EUR/GBP

The dollar traded mixed against its G10 peers during the European morning Friday. It was higher against JPY, while it was lower against AUD, GBP and NZD, in that order.

UK GDP rose 0.7% qoq in Q3, weaker than the +0.9% qoq expansion in Q2, according to today’s first estimate. The slowing in the pace of growth raise concerns that the recovery is losing steam and may push market expectations for the Bank of England tightening further back. Unless there is a strong compelling reason, the BoE is unlikely to raise rates ahead of the country’s general election in May. This suggests that further soft UK data could result in rate expectations getting pushed back even further, leaving GBP vulnerable. Nonetheless, GBP/USD strengthened at the release as the figure was in line with market expectations and there was some relief that the rate didn’t fall more. However, the pair’s rejection at around 1.6070 creates the possibility for a technical push lower in the near-term, especially if the psychological 1.6000 zone is broken.

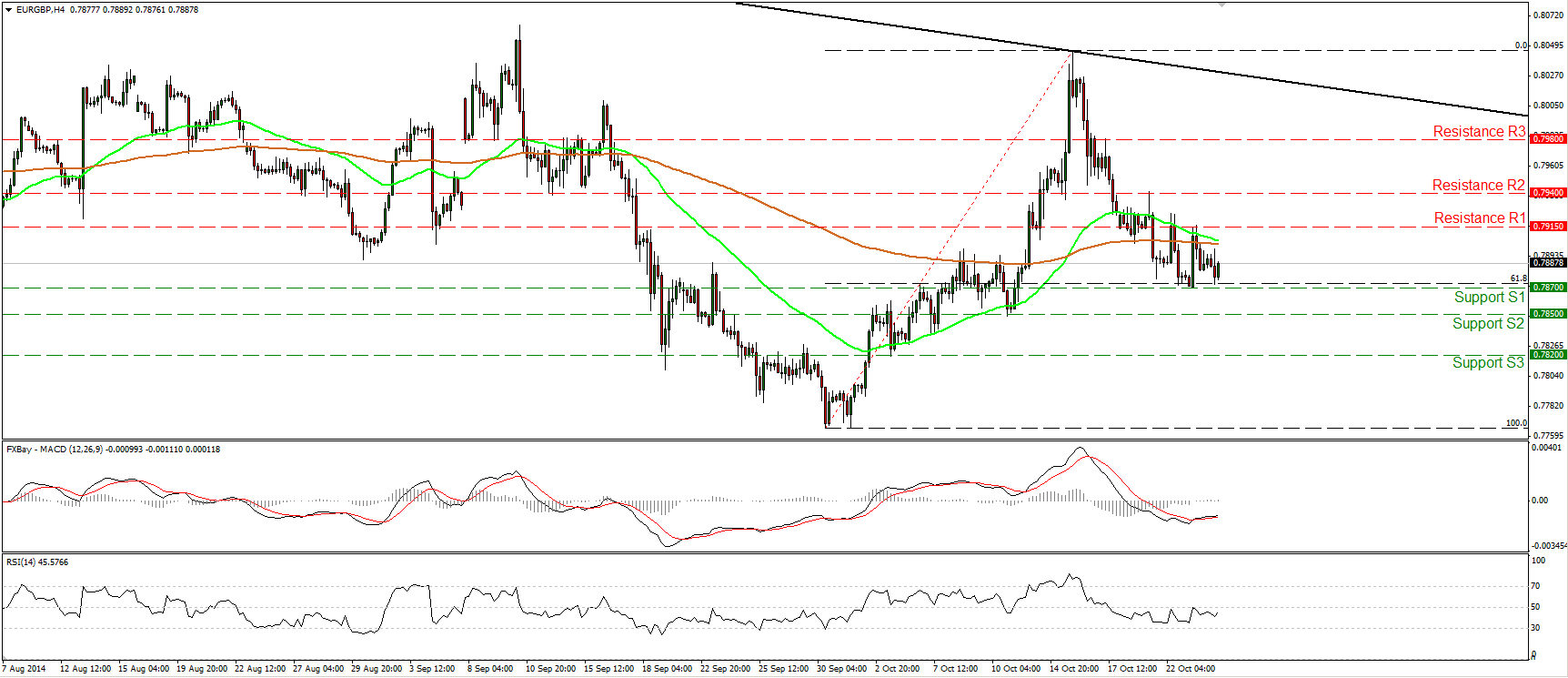

EUR/GBP moved lower during the European morning, but remained above the support line of 0.7870 (S1). In my view, as long as the resistance of 0.7915 (R1) holds, the short-term bias remains to the downside. However, our short-term oscillators point to weakening downside momentum. The MACD, although negative, lies above its trigger, while the RSI lies below 50 but is pointing up again. This together with the fact that the 0.7870 (S1) barrier happens to be pretty close to the 61.8% retracement level of the 30th September – 15th October up leg, give me reasons to wait for a dip below the 0.7870 (S1) zone before getting more confident about the downside. As for the broader trend, on the daily chart the pair is trading below the longer-term black downtrend line (taken from back at the high of the 1st of August), keeping the overall technical picture negative. Actually, on the 15th of October, the rate found resistance at that line before falling again sharply.

Support: 0.7870 (S1), 0.7850 (S2), 0.7820 (S3) .

Resistance: 0.7915 (R1), 0.7940 (R2), 0.7980 (R3) .

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.