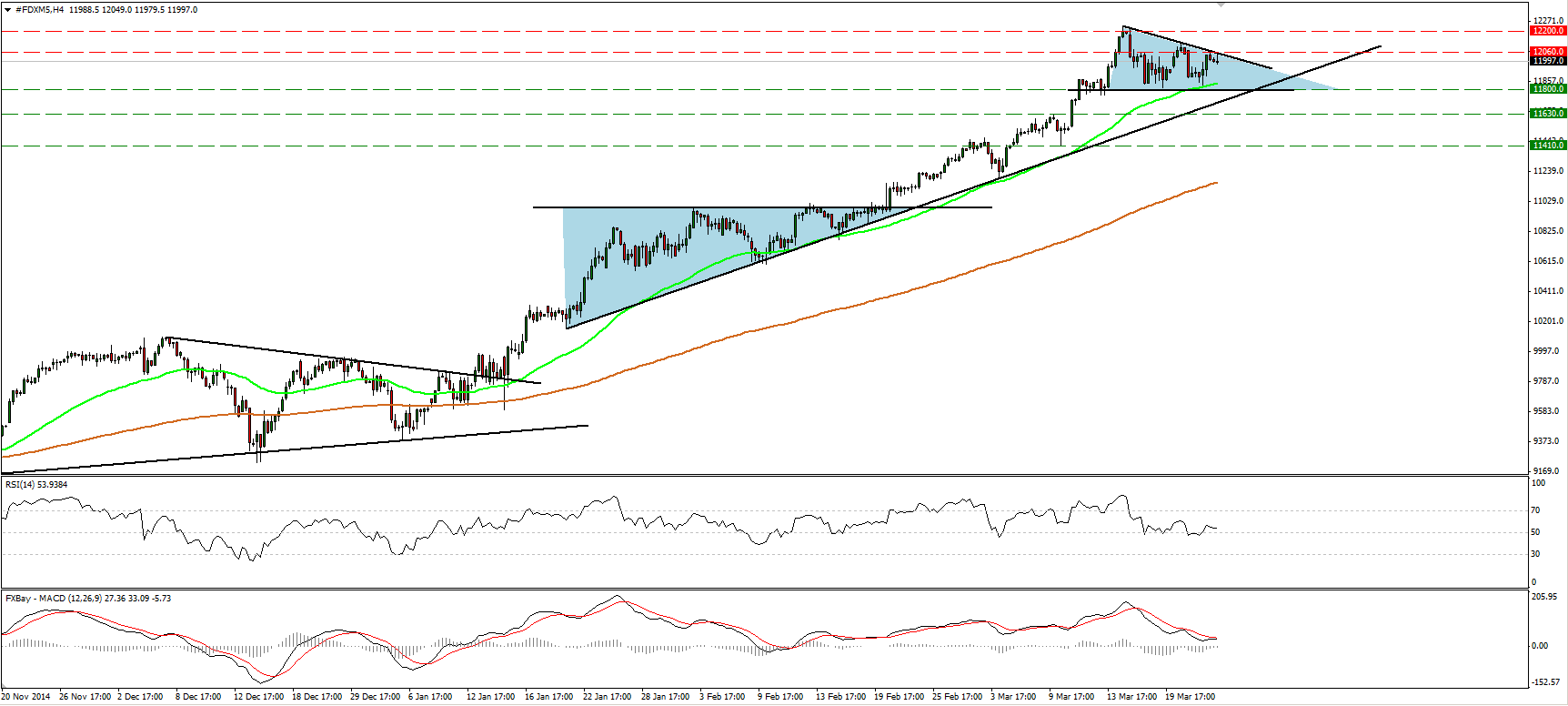

DAX futures

The dollar traded unchanged or lower against its G10 peers during the European morning Wednesday. It was lower against EUR, GBP, NOK and CHF, in that order, while it was stable vs AUD, SEK, JPY, CAD and NZD.

The German Ifo Business climate index rose for the fifth consecutive month in March, driven most likely by the low energy prices. The expectations index also rose, in line with the strong ZEW survey released last week. All three indices were above or in line with their expectations and suggested that the gradual improvement in German business confidence continues. It also suggests that business investment picked up in Q1 and fuels optimism about an economic recovery. The positive developments from low oil prices and a weaker euro will slowly feed through the real economy going forward and will provide further support to domestic sentiment.

Despite the strong data, the bulls were unable to push EUR/USD above 1.10. A clear break of that area is needed for the corrective wave to continue, perhaps towards our 1.1160 resistance line.

DAX futures moved somewhat higher during the European morning Wednesday, but hit resistance at the upper bound of a possible descending triangle formation and pulled back. Given that the price failed to overcome that boundary and remained within the pattern, I would expect the forthcoming wave to be negative and challenge once again the 11800 (S1) key support line, which happens to be the lower line of the aforementioned triangle. However, although I would expect the forthcoming wave to head south, the overall trend remains positive. DAX is trading above both the 50- and the 200-period moving averages, and above the uptrend line taken from the low of the 21st of January. I would get confident on the overall upside path though if, after the pullback, buyers seize control again and force the price to break above the upper bound of the triangle.

Support: 11800 (S1), 11630 (S2), 11410 (S3).

Resistance: 12060 (R1), 12200 (R2) (key resistance near the all-time high).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.