AUD/NZD

The dollar was unchanged or higher against most of its G10 counterparts during the European morning Monday. It was higher against NZD, AUD, GBP and CAD, in that order, while it was lower vs SEK.

Cleveland Fed President Loretta Mester speaking at a conference in Paris said that it is appropriate for the Fed to raise rates this year. She also added that the Fed won’t necessarily move on rates in June but it remains a viable option for an interest rate hike. This comment failed to support the dollar however because she also said that the level of the dollar is one of the conditions Fed officials look at and that a strong dollar will affect US exports. Her views on the dollar were similar to those that Chicago Fed President Evans and Atlanta Fed President Lockhart, two voting members of the FOMC, expressed on Friday. In addition, she mentioned that the global economic conditions are also going to be taken into account, despite the fact that the Fed only included the word “international” for the first time in their January statement. The fact that she is not a voting member this year make me believe that the market could see through these comments and USD could regain its lost ground. Perhaps Fed Vice Chair Stanley Fischer will clarify matters when he speaks later today at the Economic Club of New York.

Kiwi gave back all its Asian session gains and fell back to trade to levels before large stops triggered above 0.7610 in NZD/USD. Recently, the RBNZ kept its key policy rate on hold but maintained an upward bias for the future path of the rates. With this in mind, NZD is likely to remain strong, especially against AUD, where another rate cut seems inevitable to boost the country’s economy.

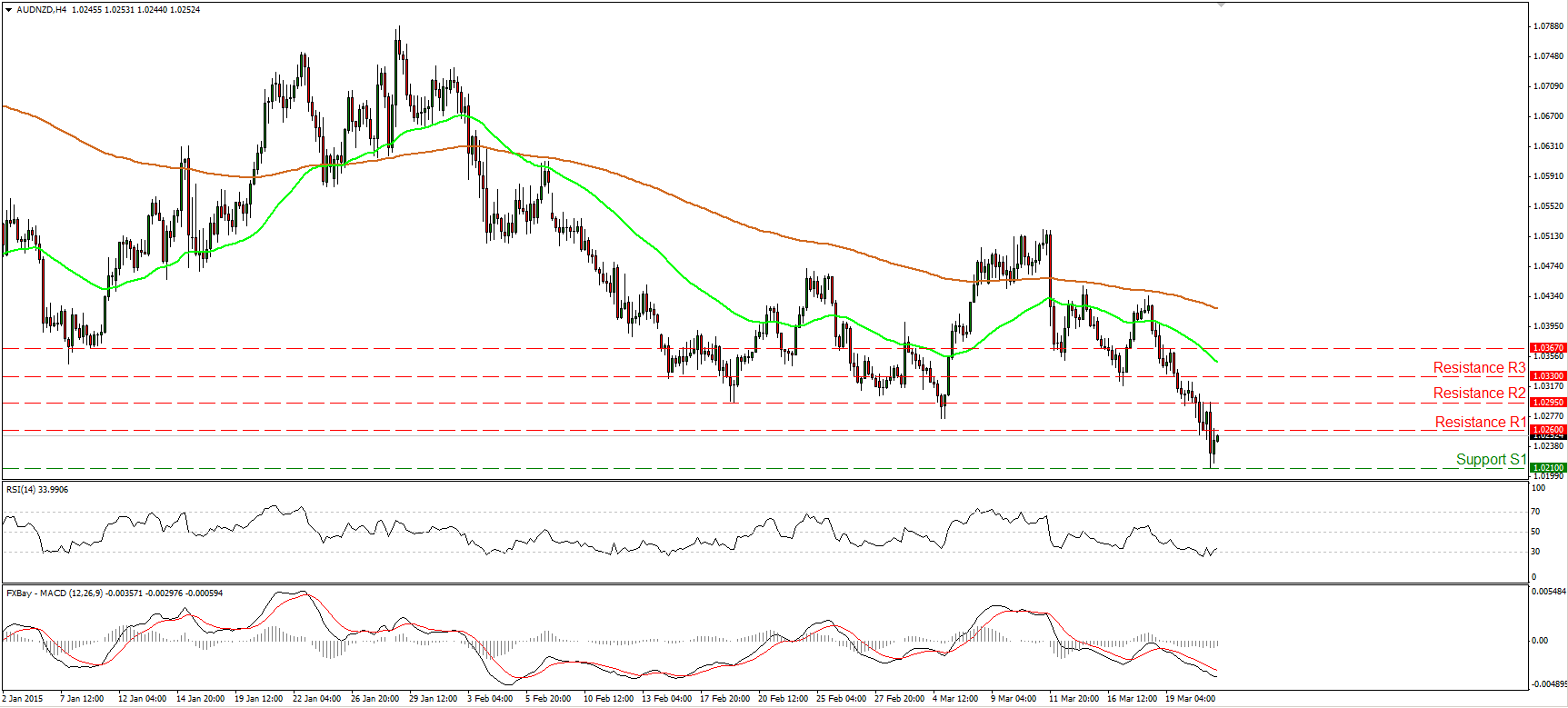

AUD/NZD moved somewhat higher during the European morning Monday, after printing a new all-time low at 1.0210 (S1). On the 4-hour chart, the price structure suggest a near-term downtrend. Taking a look at our momentum studies though, further extensions of the minor bounce might be on the cards, perhaps above the 1.0260 (R1) barrier. The RSI rebounded from marginally below its 30 line and is now pointing up, while the MACD has bottomed and could move above its trigger line any time soon. A move above the 1.0260 (R1) line, could extend the upside correction towards the next resistance at 1.0295 (R2). However, I would expect sellers to eventually regain control at some point in the not-too-distant future and to drive the battle below 1.0210 (S1). I believe that such a dip could set the stage for larger declines towards parity (1.0000 (S2).

Support: 1.0210 (S1) (all-time low), 1.0000 (S2) (parity).

Resistance: 1.0260 (R1), 1.0295 (R2), 1.0330 (R3).

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.