USD/NOK

The dollar traded higher against most of its G10 peers during the European morning Wednesday. It was lower against JPY and GBP, in that order, while it was stable vs CHF.

Eurozone’s final service-sector PMI was revised up in January, another support of the bloc’s economic sentiment following the unchanged manufacturing PMI on Monday. German PMI was also revised up, consistent with the moderate growth in domestic demand, while the French PMI fell slightly below expectations of an unchanged reading. EUR/USD remained elevated above 1.1400 and could advance a bit more given the strong data and the near-term positive bias towards the pair.

The UK service-sector PMI rose in January, well above market consensus of a moderate increase. Following the upside surprise in the manufacturing index on Monday and the increase in the construction PMI on Tuesday, the rise in the service sector confirmed the improving momentum in Q1. These figures show a strong UK outlook and could strengthen further GBP, at least temporarily.

The People’s Bank of China (PBoC) cut the reserve requirement ratio (RRR) by 50 bps to 19.5% from 20%. Following the recent weak data, the step was taken to boost lending into the real economy and stimulate growth. Rather than acting on interest rates, the Bank chose to use the RRR to release more liquidity into the markets. AUD and NZD jumped amid expectations that the growth of Australia’s and New Zealand’s biggest trade partner will support their exports.

The Norwegian krone has been strengthening following the oil rebound. Norway is Europe’s largest oil producer and its revenues, as well as investments in the oil sector, are directly affected from oil prices. The country’s economics are in a very good condition overall, compared to its peers. The unemployment rate seems to have stabilized near 3%, while inflation is just below Norges Bank’s 2.5% target. Therefore, as long as oil prices are rising, this is likely to keep NOK under buying pressure.

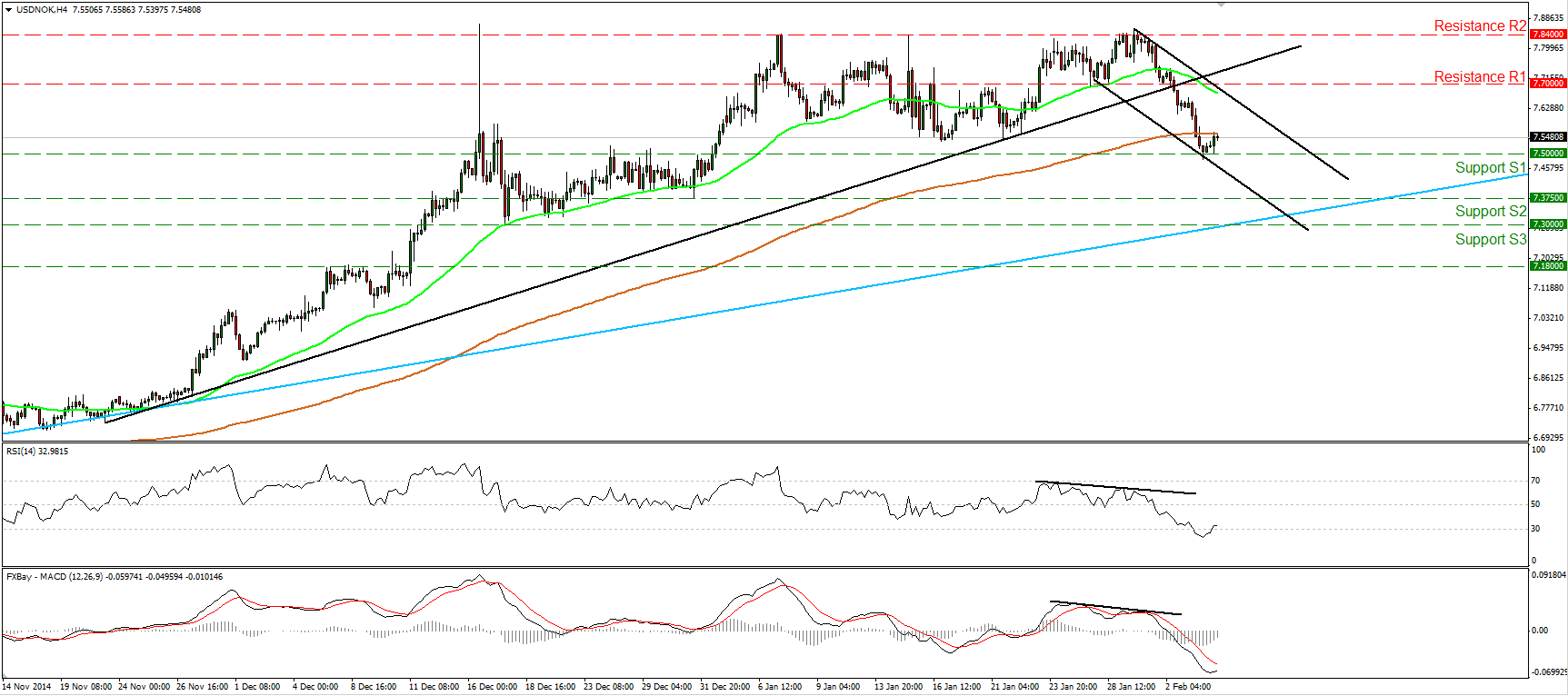

USD/NOK stopped falling today and edged somewhat higher after hitting support at around 7.5000 (S1). However, the fact that the pair is trading below the short-term black uptrend line make me believe that the downside corrective move has further to go. A clear move below 7.5000 (S1) is likely to signal further retracement and perhaps set the stage for a test near the 7.3750 (S2) barrier or the longer-term uptrend line drawn from back at the low of the 3rd of September (light blue line). As for the broader trend, as long as USD/NOK is trading above that longer-term uptrend line, I would consider the overall path to be to the upside and I would see the recent declines as a corrective phase.

Support: 7.5000 (S1), 7.3750 (S2), 7.3000 (S3).

Resistance: 7.7000 (R1), 7.8400 (R2), 8.0000 (R3).

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.