AUD/NZD

The dollar traded mixed against its G10 peers during the European morning Wednesday. It was higher against AUD, NZD and JPY, in that order, while it was lower vs GBP, CHF and EUR. The greenback remained stable against CAD, NOK and SEK.

The Bank of England’s monetary policy committee (MPC) voted 7-2 on whether to leave interest rates on hold, according to the minutes of its November policy meeting. The majority in favor of keeping the current stance had a “material spread of views” on the balance of risks to the UK’s outlook of growth and inflation. This showed split among the views of the seven members who voted to keep rates at 0.5%. While some of those views were focused on the possibility of weaker growth, other MPC members mentioned the potential for slack to be eroded faster than currently expected adding upward pressure on prices. Martin Weale and Ian McCafferty continued to justify an immediate rise in Bank rate and attributed the low CPI to the higher exchange rate and the lower raw material prices. GBP/USD surged following the minutes release but remained below our 1.5730 resistance zone. However, even if we see the rate breaking above that line, I will stick to the view that the overall trend remains to the downside and I would treat any possible upside extensions of this bounce as a corrective move.

The New Zealand dollar weakened after dairy product prices fell at the latest auction to the lowest level in more than five years. This raised worries that the country’s largest exporter of dairy products could lower its milk payout forecast, eroding the income of farmers and putting NZD under selling pressure.

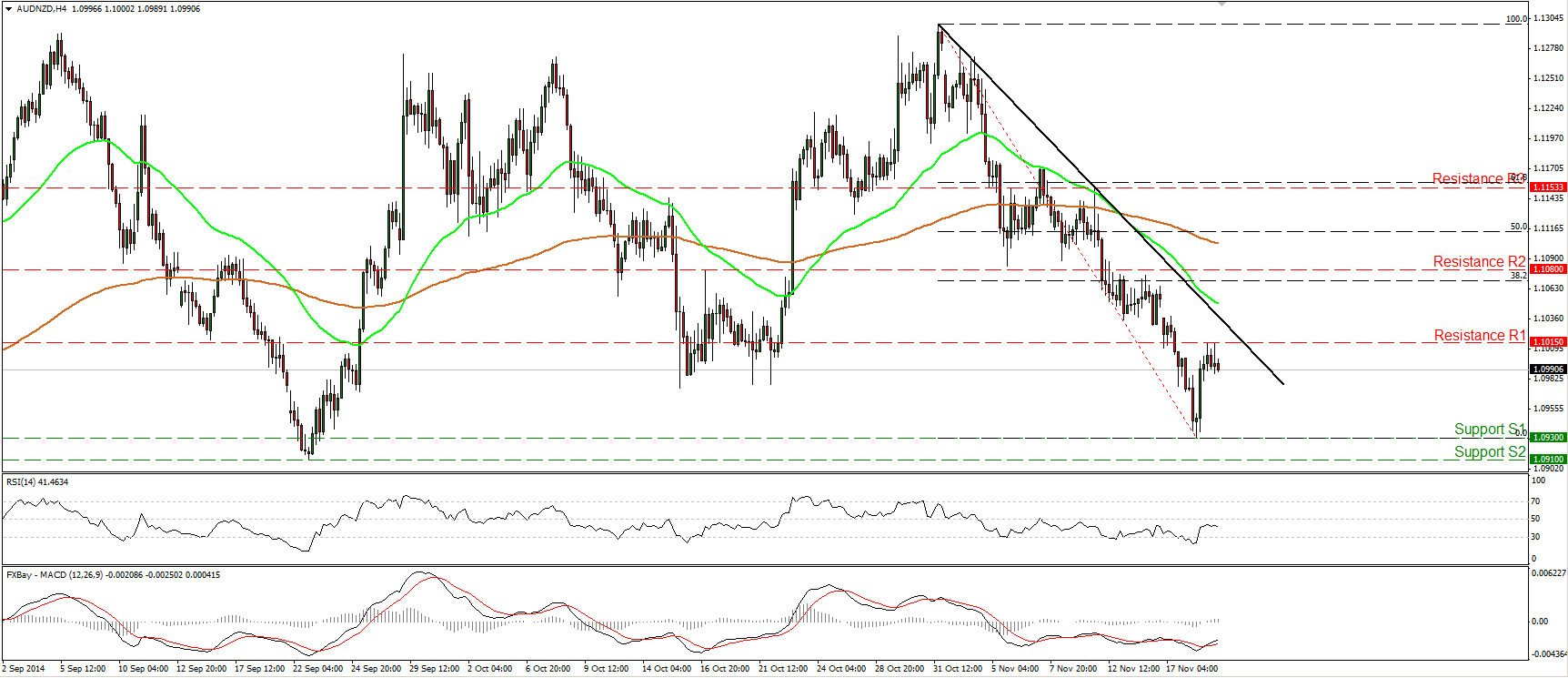

AUD/NZD rebounded after finding support at 1.0930 (S1) on Tuesday to hit resistance at 1.1015 (R1). During the European morning Wednesday, the pair moved in a consolidative manner, staying below that resistance hurdle. On the 4-hour chart, the price structure remains lower peaks and lower troughs below the black downtrend line taken from the high of the 31st of October, and below both the 50- and the 200-period moving averages. This keeps the near-term outlook to the downside and I would expect another test at the 1.0930 (S1) line in the not-to-distant future. On the daily chart the pair seems to have been printing a triple top pattern which is however not completed yet. In my view, a dip below the support line of 1.0910 (S2) is needed to signal the completion of the formation and set the stage for larger bearish extensions.

Support: 1.0930 (S1), 1.0910 (S2), 1.0830 (S3)

Resistance: 1.1015 (R1), 1.1080 (R2), 1.1155 (R3)

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.