NOK, DAX futures

The dollar traded within a narrow range of ±0.15% against all but one of its G10 counterparts during the European morning Wednesday. The exception was NOK.

Norway’s CPI rate declined to +1.9% yoy in November from 2.0% yoy in October as expected. Although the figure was in line with expectations, USD/NOK moved up nonetheless and was trading up around 7.1730 at midday, compared to 7.1070 at the start of the day. NOK investors will now turn their attention to the Norges Bank policy meeting scheduled tomorrow. At its last meeting in October, the Bank left its key policy rate unchanged at 1.5% while Governor Olsen noted that the outlook of inflation and output were broadly in line with their September projections. Although the small decline in the inflation rate in November seems harmless, bearing in mind that the low oil prices have given rise to uncertainty over the Bank’s growth outlook, the Bank could signal a rate cut early next year. This could prove negative for the Krone.

At midday in Europe, USD/NOK is above our resistance zone of 7.1600, determined by the highs of the 9th and 10th of March 2009. In our view, the move above that zone is likely to pull the trigger for the 7.3000 key area, an area that offered strong resistance to the pair from October 2008 until March 2009.

JPY and gold gave back a small portion of their yesterday’s gains as the European Stock markets advanced, rebounding from yesterday’s sell-off, their biggest in more than seven weeks. By midday, the DAX printed the highest gains (+0.77% from Tuesday’s closing levels). USD/JPY is now trading near 119.20, but I would like to see another move above the 120.00 line before getting confident for a strong up leg and another test of Monday’s highs of 121.85.

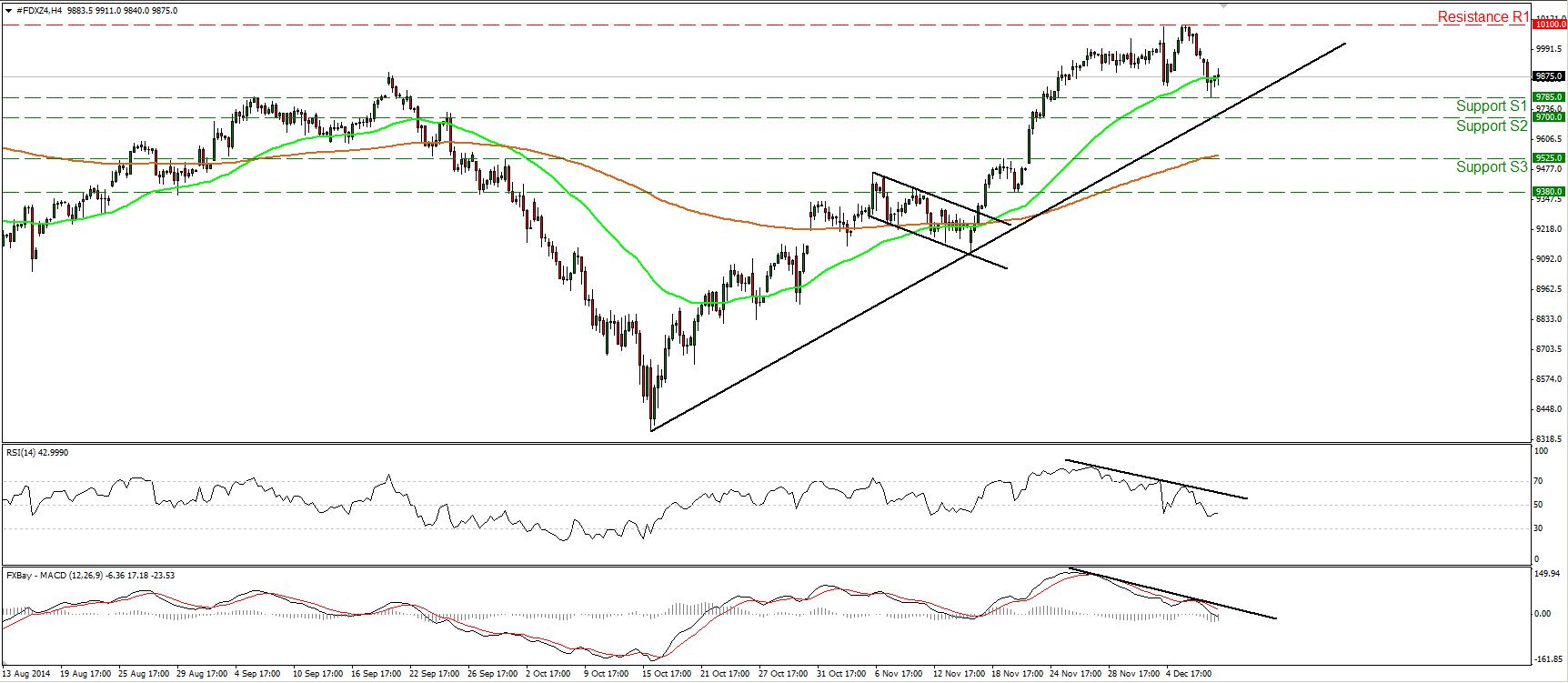

DAX futures rebounded somewhat after finding support at 9785 (S1). The price remains above the near-term uptrend line taken from back at the low of the 16th of October , which keeps the trend to the upside. Nonetheless, I would prefer to take to the sidelines for now as a further correction could be looming. My concerns are derived by our momentum signals. On the 4-hour chart, both the RSI and the MACD still lie within their negative zones. Also, I can spot negative divergence between both these indicators and the price action. On the daily chart, the 14-day RSI exited its overbought zone and is now pointing south, while the MACD has topped at extreme high levels and crossed below its trigger line.

Support: 9785 (S1), 9700 (S2), 9525 (S3)

Resistance: 10100 (R1) (All-time high)

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.