NZD/USD

The dollar traded mixed against its G10 counterparts during the European morning Thursday. It was higher against GBP, NOK and CHF, in that order, while it was lower against JPY, NZD and SEK. The greenback remained stable vs CAD, AUD and EUR.

The euro was stable during the European morning as investors’ eyes are on the most important event of the day, the ECB meeting and President’s Draghi press conference following the decision. At its September meeting, the ECB announced that it would start buying asset-backed securities (ABS) and covered bonds in effect this month, and that it would announce the details of these programs after its meeting today. EUR/USD is not giving any clear directional impulse and much will depend on what Mr. Draghi will say at the press conference.

The New Zealand dollar gained against the greenback after policy makers in China eased property restrictions amid concerns of a weak economic growth. However, weakening fundamentals like the latest fall in wholesale dairy prices, the declining commodity prices and the possibility of another RBNZ currency intervention are expected to weigh on the currency. With this in mind, I could see kiwi to weaken more in the near future.

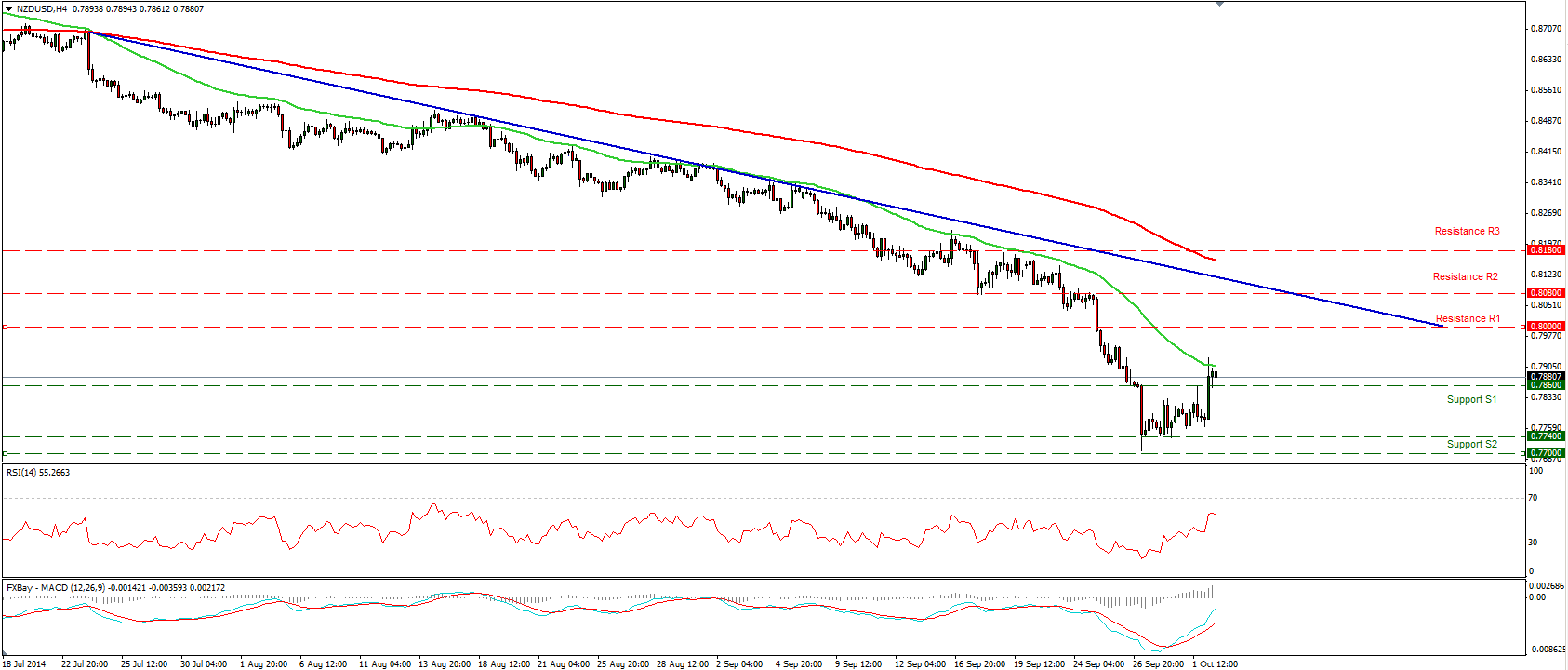

NZD/USD advanced after the positive news from China, and break our resistance-turned-into-support line of 0.7860 (S1). The pair declined a bit after finding resistance at the 50-period moving average which seems to provide good resistance to the highs of the price action. Shifting our attention to our momentum studies, the RSI turned down after crossing above its 50-level, while the MACD still in its negative territory crossed above its trigger line. As long as the rate is printing lower lows and lower highs below the trend line and below both the moving averages, I still see a negative short-term picture.

Support: 0.7860 (S1), 0.7740 (S2), 0.7700 (S3).

Resistance: 0.8000 (R1), 0.8080 (R2), 0.8180 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.