USD/NOK

The dollar traded unchanged against most of its G10 counterparts during the European morning Wednesday, except AUD and NOK, where it was higher.

The 2nd estimate of UK Q3 GDP came in as expected at 0.7% qoq, unchanged from the initial estimate. Growth in the service sector was revised up but industrial production was revised down, adding to evidence that the recovery was less balanced than previously thought. GBP strengthened ahead of the GDP release but weakened afterwards to trade unchanged against the dollar. The growth report was not so encouraging and is likely to leave GBP vulnerable, especially if the US data to be released later in the day beat expectations.

The Norwegian krone depreciated after the country’s AKU unemployment rate for September failed to decline as the official unemployment figure did for the same month. Another reason for the increased pressure on NOK is the cautious mood of investors before the OPEC meeting on Thursday. Since Norway is the largest oil producer and exporter in Western Europe, the country’s currency could weaken further if the meeting ends without a consensus to stabilize oil market.

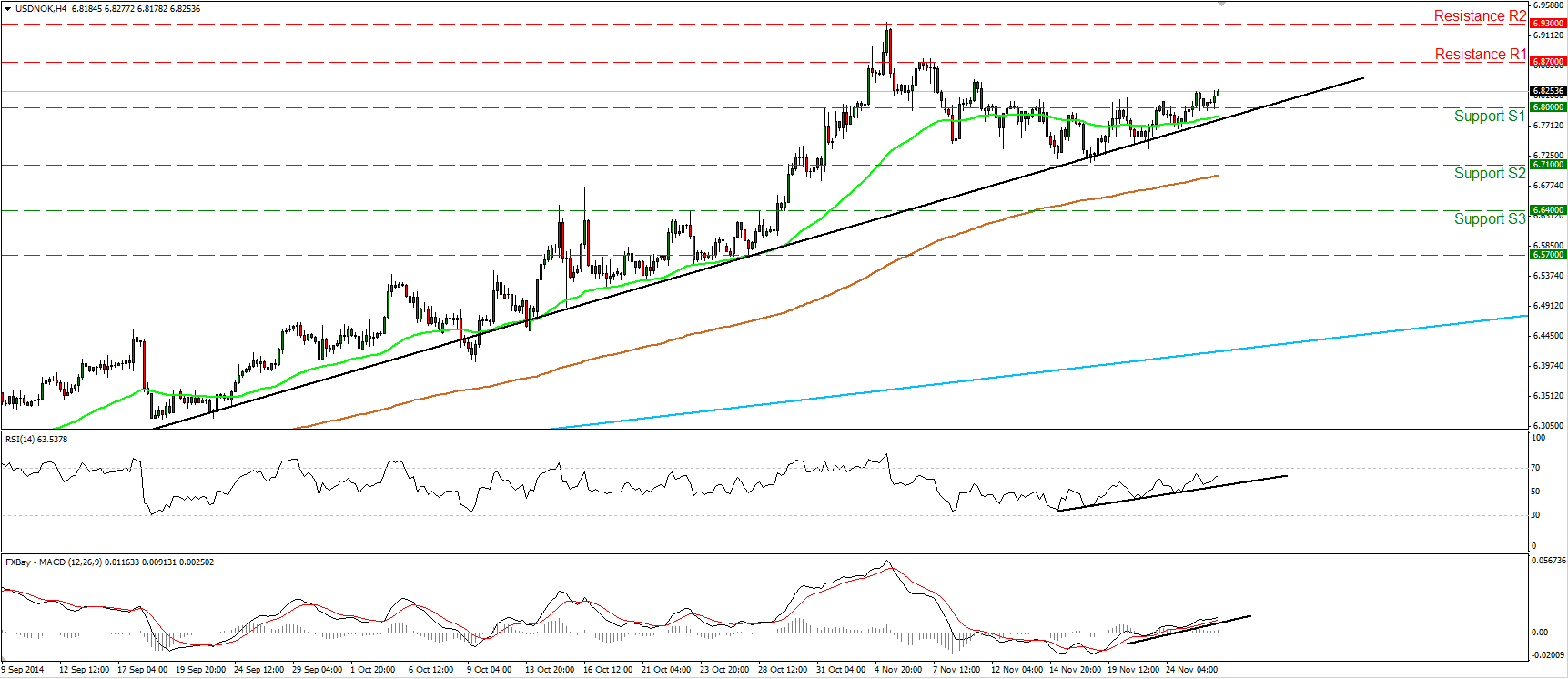

USD/NOK moved higher during the European morning after finding support near 6.8000 (S1). I would now expect the rebound to target the resistance zone of 6.8700 (R1). A clear break above that hurdle is likely to extend the bullish wave, perhaps towards the next resistance zone, at 6.9300 (R2), determined by the high of the 5th of November. Our short-term oscillators support this scenario. Both of them follow upside paths as marked by their upside support lines. Moreover, the RSI rebounded from slightly above its 50 line and edged higher, while the MACD stands above both its zero and signal lines. As long as the rate is trading above the black uptrend line drawn from the low of the 3rd of September, I consider the near-term picture to remain positive. On the daily chart, USD/NOK stands above the 50- and the 200-day moving averages and well above a longer-term uptrend line taken from back at the low of the 8th of March. This confirms that the overall outlook of the pair is to the upside.

Support: 6.8000 (S1), 6.7100 (S2), 6.6400 (S3) .

Resistance: 6.8700 (R1), 6.9300 (R2), 7.0000 (R3).

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.