USD/NOK

The dollar traded unchanged against most of its G10 peers during the European morning Thursday. It was higher against EUR and CHF, while it was lower only against NOK.

EUR/USD moved lower as the bloc’s preliminary Eurozone composite PMI fell to 51.4 in November from 52.1 previously, below market expectations of 52.3. Even though the figure managed to remain above the neutral level for the 17th consecutive time, November’s reading was the lowest since July 2013. However, what came as more of surprise was the decline in German manufacturing PMI from 51.4 to 50.0, the threshold dividing expansion from contraction. The below consensus figure caused euro to brush aside any early gains triggered from the increase in France preliminary composite PMI. The overall poor PMIs are consistent with a slowing in the pace of the Eurozone’s recovery and could weigh more on the bloc’s single currency.

The British pound remained stable despite the strong rebound in retail sales. Retail sales rose 0.8% mom in October, a turnaround from -0.3% mom in September and exceeded the forecast of +0.3% mom. While the GBP/USD gyration around the 1.5650 may continue, the fact that the BoE is likely to avoid raising rates around general election in May and as long as Cable is trading below the 80-day exponential moving average, the overall path remains to the downside in my view.

The Norwegian krone was the only gainer during the European morning, after the country’s GDP for Q3 came in right on the +0.5% qoq consensus from a revised +1.1% qoq in Q2. NOK was boosted however by the upward revision of Q2 GDP to 1.1% qoq from +0.9% qoq before. Despite the move higher, I still believe the increased uncertainty over Norway’s economy is likely to put NOK under selling pressure and I would treat the current setback as renewed USD/NOK buying opportunity.

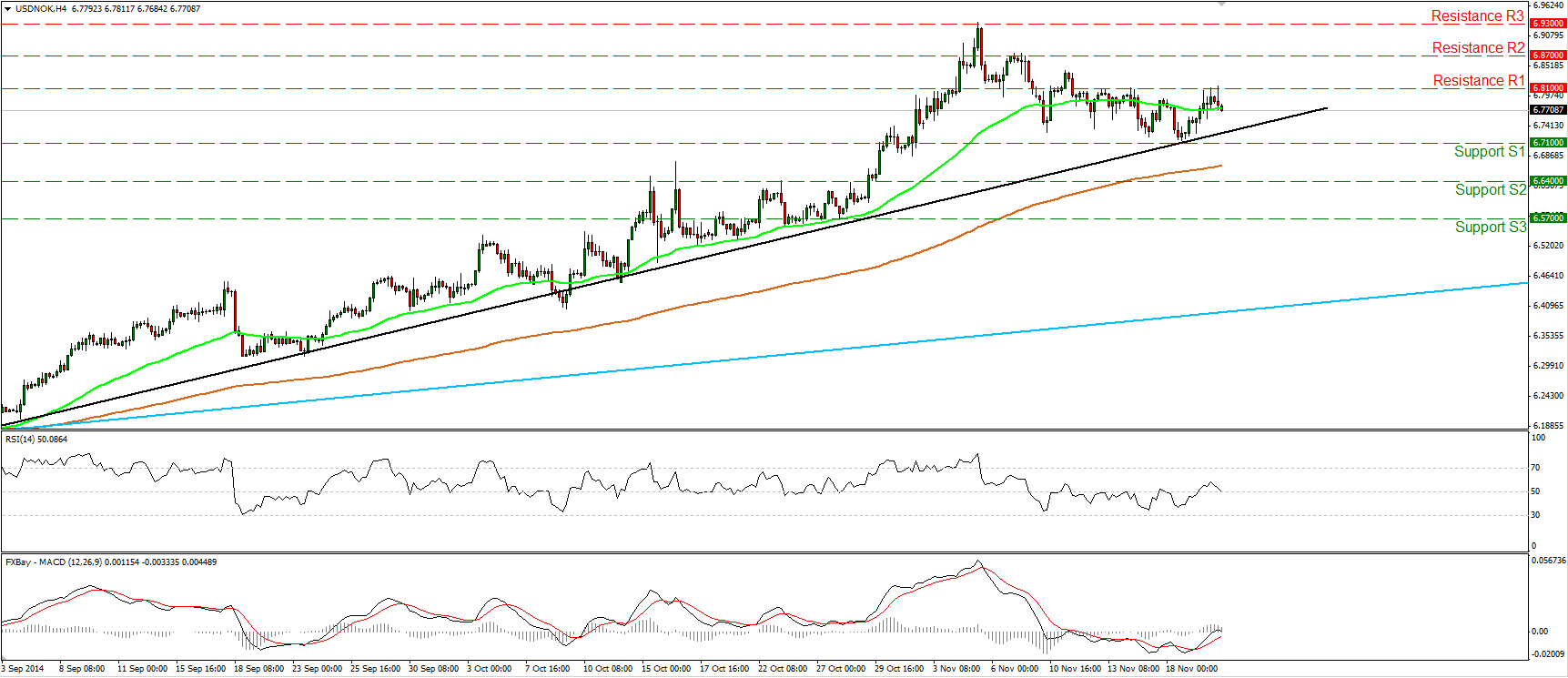

USD/NOK slid during the European morning Thursday after finding resistance near the 6.8100 (R1) barrier. Although the near-term trend remains to the upside, I would be cautious that the minor down wave may continue, perhaps for a test at the support line of 6.7100 (S1). My worries are derived by our near-term oscillators. The RSI moved lower and seems willing to cross below its 50 line, while the MACD, has topped marginally above its zero line, turned negative again, and could move below its signal line any time soon. However, as I mentioned above, the near-term trend remains to the upside. The rate is still trading above the black uptrend line drawn from the low of the 3rd of September. On the daily chart, USD/NOK stands above the 50- and the 200-day moving averages and well above a longer-term uptrend line taken from back at the low of the 8th of March. This confirms that the overall picture of the pair remains positive.

Support: 6.7100 (S1), 6.6400 (S2), 6.5700 (S3)

Resistance: 6.8100 (R1), 6.8700 (R2), 6.9300 (R3)

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.