USD/RUB

The dollar traded mixed against its G10 counterparts during the European morning Friday. It gained the most against the Norwegian krone, even though Norway’s official unemployment rate declined to 2.6% in November from 2.7% previously and retail sales rebounded in October. I believe that following OPEC’s decision to maintain its current output, the ongoing fall in oil prices is likely to keep NOK under selling pressure and the Norges Bank will probably remain on hold for longer than it would have otherwise.

The euro was stable as Eurozone’s CPI estimate rose 0.3% yoy in November, a slight deceleration from +0.4% yoy previously, while the unemployment rate for October remained unchanged. The data were in line with the forecasts thus they had limited impact. Only a week before the ECB’s crucial December meeting, the low CPI rate confirms President Draghi’s concerns over stubbornly low inflation coupled with weak growth. A stronger recovery is unlikely in the coming months and reinforces my opinion that the euro has plenty of room on the downside.

Ruble plunged to a new record low after OPEC left its production ceiling unchanged. The Russian currency has lost approximately 4% since the decision on Thursday and has fallen around 50% since the beginning of the year because of the international sanctions imposed over Russia’s role in Ukraine. Given the ongoing fall in oil prices and the increasing bite of the sanctions, I would expect RUB to weaken further.

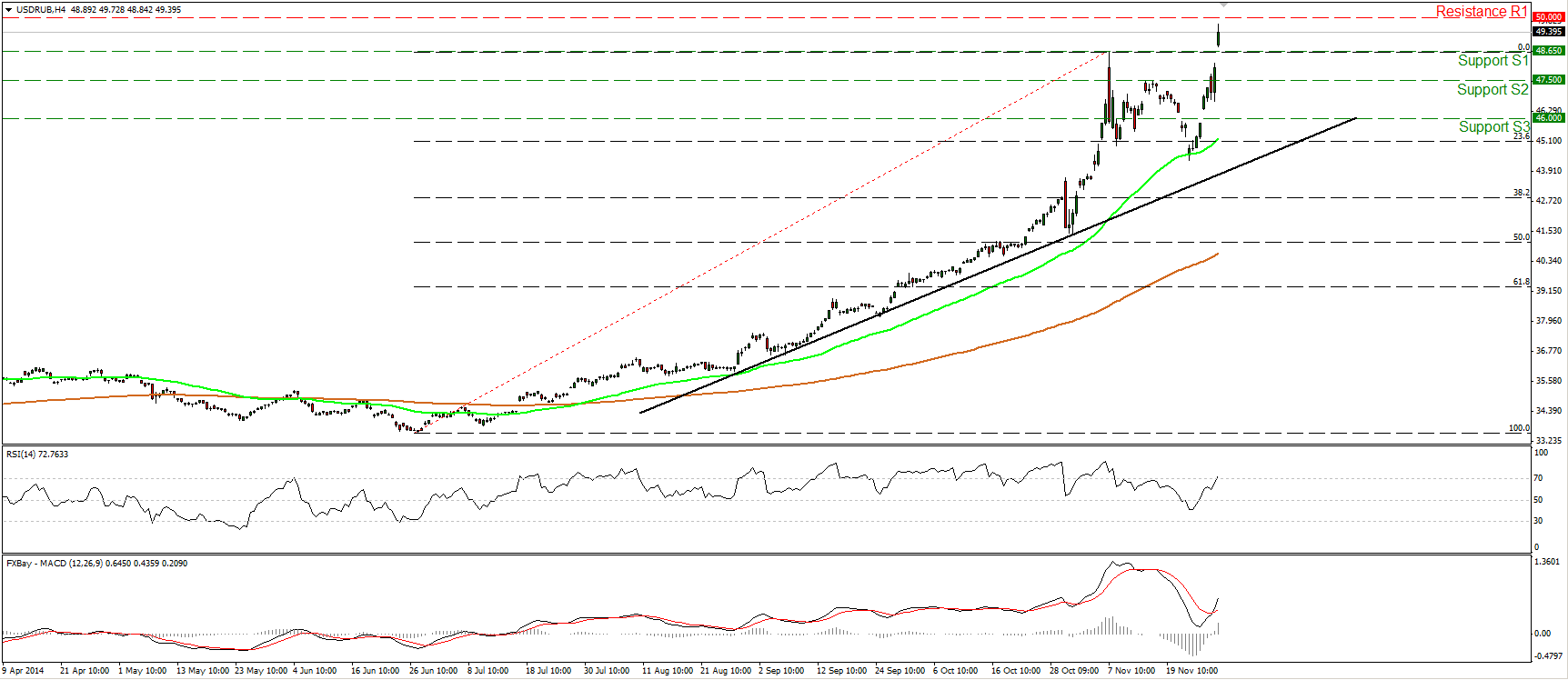

After finding support near the 50-period moving average, slightly below the 23.6% retracement level of the 27th of June - 7th of November rally, USD/RUB surged and broke above the peak of this up leg and is now printing new all-time highs. At midday in Europe, the pair is heading towards the round figure of 50.000 (R1), As long as USD/RUB stays above the black uptrend line and above both the moving averages, the overall trend is to the upside and is only a matter of time before RUB overcomes the 50.000 barrier (R1). The RSI bottomed below its 50 line, emerged above it and has just poked its nose into overbought territory. The MACD, already positive, turned up and firmed above its trigger line. These momentum indicators signal accelerating upside speed and support the continuation of the uptrend.

Support: 48.650 (S1), 47.500 (S2), 46.000 (S3)

Resistance: 50.000 (R1). (psychological level) Since the pair is printing new highs, no resistance is identified from past market activity.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.