GBP/USD

The dollar traded mixed against its G10 peers during the European morning Tuesday. It was higher against AUD, NZD, JPY and CAD, in that order, while it was lower against EUR and CHF. The greenback was stable vs NOK, GBP and SEK.

During the Bank of England hearing at the parliament before the Treasury Select Committee, GBP/USD gyrated around 1.5680, reflecting the restrained mood of investors. The BoE officials reiterated that the future vote on the first rate hike will depend on the macro data. In addition, Governor Mark Carney stressed that the next policy move will be a rate increase and that there’s no discussion to provide additional stimulus. BoE Governor reiterated that rate increases are likely to be limited and gradual and that the MPC members discuss about the pace, timing and degree of the tightening policy. Investors expecting the testimony to clarify a bit the Bank’s dovish stance where probably disappointed. In a question over inflation being below BoE’s target, the answer of the Deputy Governor Jon Cunliffer, that there are risks to the upside and to the downside, displayed the overall stance of the hearing keeping GBP stable against its peers.

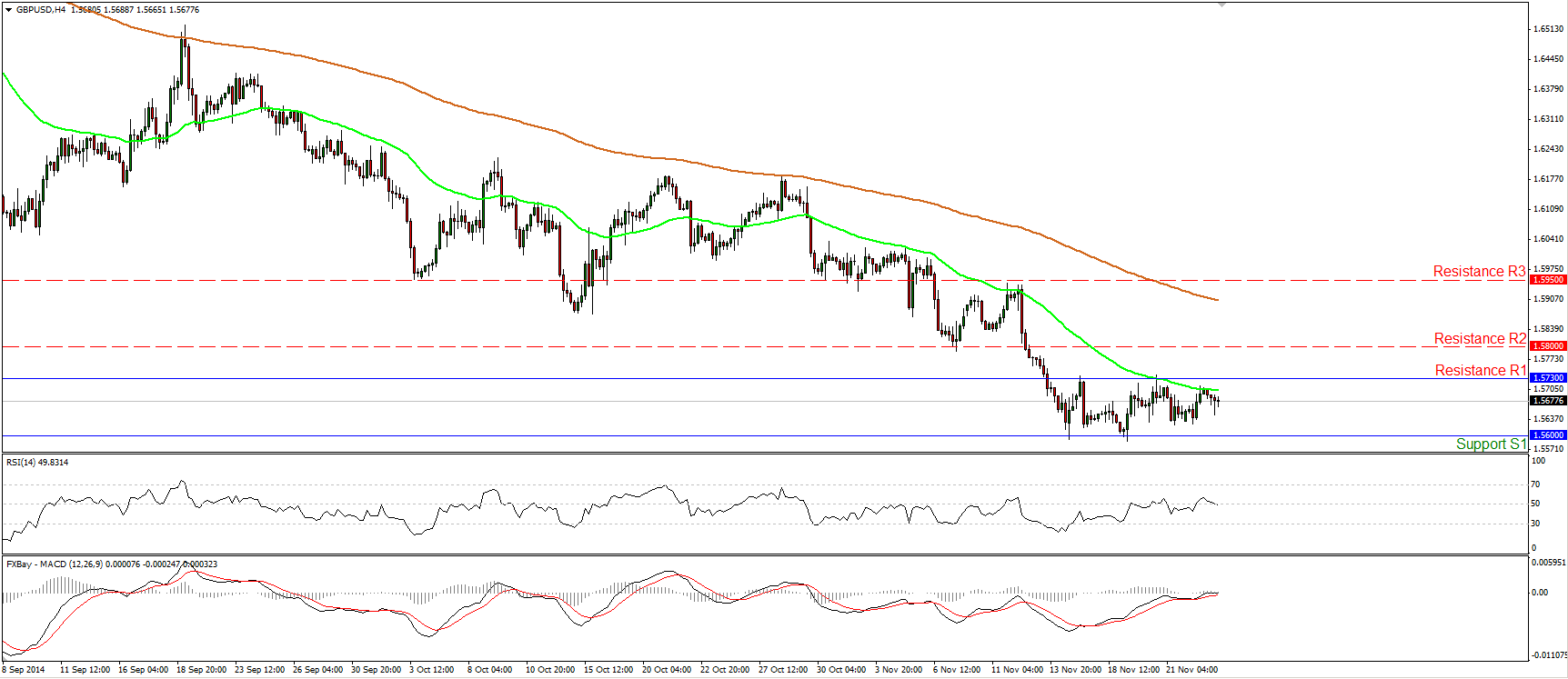

GBP/USD moved slightly lower after finding resistance near the 50-period moving average, slightly below the 1.5730 (R1) barrier. Cable remains within its sideways range between that resistance hurdle and the support line of 1.5600 (S1). As a result I would hold a flat stance as far as the short-term outlook is concerned. A clear break below the 1.5600 (S1) line is likely to open the way for the psychological barrier of 1.5500 (S2). On the other hand, a move above 1.5730 (R1) could target the 1.5800 (R2) barrier. Both our short-term momentum oscillators stay around their neutral levels, confirming the trendless bias of the rate. However, as for the broader trend, the price structure remains lower peaks and lower troughs below the 80-day exponential moving average, thus I would consider the overall picture of GBP/USD to be negative.

Support: 1.5600 (S1), 1.5500 (S2), 1.5430 (S3).

Resistance: 1.5730 (R1), 1.5800 (R2), 1.5950 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.