EUR/GBP

The dollar traded unchanged or higher against its G10 counterparts during the European morning Friday. It was higher against NOK, EUR, SEK, AUD, NZD and CAD, in that order, while it was unchanged vs GBP, CHF and JPY.

EUR continued plunging despite the better-than-expected preliminary Eurozone composite PMI for January. Even though the overall figure managed to remain in expansionary territory for the 19th consecutive month, it was not enough to overcome the psychological impact of the marginal decline in German manufacturing PMI from 51.2 to 51.0. The overall poor PMIs are consistent with a slowing in the pace of the Eurozone’s recovery and could keep EUR under selling pressure.

On the other hand, UK retail sales beat expectations and rose 0.2% mom in December from 1.7% mom previously. On top of Wednesday’s wage data, which showed some signs of recovery, consumers are probably benefitting from cheaper fuel prices and may remain a strong driver of the UK economic recovery. Nonetheless, expectations that inflation will continue to drift lower are likely to push GBP/USD even lower. On the other hand, the better fundamentals compared with the Eurozone are likely to maintain the downward path of EUR/GBP, in our view.

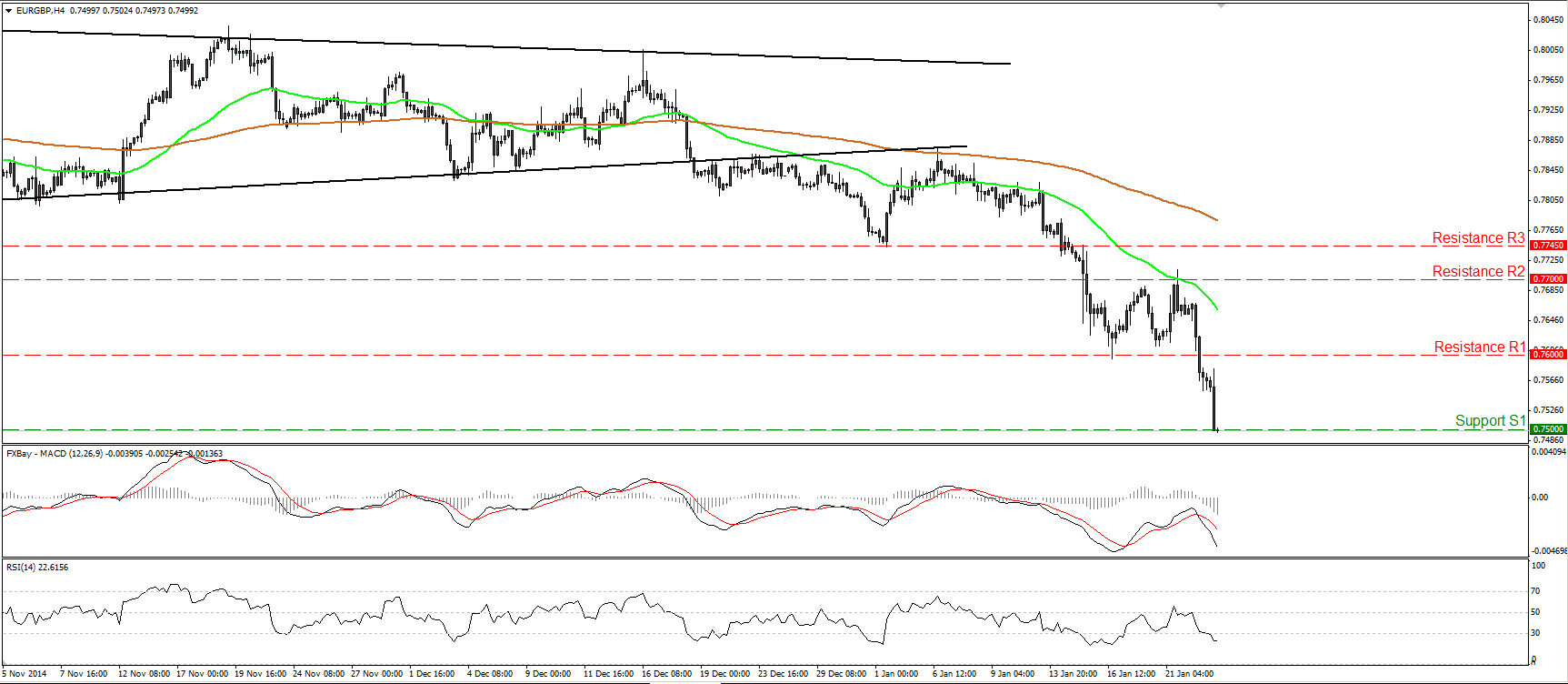

EUR/GBP tumbled during the early European morning and is currently testing the psychological support barrier of 0.7500 (S1). The intraday bias remains to the downside and therefore I would expect a break below 0.7500 (S1) to pull the trigger for the 0.7400 (S2) area, determined by the lows of February 2008. The accelerating downside momentum is visible on our near-term momentum studies as well. The RSI dipped within its oversold territory and is pointing down, while the MACD moved deeper into its negative territory, pointing south as well. As for the bigger picture, the downside exit of the triangle pattern on the 18th of December signaled the continuation of the longer-term downtrend, thus the overall outlook stays negative in my view.

Support: 0.7500 (S1), 0.7400 (S2), 0.7230 (S3)

Resistance: 0.7600 (R1), 0.7700 (R2), 0.7745 (R3)

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.