GBP/JPY

The dollar traded higher against the majority of its G10 peers during the European morning Tuesday. It was lower against SEK, while it was stable vs NOK, GBP and CHF.

The euro was lower despite the strong final German Q4 GDP growth. The final growth rate was unchanged from the preliminary reading, and showed that the German economy expanded at a 0.7% qoq pace, the same speed of expansion as in the beginning of 2014. Low energy prices and the aggressive monetary policy by the ECB have probably supported the German recovery, which had been interrupted by the crisis in the Ukraine and the building uncertainty over Greece. Nevertheless, strong Q4 growth provides good momentum to start 2015, but we would remain cautious as the two main risk factors of Ukraine and Greece persist. In the meantime, Eurozone’s final CPI confirmed the preliminary rate of -0.6% yoy in January, justifying the move by the ECB to announce its QE stimulus program last month. The increasing strength of the German economy is a EUR-positive factor and could support the currency somewhat, but it is not enough to change our long-term bearish EUR/USD view.

In much-anticipated testimony, Bank of England Governor Mark Carney simply reiterated that policy makers may look through the low inflation and consider raising rates sooner than expected. GBP/USD gyrated around 1.5435 during the testimony with no clear directional bias. Another failure to reach the psychological level of 1.5500 amplify the case that the forthcoming wave is likely to be to the downside. Perhaps to test once again the 1.5350 territory.

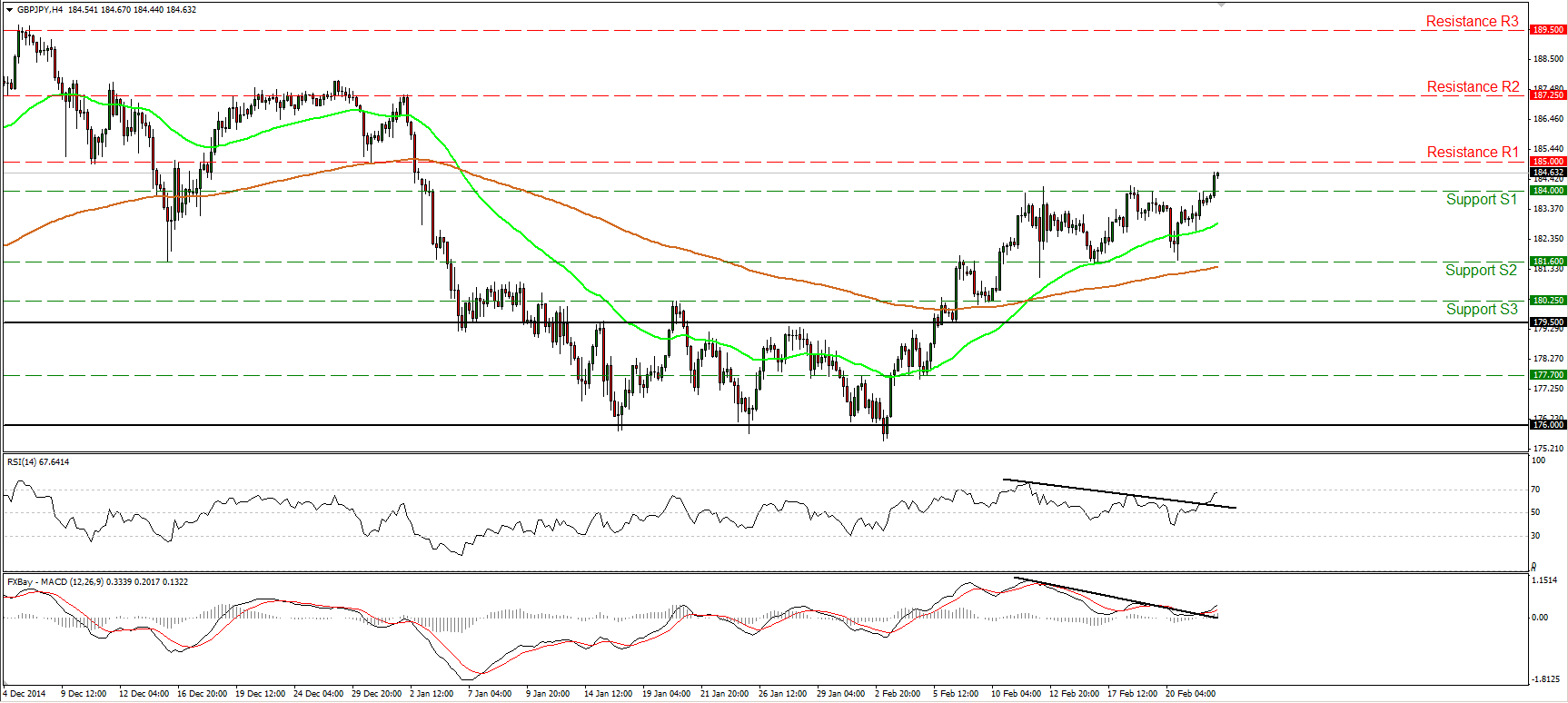

GBP/JPY raced higher during the European morning Tuesday, breaking the key resistance (now turned into support) hurdle of 184.00 (S1). Alongside the surge above 184.00 (S1), our near-term oscillators broke above their downside resistance lines, confirming that the bulls are gaining momentum. The rate is now heading towards the psychological line of 185.00 (R1), where a clear and decisive violation is likely to lay the groundwork for further upside extensions, perhaps towards the next resistance zone of 187.25 (R2), determined by the high of the 2nd of January. After the completion of a triple bottom formation on the 5th of February, the price structure has been suggesting a short-term uptrend above both the 50- and the 200-period moving averages. Nevertheless, although I see a positive short-term picture, in the absence of any defined trending structure on the daily chart, I do not see any convincing longer-term trend.

Support: 184.00 (S1), 181.60 (S2), 180.25 (S3)

Resistance: 185.00 (R1), 187.25 (R2), 189.50 (R3)

Recommended Content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.