USD/CAD

The dollar traded higher against all of its G10 major peers during the European morning Thursday, after having corrected over the past few days.

The euro was lower during the European morning ahead of the preliminary German CPI for November. All of the regional CPIs were 0.1-0.3ppt lower on a yoy basis (except Bavaria), indicating that the national inflation rate is also likely to be lower. In the meantime, even though the unemployment rate remained unchanged at 6.6% in November, the unemployment change declined 14k from -23k previously, showing that the labor market in Germany remains strong. Although the labor market shows signs of improvement, the softer inflation data raise the likelihood that Friday’s Eurozone estimate CPI rate may show a decline as well. With just a week ahead of the ECB’s crucial December meeting, the low inflation confirms President Draghi’s concerns that a stronger recovery is unlikely in the coming months and reinforces my opinion that the euro has plenty of room to the downside.

The Canadian dollar moved lower ahead of the OPEC’s press conference later in the day, due to concerns that the organization may not reach to an agreement to cut its oil production. However, given the recent batch of positive data and the positive sentiment towards CAD since early November, the currency doesn’t seem to react much on the ongoing decline in oil prices. Nevertheless, OPEC’s decision today could have a strong downside impact on CAD, given that the members fail to reduce oil production.

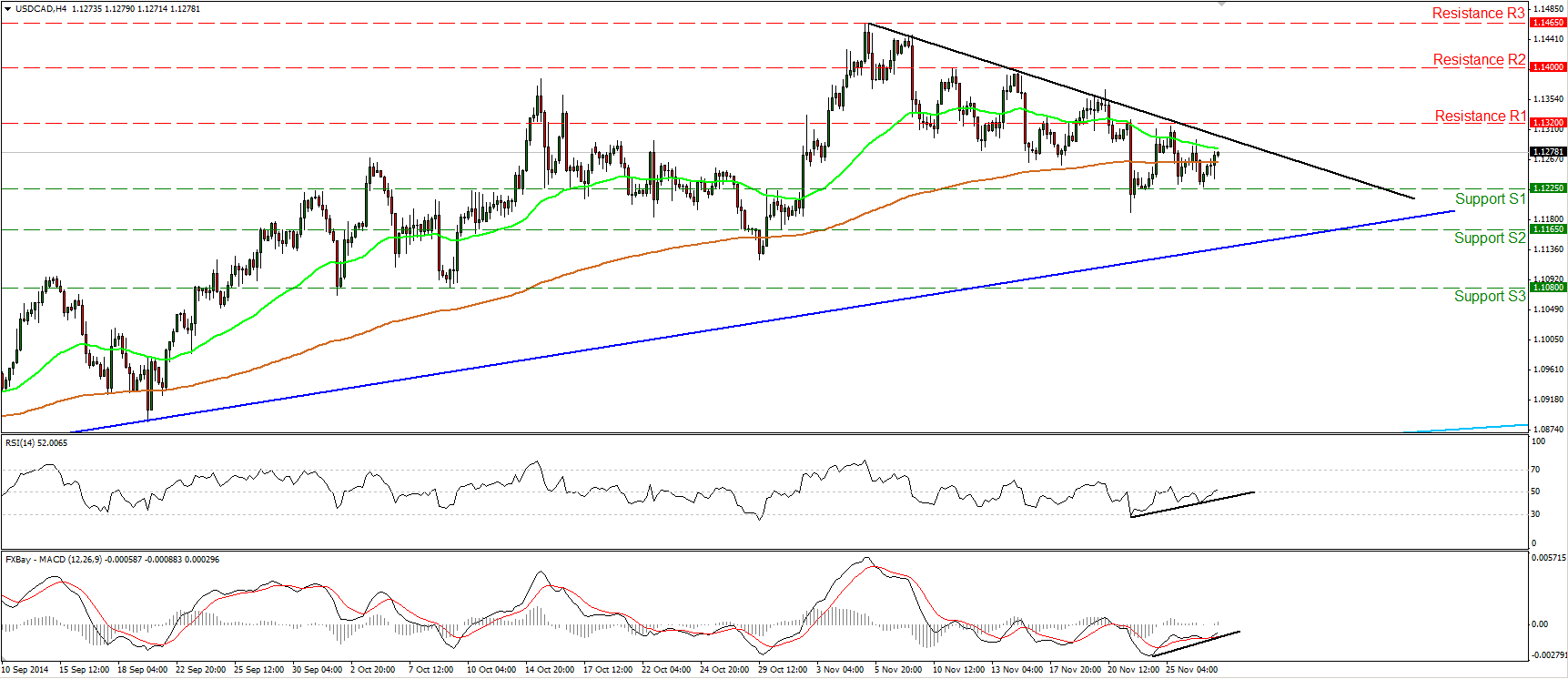

USD/CAD rebounded somewhat after finding support at 1.1225 (S1). Although the pair is still in a retracing mode, as marked by the short-term black downtrend line, I see signs that we may be experiencing the latest stages of the correction. A move above the black downtrend line and above the 1.1320 (R1) area is likely to reaffirm the case and perhaps trigger extensions towards our next resistance hurdle at 1.1400 (R2). The first reason why I believe the retracement could be ending is that, after printing a low below 1.1225 (S1) on the 21st of the month, the following lows where formed above that line. Second, our momentum studies have started printing higher lows as marked by their black upside support lines. Also, the RSI moved above its 50 line, while the MACD stands above its signal line and could enter its positive field in the near-future. As for the broader trend, on the daily chart, the dollar/loonie rate is still trading above both the 50- and the 200-day moving averages, and above the blue uptrend line drawn from back at the low of the 11th of July. Hence, I still see a longer-term uptrend.

Support: 1.1225 (S1), 1.1165 (S2), 1.1080 (S3).

Resistance: 1.1320 (R1), 1.1400 (R2), 1.1465 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.